Fed Holds Rates Steady—But the Cracks Are Starting to Show

The Federal Reserve just played another round of 'wait-and-see'—but the market isn't buying the act anymore.

Behind the calm facade, pressure's building. Inflation won't die, recession whispers grow louder, and those 'transitory' excuses expired years ago. The Fed's stuck between a rock and hard place: hike and risk collapse, or hold and let inflation eat the economy alive.

Meanwhile, Bitcoin's sitting pretty at $65K—no central bank drama, no emergency meetings. Just code doing its job. Funny how the 'bubble' keeps outliving the 'stable' system.

Wall Street's still betting on fairy-tale rate cuts. Wake up call: the Fed's out of ammo, and the dollar's on borrowed time.

Michelle Bowman and Christopher Waller dissented, calling for a 25 basis point rate cut, marking the first time since 1993 that two Fed governors openly opposed the majority. In Fed-speak, that’s like a knife fight at a dinner party.

Powell is now navigating a classic political-economic standoff. With economic growth showing signs of fatigue and President Trump’s re-election campaign ramping up the pressure for looser monetary policy, Powell is standing in the way like a human sandbag. But even he can’t ignore the rumblings from inside the house.

“Although swings in net exports continue to affect the data, recent indicators suggest that growth of economic activity moderated in the first half of the year,” said the Fed statement. Translated from Fedspeak: things are slowing, but we’re pretending it’s fine.

Inflation remains elevated (whatever that means in this post-COVID, post-QE, post-everything era), the labor market is “solid” (another data-warped word), and Powell continues to signal “higher for longer” despite mounting political headwinds.

Yet two key signals flashed yellow:

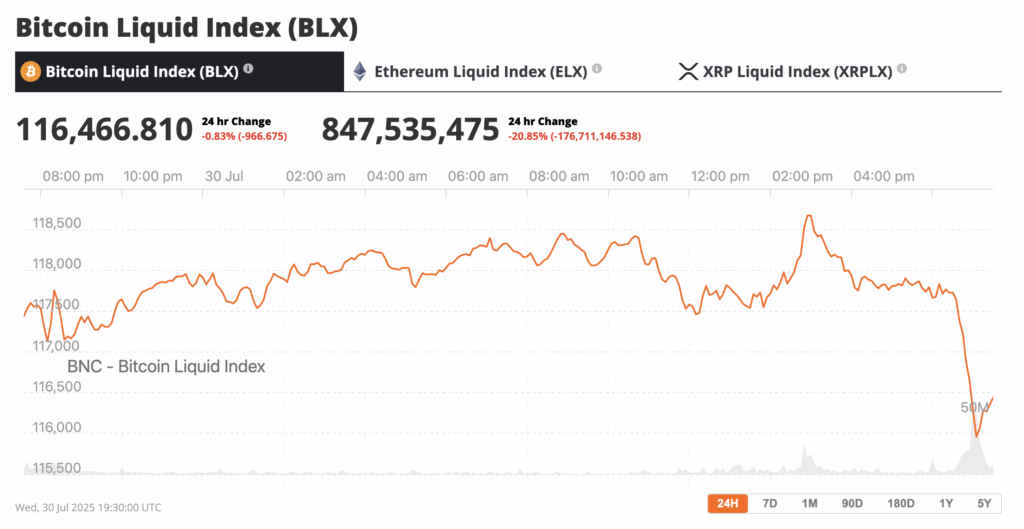

Bitcoin dumped to $116,000 before recovering slightly, source: BNC Bitcoin Liquid Index

All eyes now shift to Powell’s press conference, where his every sigh, pause, and coded phrase will be dissected by algorithms, journalists, and memelords alike.

Is a September rate cut coming? The CME FedWatch tool gives it a ~60% chance, and Powell’s resolve is already being tested by both the bond market and the WHITE House.

In the end, Powell may be holding firm, but the Fed’s fortress just showed its first cracks. Rate cuts will come, it is just a matter of time. If you don’t already own Bitcoin, it’s generally good to buy bitcoin before rate cuts are announced. Something to think about for those wondering if now is a good time to buy crypto.