Bitcoin, Ethereum, and XRP Stage Comeback—U.S. Inflation Data Could Fuel the Rally or Kill It

Crypto bulls are back in the saddle—for now. Bitcoin, Ethereum, and XRP clawed their way up after a brutal sell-off, but all eyes are glued to upcoming U.S. inflation numbers. Will the data dump spark a fresh rally or send prices tumbling again? Only the Fed knows (and they’re not telling).

Market jitters? Absolutely. But hey—since when has crypto ever been predictable? Traders are either loading up on dips or bracing for impact, depending on how much trust they’ve got left in the ‘inflation is transitory’ fairy tale.

One thing’s certain: volatility isn’t going anywhere. Buckle up.

A combination of U.S. labor market weakness, trade war fears, and rate-cut speculation has reenergized bullish sentiment in the digital asset space. Now, with U.S. inflation data due next week, traders are closely watching for the next directional cue.

Crypto Market Bounces Back After Economic Jitters

After a sharp midweek decline triggered by weaker-than-expected U.S. non-farm payroll numbers and renewed global trade tensions, the crypto market quickly regained ground. The rebound was led by XRP, which rose 6.5%, and Ethereum, which gained 2.7% on the day. Bitcoin, too, reclaimed key levels, trading around $115,043 at the time of reporting.

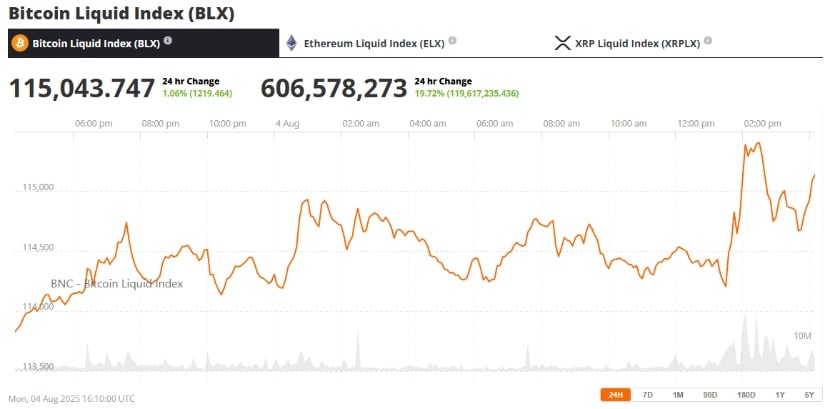

Bitcoin (BTC) was trading at around $115,043, up 1.06% in the last 24 hours at press time. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

According to Min Jung, an analyst at Presto Research, “The sell-off was largely driven by disappointing labor data, which compounded risk-off sentiment across both crypto and traditional markets.”

However, the downturn proved short-lived. Jeff Mei, COO at BTSE, noted: “Every time the market pulls back, long-term investors treat it as an entry point. That’s why we’re not seeing prolonged downturns.”

Inflation Data in Focus: CPI Could Define Market Direction

The market’s next critical milestone is the U.S. Consumer Price Index (CPI) release scheduled for next week. Traders view the report as a potential catalyst for policy shifts, especially with rising expectations that the Federal Reserve could begin cutting interest rates as early as September.

Analysts say that a softer inflation reading may reinforce dovish monetary expectations, potentially adding further fuel to the ongoing crypto rally. As of now, futures markets are pricing in an 89.1% probability of a Fed rate cut next month.

“Macro conditions are aligning in crypto’s favor again,” said Vincent Liu, CIO of Kronos Research. “Between whale accumulation and rate-cut anticipation, sentiment is cautiously optimistic.”

XRP and Ethereum Take the Lead

Among the top performers, XRP and ethereum continue to outshine broader altcoins. XRP’s 6.5% daily rise comes as discussions around a potential XRP ETF gain traction, with some prediction markets assigning it a 64% probability of approval before Litecoin.

XRP was trading at around $3.066, up 6.53% the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

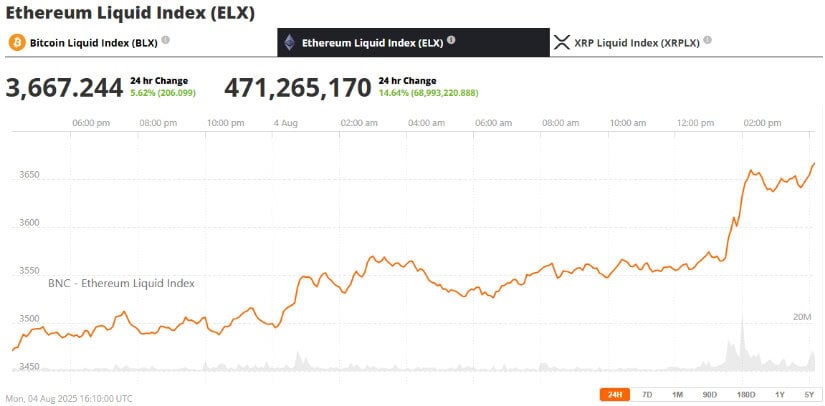

Ethereum, trading NEAR $3,667, is now just 25% off its all-time high of $4,878. Market confidence is growing that ETH could revisit those levels, especially as Layer-2 networks and DeFi activity pick up pace.

Ethereum (ETH) was trading at around $3,667, up 5.62% in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

Meanwhile, Ethena (ENA), a rising Ethereum-based DeFi protocol, led altcoin gains with a 10.8% surge, followed by strong performances from Stellar, Injective, and meme coin BONK.

Adding a geopolitical twist, former President Trump’s renewed trade war, including tariffs up to 41% on major U.S. trading partners, initially spooked markets but may be aiding Bitcoin’s positioning as a digital SAFE haven.

As traditional assets like equities faltered—S&P 500 dropped 3.33%—investors rotated into crypto as a hedge. This shift mirrors past behavior during periods of political instability, likening bitcoin to “digital gold” in uncertain times.

Institutional Interest and On-Chain Developments Support Growth

Institutional engagement is also ramping up. A Ripple-backed report highlighted significant blockchain investments by legacy institutions like Citigroup, JPMorgan, and Goldman Sachs. At the same time, Bitfinex whales are reportedly acquiring 300 BTC daily, signaling long-term confidence.

Japanese firm Metaplanet has acquired 463 BTC worth $53 million, raising its total Bitcoin holdings to 17,595 BTC valued at $2.02 billion. Source: Arkham via x

The recovery of the Satoshi Nakamoto statue in Switzerland and new insights from Arkham Intelligence into historic crypto hacks are further energizing communities and reinforcing trust in blockchain transparency.

Market Sentiment Turns Neutral as Buyers Re-Enter

The Crypto Fear & Greed Index now sits at 52, reflecting a shift from fear toward neutrality. With a global crypto market cap back at $3.6 trillion, momentum appears to be building. Traders are now eyeing $3.7 trillion as the next psychological target.

“Winter is not coming back,” declared Michael Saylor, echoing the Optimism that is gradually returning to the digital asset space.

As the crypto market stabilizes, the coming CPI data will be critical in determining whether Bitcoin, Ethereum, and XRP can sustain their rebound—or face renewed pressure from macro headwinds. For now, cautious optimism is guiding sentiment, and investors are watching closely for confirmation of the next leg up.