Ethereum (ETH) Price Surge: Mega Whales Gobble Up ETH as $4,200 Looms—Can Retail Keep Up?

Ethereum isn't just holding $3,500—it's priming for a rocket ride. While Wall Street plays catch-up, crypto's mega-whales are stacking ETH like it's a Black Friday sale. Here's why $4,200 isn't a target—it's a pit stop.

The Whale Feeding Frenzy

When wallets holding 10,000+ ETH start accumulating, the market listens. These aren't dabblers—they're the crypto equivalent of hedge funds loading up before a short squeeze. Retail traders? Still debating whether to 'buy the dip.'

Liquidity = Launchpad

Consolidation above $3,500 isn't boredom—it's a coiled spring. Every sideways day shakes out weak hands and builds liquidity for the next leg up. Technicals scream 'bull flag,' but try telling that to the guy waiting for a 'correction.'

The Cynic's Corner

Let's be real—the same institutions that called ETH a 'scam' in 2020 now treat it like a digital T-bill. Funny how profitability changes narratives faster than a meme coin rug pull.

Buckle up. The only thing thicker than whale wallets right now? The irony of traditional finance playing FOMO catch-up.

The ETH price today reflects a critical consolidation phase after rejecting near $3,576 resistance. With on-chain data signaling institutional buying and technicals aligning at key levels, traders are watching closely for Ethereum’s next big move.

Ethereum Price Today: Range-Bound Above $3,500 with Mixed Momentum

Ethereum price today hovers around $3,550, showing resilience after a volatile weekend dip that briefly sent ETH below $3,400. According to TradingView data, ETH touched a weekly high of $3,576 before facing rejection at long-term resistance NEAR $3,565. This area coincides with a key Fibonacci confluence zone and a descending trendline from the 2021 high, suggesting a significant structural challenge for bulls.

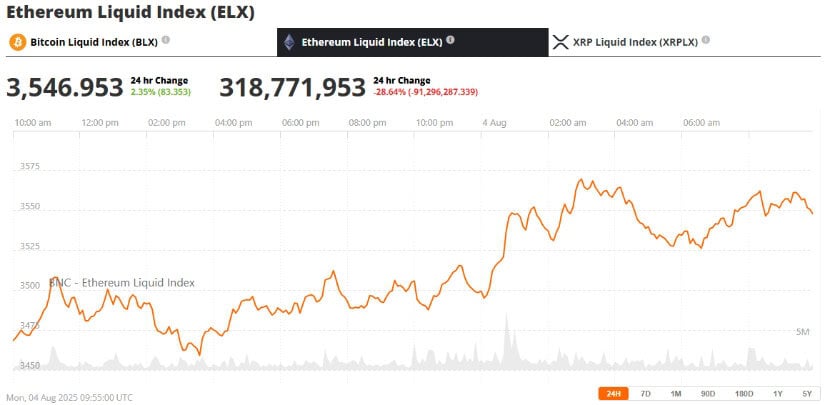

Ethereum (ETH) has been trading at around $3,546, up 2.35 % in the last 24 hours at press time. Source: ethereum Liquid Index (ELX) via Brave New Coin

Despite this rejection, Ethereum has maintained its position above crucial support near $3,500, a region that previously triggered bullish reversals. Market indicators, including a 30-minute RSI at 62.61 and a flattening MACD, point to neutral-to-mildly bullish sentiment. Analysts believe Ethereum’s consolidation phase may be setting the stage for its next big move.

ETH Mega Whales Return: $300M Accumulated OTC

On-chain data reveals a sharp uptick in Ethereum megawhale activity, with large addresses scooping up ETH through over-the-counter channels. Blockchain analytics firm Arkham Intelligence reported that a single address acquired $300 million in ETH over the weekend from Galaxy Digital.

Bitmine has acquired $300M in ETH from Galaxy Digital OTC over the past 3 days. Source: @krypto_maverick via X

This wallet, now holding over 79,000 ETH worth approximately $282.5 million, is part of a broader trend. According to Glassnode, more than 200 new mega whale addresses—each holding over 10,000 ETH—have emerged since early July. Many of these are linked to exchange-traded funds, custodians, and institutional players, all of whom are aggressively increasing their Ether exposure.

Meanwhile, ETF inflows continue to build. BlackRock’s iShares Ethereum Trust saw $1.7 billion in inflows over 10 consecutive trading days, according to Dune Analytics. ETF holdings have surged over 40% in the past month, fueling speculation that Ethereum is quietly becoming the institutional favorite.

Technical Analysis: Breakout or Breakdown?

Ethereum’s technical chart shows a tug-of-war between bulls and bears. On the 4-hour chart, ETH has reclaimed its 20 and 50 EMAs at $3,542 and $3,566, respectively, but remains under pressure from the 100 EMA and the Supertrend resistance around $3,639. Bollinger Bands are contracting, indicating a squeeze that often precedes a sharp move.

Ethereum signals a potential bullish move, with a key retest likely soon to maintain weekly momentum. Source: Just_Joey_Coman on TradingView

If Ethereum closes above the $3,565–$3,580 resistance zone with strong volume, analysts expect a rally toward $3,700–$3,750, and possibly the psychological $4,000 level. A successful break above $4,106, the 1.0 Fib level, could extend gains toward $4,200 in the coming weeks.

Conversely, failure to reclaim the upper range could trigger a short-term retracement. Immediate support lies near $3,480, followed by the 200 EMA at $3,339. A dip below these levels may expose the $3,250 Fib zone.

ETF Flows and Macro Tailwinds Boost Long-Term Outlook

Fundamentally, Ethereum remains buoyed by strong ETF demand, ongoing staking growth, and a cooling U.S. labor market that could prompt looser monetary policy. As noted by CoinW’s Monika Mlodzianowska, “The heightened likelihood of monetary easing could soon reverse the sell-off, offering crypto a bullish tailwind as liquidity expectations shift.”

Mega whales are accumulating $ETH as ETF demand, staking growth, and easing macro conditions fuel a bullish outlook. Source: @crypto_goos via X

Ethereum staking rewards remain competitive, and validator participation continues to rise, supporting the network’s long-term health. Meanwhile, Ethereum gas fees have moderated, improving usability across LAYER 2 platforms like Arbitrum, zkSync, and Optimism, which are driving transaction volume and reinforcing Ethereum’s position as the leading smart contract platform.

Will Ethereum Break Its August Losing Streak?

Historically, August has not been kind to Ethereum. The asset posted double-digit losses in both August 2023 and 2024, though it soared 35.6% in August 2021 during a broader bull market. While sentiment remains cautious, the ongoing whale accumulation and institutional positioning offer a more optimistic setup for this month.

Eric TRUMP encouraged investors to buy the Ethereum dip, signaling growing mainstream interest. Source: @EricTrump via X

Even Eric Trump joined the ETH conversation over the weekend, encouraging his X followers to “buy the dip,” underscoring the growing visibility of Ethereum in mainstream financial and political spheres.

Ethereum Price Prediction: Can ETH Hit $4,200 in August?

In the short term, Ethereum is likely to remain range-bound between $3,480 and $3,620, awaiting a decisive breakout signal. A confirmed close above $3,750 WOULD likely validate the bullish scenario and set the stage for a potential rally toward $4,200.

Given the surge in ETF inflows, whale accumulation, and a favorable macro backdrop, Ethereum appears fundamentally poised for upside—but traders should watch closely for momentum confirmation.