Twenty One Capital Emerges as a Silent Bitcoin Titan – Here’s Why It Matters in 2025

Wall Street's worst-kept secret is out: Twenty One Capital just joined the Bitcoin whale club. No press releases, no CNBC appearances—just cold, accumulating BTC while traditional finance still debates its 'tulip mania' narrative.

How a low-profile fund outmaneuvered crypto's loudest hype beasts

While crypto Twitter fights over memecoins, this institutional player stacked sats like a Vegas card counter. Their playbook? Ignoring short-term noise and banking on Bitcoin's hardening monetary properties—even as three major banks folded last quarter holding 'stable' fiat.

The ultimate hedge against financial theater

Twenty One's move screams institutional conviction at a time when the SEC still can't decide if Bitcoin is a security, commodity, or existential threat. Meanwhile, their BTC stash now rivals some nation-states—proving once again that in finance, the smart money talks by not talking.

One cynical footnote: At least they didn't buy the top like that hedge fund that went all-in on NFTs in 2022.

According to Bloomberg, Twenty One has scooped another 5,800 BTC recently, the bulk of which reportedly came directly from Tether. That brings its total stash to an estimated 43,500 BTC, or a cool $5.13 billion USD at current prices.

From 0 to 43K BTC in Months

This isn’t just some slow DCA play. Twenty One Capital launched in April 2024, and in just a few months, it’s joined the upper ranks of Bitcoin corporate holders. Notably, it’s doing this without using debt, unlike Saylor’s Strategy (fka MicroStrategy), which printed convertible notes to go on its BTC binge.

The project is spearheaded by Jack Mallers, CEO of Strike and a well-known bitcoin evangelist who thinks fiat is broken and that Lightning will save us all. Whether you buy into that worldview or not, the results speak for themselves: Twenty One Capital is now within striking distance of MARA Holdings, a Bitcoin mining company sitting on 50,000 BTC.

Bitcoin Treasuries: The New Corporate Flex

This sudden rise reflects a broader trend. 2024 has seen a resurgence of the “hodl strategy” among miners and corporates alike, with more firms treating BTC as a Core treasury asset instead of a speculative trade. Mining giants like Riot Platforms, CleanSpark, and Hut 8 are stacking coins instead of selling them, while even outliers like Japanese textile firms and medical tech companies are adding orange coin to their balance sheets.

But Twenty One Capital’s approach is different: it’s not just holding BTC, it’s building a vertically integrated Bitcoin financial institution. And it’s doing it with serious firepower. The firm’s proposed merger with Cantor Equity Partners, a SPAC backed by Cantor Fitzgerald, suggests an IPO is in the works. That could make it one of the first Bitcoin-native treasury companies to go public in a way that doesn’t depend on mining or software sales.

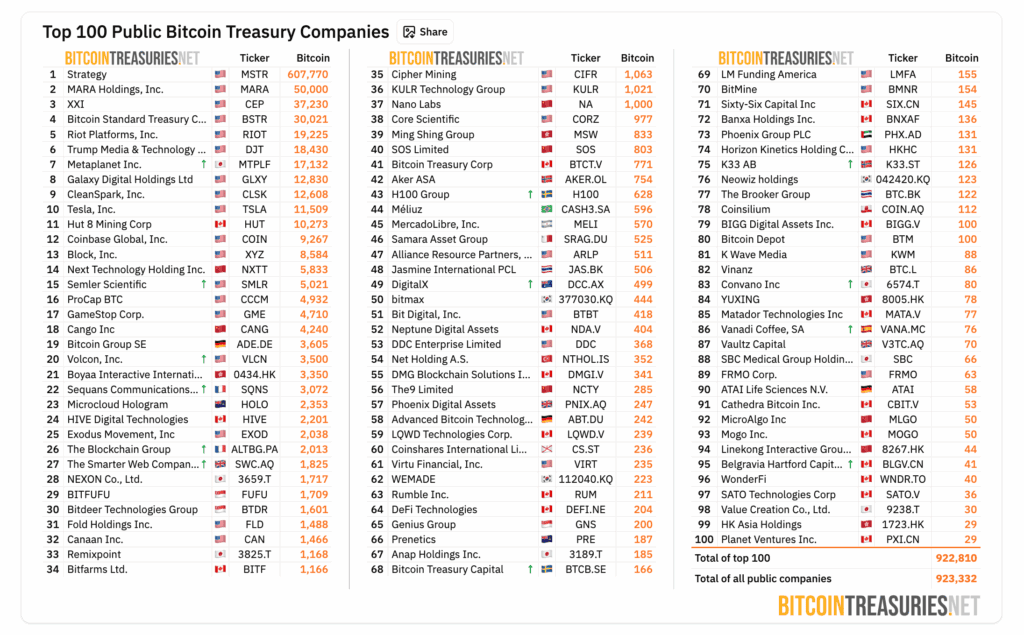

The top 100 Bitcoin Treasury Companies, Source: Bitcoin Treasuries

Why Tether Is Helping Is the Real Question

Here’s the spicy bit: Tether quietly transferred 37,229.69 BTC to Twenty One Capital earlier this year, a MOVE that raised eyebrows but not enough questions. Why is the world’s largest stablecoin issuer unloading that much Bitcoin? Strategic partnership? Risk offloading? PR optics? We’re not sure yet, but one thing is clear: this isn’t a casual relationship.

SoftBank’s involvement adds another layer of intrigue. The Japanese VC giant has been relatively quiet on the crypto front lately, licking its wounds from WeWork and other misadventures. Their bet on Twenty One could signal a reentry into risk markets via a Bitcoin-first strategy, one that’s immune to traditional inflation and monetary meddling.

Twenty One Capital came to play. In just a few months, it’s vaulted into the Bitcoin big leagues, outpacing expectations, backed by some of the most powerful players in finance and crypto. With Jack Mallers at the helm and an IPO looming, this isn’t just another Bitcoin treasury; it’s a signal that institutional Bitcoin accumulation is entering a new, more aggressive phase.

Michael Saylor, better keep stacking, you’ve got company.