🚀 Ethereum (ETH) Price Surge Ahead? ETF Liquidity Wave Fuels $4K Breakout Hopes

Wall Street's latest crypto playbook just went live—Ethereum ETFs are flushing the system with liquidity, and traders are betting big on a decisive move past $4,000.

### The ETF Effect: Rocket Fuel or Hot Air?

Redemptions from newly launched ETH ETFs are injecting capital faster than a DeFi yield farm. Market makers now have ammunition to push ETH beyond its stubborn resistance—if they can outpace the usual suspects (looking at you, profit-taking whales).

### Technicals Scream 'Breakout'

The $4K psychological barrier isn't just a number—it's the line between another range-bound yawn and FOMO-driven price discovery. Chartists see clean setups; skeptics see another 'institutional adoption' narrative that'll crash harder than a Celsius withdrawal.

### The Bottom Line

Either ETH shatters its ceiling and proves crypto's institutional era is real... or we're all just trading an over-engineered ETF liquidity mirage. Place your bets—the house always wins.

As ethereum gains momentum across both retail and institutional markets, analysts are closely eyeing the critical $4,000 resistance level. Backed by bullish technical indicators and strengthening on-chain fundamentals, Ethereum appears poised for a decisive breakout in the coming sessions.

Ethereum Price Today: Solid Momentum Near $3,850

Ethereum traded around $3,827 at the time of writing, reflecting a weekly gain of 3.61% and strengthening bullish momentum across the cryptocurrency market. This upward push is largely attributed to institutional demand, particularly through Ethereum exchange-traded funds (ETFs), which have become a major source of capital inflow into the ETH ecosystem.

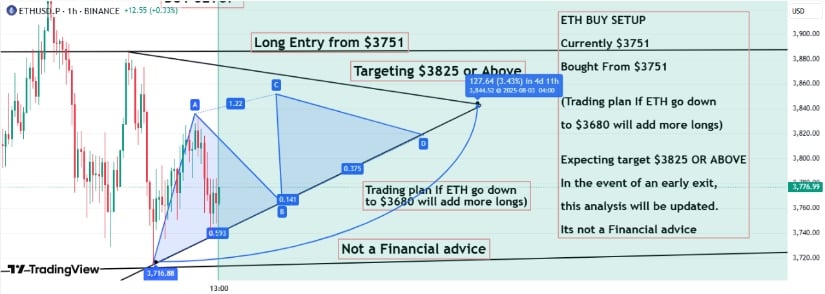

Ethereum buy setup activated with plans to add on dips, targeting a MOVE higher as bullish momentum builds. Source: salahuddin20041 on TradingView

The 24-hour trading volume has crossed $36 billion, and Ethereum briefly touched a high of $3,884. Technical analysts have noted that the $3,900 level is a significant resistance. A breakout above this point may unlock rapid gains, especially if Ethereum crosses the key psychological level of $4,000. Market observers have identified a potential $1.4 billion worth of short positions that could be liquidated if this breakout occurs, likely adding fuel to further upward momentum.

Ethereum ETF News: Redemptions Reshape Liquidity Landscape

The Ethereum ETF landscape has seen tremendous activity. Latest statistics show that Ethereum spot ETFs observed more than $218 million in net inflows on July 29, far surpassing Bitcoin ETFs, which observed close to $80 million. BlackRock’s ETHA ETF was the hub of it all, with more than $223 million in inflows and bringing its total to $9.7 billion.

Ethereum ETFs surged $21B in July, led by BlackRock’s ETHA—strong institutional buying, not retail hype. Source: @0xChainMind via X

This kind of institutional capital flood is reshaping the structure of liquidity in the market, enabling smoother price action and investor sentiment. Ethereum ETFs on July 29 had a total of $21.61 billion in assets, representing roughly 4.75% of ETH’s total market cap. This is contrasted with bitcoin ETFs, which have since managed $152.71 billion, or 6.53% of the market capitalization of BTC.

Whale Activity Reflects Institutional Confidence

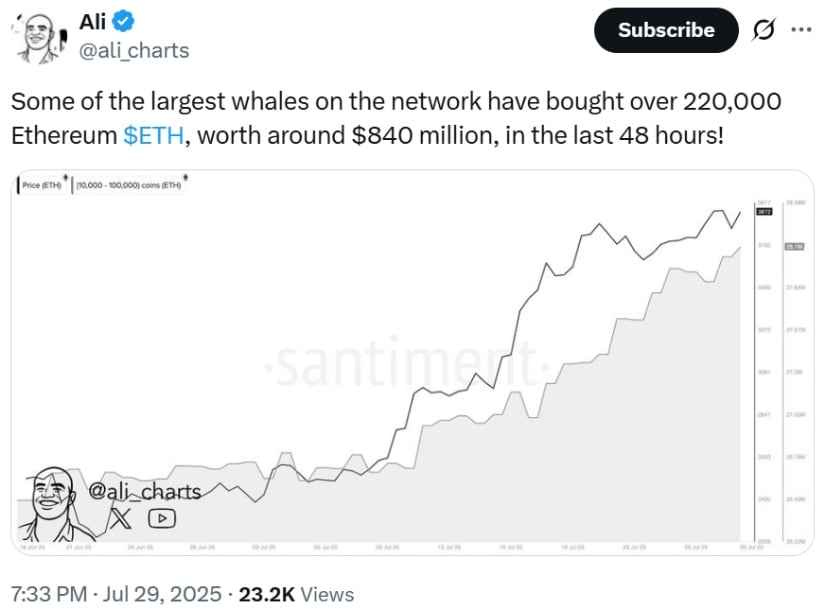

Latest blockchain data shows a steep increase in Ethereum whale wallet transaction activity. Over 220,000 ETH—amounting to nearly $840 million—has been transferred onto large addresses alone over the past 48 hours. The steep uptick is an 8% growth in whale wallets holding in excess of 10,000 ETH, which shows firm accumulation behavior by market leaders.

Whales make waves — over 220,000 ETH scooped up in 48 hours, signaling major bullish intent across the Ethereum network! Source: Ali via X

On the other hand, Bitcoin whale wallets have dipped by approximately 1.61% within the same period. This difference reflects institutional rotation of capital from Bitcoin to Ethereum, with demand for ETH growing as the asset of the day among institutions. Experts believe that the accumulation is not just capital rotation out of Bitcoin, but more so a reflection of new capital into Ethereum itself.

The faith demonstrated by Ethereum whales, while some retail investors are taking profits, speaks to faith in Ethereum’s long-term use case—particularly in decentralized finance (DeFi) and staking-based yield pools.

Technical Analysis: Ethereum RSI Today and Breakout Scenarios

Ethereum’s technical setup supports the current bullish sentiment. The Relative Strength Index (RSI) remains at 56.55, reflecting neutral market momentum and room for further price action. Ethereum is close to the top Bollinger Band at $3,901, one that has capped recent attempts on the upside but is also set to act as a springboard for catapulting above it.

Ethereum trades within an ascending channel, supported NEAR $3700, with RSI signaling a bullish breakout—targets set from $3867 up to $4000. Source: CryptoAnalystSignal on TradingView

Meanwhile, solid support is observed at $3,565. It is the point of intersection with earlier mid-July consolidation as well as the lower Bollinger Band, which are both important levels for the bulls to defend. If Ethereum keeps up its pace and breaks above resistance near $4,096, it can potentially climb towards the $4,500 level. This place has been historically a pivotal watermark in the middle of the large rallies, based on such on-chain metrics as Realized Price-to-Liveliness Ratio.

Final Thoughts: $4K Breakout Could Signal Market Shift

With institutional capital flooding into Ethereum ETFs, record whale accumulation, and technical indicators primed for a breakout, Ethereum’s price action is poised to change direction. Successful breaking above $4,000 WOULD trigger short liquidations at scale and propel prices rapidly toward the next level of resistance at $4,500.

Ethereum (ETH) has been trading at around $3,777, down 0.74% in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

Investors need to keep a close eye on the actions of markets at this level. The combination of ETF liquidity, healthy on-chain fundamentals, and increasing whale wallet balances may decide Ethereum’s direction in the second part of 2025. Volatility in the short term is always a possibility, but overall, the situation for ETH is bullish, with all signs pointing to Ethereum becoming established as a front-line asset in the new digital economy.