Avalanche (AVAX) Primed for Breakout: $35 Target Looms as Consolidation Phase Nears Climax

Avalanche (AVAX) coils like a spring—tight consolidation hints at an explosive move. Traders brace as technicals scream momentum.

Why $35 isn't just hopium

The charts don't lie: AVAX's stubborn refusal to dip below key support levels signals accumulation. Whispers of institutional interest swirl—because nothing moves markets like hedge funds late to the party.

Riding the next wave

Volume spikes and tightening Bollinger Bands suggest the patience game is ending. Retail FOMO hasn't even kicked in yet—classic sign this could get messy (or profitable).

Just remember: In crypto, 'imminent' means anywhere between 5 minutes and 5 fiscal quarters. Bankers still can't decide if they're 'crypto-curious' or just need a scapegoat for their next earnings miss.

AVAX price has recently started to show improving strength, while most altcoins are in a state of slowdown. Market participants now believe that the AVAX coin may be gearing up for a major breakout, particularly as it approaches a resistance zone that has capped its price for nearly six months.

AVAX Price Shows Relative Strength Amid Market Pullback

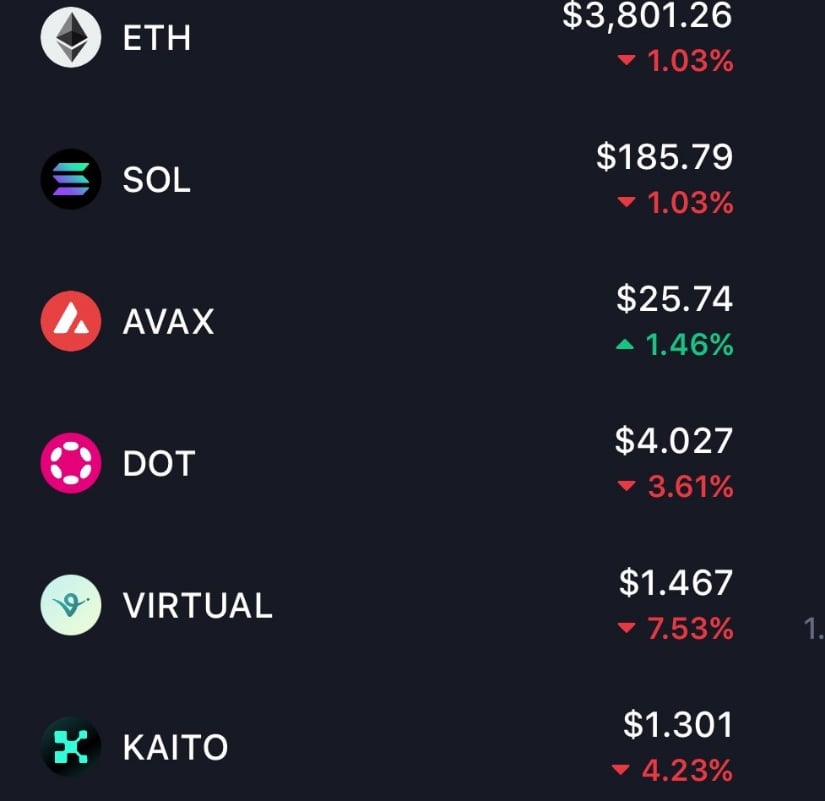

As the crypto market sees a broader corrective-led session, the AVAX price held its ground far better than most. As shown in the image shared by Xero, assets like ETH, SOL, DOT, and VIRTUAL all posted deeper losses, but AVAX stayed relatively stable with only a mild decline before briefly flipping green during intraday action. This kind of resilience can be an early tell of rotation or capital anchoring within the Avalanche ecosystem.

Avalanche’s AVAX holds firm as peers drop, signaling early signs of capital rotation within the ecosystem. Source: Xero via X

In choppy markets, tokens that show relative strength, even when they technically close red, tend to lead once sentiment flips. For now, AVAX seems to be quietly separating itself from the broader market weakness.

AVAX TVL Breaks $2B as On-Chain Activity Heats Up

Building on its recent show of strength, AVAX is now making headlines with explosive on-chain growth. As shown in the latest post by Bubits, the network’s Total Value Locked (TVL) has officially crossed the $2 billion mark, outpacing several top blockchains.

Avalanche’s TVL crosses $2 billion as daily transactions and DEX activity surge to new highs. Source: Bubits via X

Alongside that, DEX volume has hit fresh highs, suggesting DEEP liquidity and rising user participation across the board.

This growth isn’t isolated to TVL alone. Daily transaction activity has been averaging 15 million, and now, speculation around a potential VanEck AVAX ETF filing is stirring optimism across the ecosystem. With both network fundamentals and narrative traction climbing, Avalanche continues to signal that it may be preparing for a bigger rally ahead.

AVAX Tests Key Resistance After 176-Day Consolidation

Fresh off its on-chain momentum and TVL milestone, Avalanche now finds itself in a technically critical spot. The chart shared by Jesse Peralta shows AVAX pressing into a long-standing resistance zone that has held firm since March. Price has been oscillating in a wide range for over 170 days, and it’s now knocking on the upper boundary once again, just shy of the $27 region.

AVAX retests six-month resistance NEAR $27, with rising volume hinting at a potential breakout. Source: Jesse Peralta via X

With rising volume, bullish structure, and multiple successful retests of mid-range support, the setup suggests a potential breakout scenario if momentum holds. A clean daily close above $27 could mark the beginning of a broader trend reversal, flipping the entire consolidation range into fresh support.

AVAX Price Sets Sights on $35 If $27 Breakout Holds

As AVAX price presses into the same resistance zone discussed earlier, chartist Ali Martinez reaffirms the importance of a daily close above $27. The clean horizontal levels laid out on his chart suggest a well-defined structure, with the $27 mark acting as a key inflection point. Historically, this level has capped multiple attempts over the past few months, making it a strong pivot area to watch.

AVAX targets $35 as Ali Martinez highlights $27 as the key breakout level to watch. Source: Ali Martinez via X

Should the price manage to close above this range with follow-through volume, the next technical target sits near the $35 zone, aligning with the upper resistance band from earlier consolidation phases. With a clear base building beneath and growing confidence in the ecosystem, this potential MOVE could open up a new leg of upside for Avalanche.

AVAX/BTC Pair Signaling Acceleration Ahead

Kaleo’s latest chart on the AVAX/BTC pair adds another LAYER to Avalanche’s growing strength narrative. AVAXBTC pair has climbed to the highest levels since 23rd May 2025. This emerging strength is a welcome signal for AVAX bulls, especially as it breaks above prior local highs with a steep incline that suggests momentum is accelerating.

AVAX/BTC pair hits its highest level since May 2025, signaling a momentum shift amid mixed market conditions. Source: Kaleo via X

What makes this particularly interesting is that it’s happening while broader market conditions remain mixed. When an altcoin outpaces BTC during sideways or uncertain environments, it often foreshadows a deeper rotation in favor of that asset. If this relative strength holds, AVAX could continue to outperform across both USD and BTC pairs.

Final Thoughts: Is AVAX Ready to Break Free?

Avalanche has steadily carved out a bullish narrative in a market that is looking for its next direction. With on-chain growth hitting new records, a $2B TVL milestone, and relative strength against both USD and BTC pairs, AVAX isn’t just surviving this chop; it’s starting to lead. The test at $27 marks a potential turning point, and if bulls manage a clean close above, the next leg toward $35 could come quicker than many expect.