XRP Price Prediction: Structural Breakout Hints at $48.90 Rally—Is August the Launchpad?

XRP's chart structure just flashed its most bullish signal in years—and the target is a staggering $48.90. Forget 'slow and steady.' This setup screams volatility.

### The Technical Case for a Parabolic Move

A multi-year consolidation pattern is breaking upward, with August historically acting as XRP's breakout month. The last time these conditions aligned? A 600% price explosion.

### Why Traders Are Watching the Next 72 Hours

Liquidity pools show whales accumulating at current levels while shorts get squeezed. One hedge fund analyst quipped, 'This either moons or becomes another 'crypto winter' cautionary tale—no in-between.'

### The Cynical Take

Of course, this could just be another 'number goes up' fantasy before the SEC finds creative new ways to drain crypto's momentum. But for now? The charts don't lie.

As speculation builds around Ripple’s legal saga and technical patterns tighten, analysts are eyeing a potential final leg of XRP’s rally. With price targets ranging from $4.89 to $48.90, August may prove to be a defining month for XRP’s future trajectory.

A Critical Juncture for XRP Price Movement

As of August 5, 2025, the price of XRP today hovers around $3.04, reflecting a modest 2.20% daily gain. While some view this as part of a healthy consolidation phase, others are questioning whether this signals the beginning of XRP’s long-awaited final rally. Analyst EGRAG crypto has weighed in with a compelling long-term perspective, suggesting that XRP’s current structure mirrors historic setups seen before major price explosions.

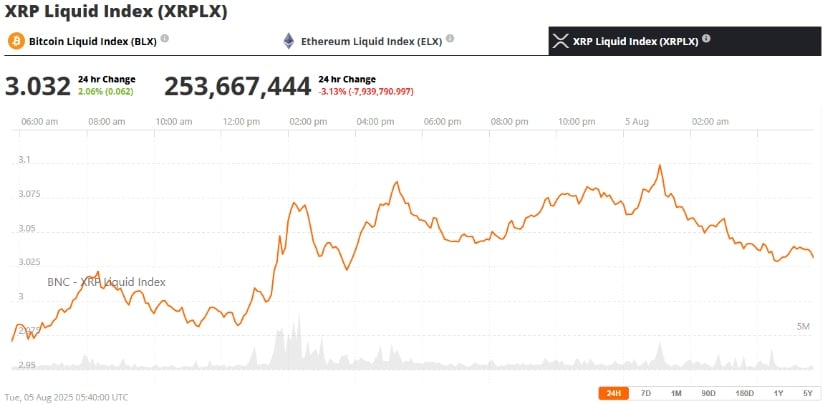

XRP was trading at around $3.03, up 2.06% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

In a recent chart analysis shared on social media, EGRAG emphasized that the ongoing 6-month candle still has nearly five months left before closure, leaving ample time for a parabolic MOVE to play out. His key question: Has XRP already peaked, or is the true breakout yet to come?

XRP Price Prediction: From $4.89 to $48.90?

According to EGRAG, the XRP price prediction depends largely on the scale of analysis used. On a standard, non-logarithmic scale, his target is a relatively modest $4.89, representing about a 63% gain from current levels. However, when applying a logarithmic scale—commonly used in crypto due to its ability to model exponential growth—EGRAG outlines a far more ambitious target of $48.90.

Despite speculation that the top may already be in, the analyst remains confident that XRP’s final and potentially epic rally is still ahead, with targets of $4.89 to $48.90. Source: EGRAG CRYPTO via X

To balance these extremes, he proposes an average target of $27, which WOULD equate to an 800% increase from current prices. While such numbers may seem extraordinary, they are supported by historical precedents: XRP recorded similar massive surges during bullish cycles in 2017 and 2021, especially when breaking key resistance zones.

The ‘Bifrost Bridge’ and Technical Outlook

At the Core of EGRAG’s thesis is the so-called “Bifrost Bridge”—a long-standing resistance area that XRP has struggled to clear over the past 240 days. A decisive weekly close above this zone, the analyst believes, could serve as the trigger for XRP’s next meteoric move.

With 4 months left, XRP faces a pivotal moment—either a breakout ahead or the top has already passed unnoticed. Source: EGRAG CRYPTO via X

In addition to EGRAG’s long-term forecast, other analysts point to Fibonacci extensions, which also suggest XRP predictions in the $4 to $15 range in the coming months. These projections further strengthen the argument that XRP may be building toward a substantial breakout.

Contrasting Views: Bearish Divergence Raises Caution

Despite the optimism, not all market signals are flashing green. A separate analysis highlights a concerning bearish divergence on XRP’s weekly chart—an occurrence where the xrp price posts higher highs while the Relative Strength Index (RSI) trends lower. Historically, such patterns have preceded significant corrections.

Analysts confirm a bearish divergence on the XRP chart, where price makes higher highs while RSI forms lower highs. Source: Crypto World on YouTube

The last notable divergence of this type occurred in late 2020, eventually leading to a 60% drop in XRP prices over a few months. Analysts warn that although XRP may experience short-term rallies, this underlying bearish divergence could result in prolonged downside pressure, similar to the one observed during mid-2021.

This split in technical indicators leaves investors and traders at a crossroads—torn between the promise of a dramatic breakout and the threat of another bearish cycle.

Broader Market Conditions Add Complexity

Adding to the uncertainty is the broader macroeconomic climate. As of August 2025, the global crypto market cap has declined by 2.74% over the week, down to $3.63 trillion, according to Coinbase data. High interest rates and renewed U.S. tariff concerns have triggered caution across risk markets, putting additional pressure on altcoins like XRP.

Furthermore, regulatory factors such as the XRP lawsuit update, progress on a potential XRP ETF, and rulings in the Ripple vs SEC case continue to influence sentiment. While Ripple Labs has scored partial victories in court, the absence of a final resolution in the XRP SEC case remains a source of uncertainty.

Ripple’s Legal Battle and Long-Term Forecasts

As legal proceedings between Ripple and the SEC drag on, speculation continues about the long-term impact of regulatory clarity on the XRP crypto price prediction. Some industry projections, such as Standard Chartered’s $12.25 target in five years or Morningstar’s $6.15 forecast in ten years, underline the broad range of opinions on XRP’s potential.

The XRP price prediction 2025 varies significantly depending on the outcome of the Ripple XRP SEC dispute and the overall direction of crypto adoption, especially in institutional finance.

Will XRP Go Up? What to Watch in August

As August unfolds, all eyes remain on XRP’s ability to reclaim and sustain key resistance zones. Traders are closely watching the $3.10–$3.40 range, while bullish momentum above the Bifrost Bridge could open the door to midterm targets, such as $4.89, and perhaps even the lofty $27–$48.90 zone suggested by logarithmic models.

Strong buying at $2.95 and lack of selling pressure keep the bullish case intact, with a potential move toward $4.64. Source: thecafetrader on TradingView

However, the presence of bearish divergences and macro headwinds means caution is still warranted. Whether XRP can defy expectations and chart a new trajectory or retrace into a deeper correction depends on how the market reacts to technical, legal, and macroeconomic signals in the coming weeks.

Final Thoughts

The XRP price today may look modest in the short term, but analysts like EGRAG see the potential for a historic rally if key conditions align. While such bold predictions offer hope to long-term holders, traders should remain mindful of both bullish opportunities and bearish risks.

With the Ripple SEC lawsuit update still in flux and the crypto market searching for clear direction, August could prove pivotal in shaping the next chapter of the XRP coin story.