🚀 Bitcoin (BTC) Price Prediction: $250K by 2025 as PayPal Supercharges Global Crypto Payments

Bitcoin's bull run isn't just alive—it's accelerating. With PayPal doubling down on BTC payments worldwide, the stage is set for a potential moonshot to $250K. Here's why the stars are aligning for crypto's flagship asset.

The PayPal Effect: Mainstream Adoption on Steroids

When a payments giant like PayPal embraces Bitcoin, merchants listen. Suddenly, 'digital gold' starts behaving like digital cash—only with 1000% more volatility to keep things spicy.

Technical Tailwinds Meet Institutional FOMO

The halving cycle squeeze is colliding with Wall Street's late-stage crypto cravings. Result? A perfect storm that could send BTC valuations into uncharted territory—assuming the SEC doesn't try to 'protect' investors into oblivion first.

Remember: in crypto, the line between prophecy and hopium is razor thin. But with real-world utility finally catching up to the hype, this might be one prediction that doesn't vanish like a DeFi rug pull.

As institutional inflows rise and Bitcoin ETF news continues to fuel demand, analysts predict Bitcoin could reach $250,000 by 2025, positioning BTC as a top-performing asset in the post-halving cycle.

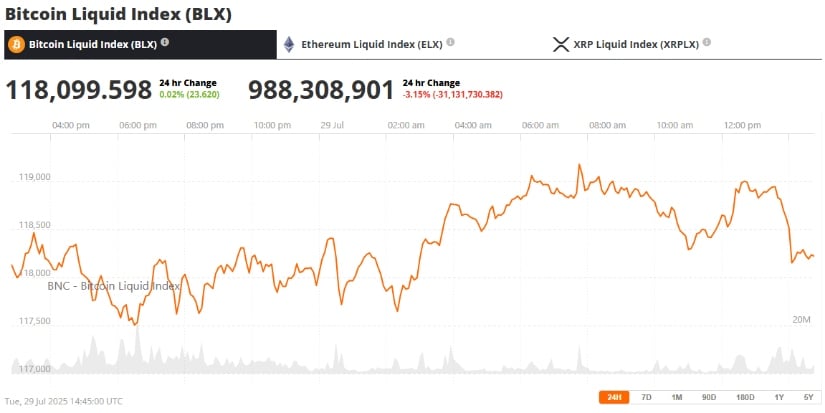

Bitcoin Price Today Holds Steady Near $119K Despite Bullish Momentum

Bitcoin price today hovers around $118,800, continuing a period of consolidation just below the critical $120,000 resistance zone. Despite muted short-term price action, a wave of institutional interest and adoption-driven developments—most notably PayPal’s global expansion of BTC payments—has reignited bullish forecasts, with some analysts projecting a surge toward $250,000 by 2025.

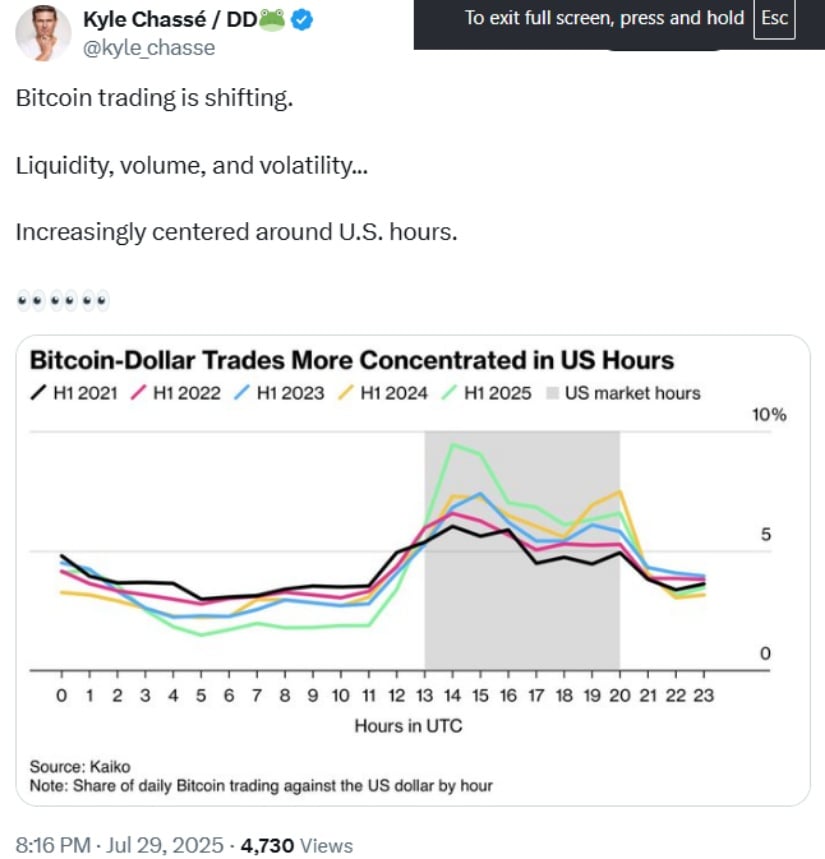

Bitcoin trading shifts to U.S. hours as BTC consolidates NEAR $118,800 — bullish momentum builds with PayPal adoption and $250K predictions ahead. Source: @kyle_chasse via X

In the latest Bitcoin news today, PayPal has rolled out a “Pay with Crypto” feature enabling U.S. merchants to accept over 100 cryptocurrencies, including Bitcoin (BTC), ethereum (ETH), and Solana (SOL). The payments giant is also preparing for a global rollout later this year with a platform called “PayPal World”, which will enable cross-border wallet interoperability and seamless crypto-fiat conversions.

Market Overview: Bitcoin Technical Analysis Signals Breakout Setup

From a technical perspective, bitcoin remains in a tight symmetrical triangle, coiling between support at $117,400 and resistance near $121,000. The RSI indicator currently reads 55.46, suggesting neutral momentum with a slight bullish bias. Bitcoin’s price also remains above the 50-day simple moving average (SMA), currently at $118,201, reinforcing short-term support.

Bitcoin rebounds from key Fibonacci support after whale-driven dip — bullish structure intact as BTC eyes $140K breakout zone. Source: Kevinn_Nguyen on TradingView

According to analysts, a breakout above $121,100 could lead BTC to test the $125,645 zone, while failure to hold $117,400 may result in a correction toward $114,500. With volatility tightening and the Bollinger Bands compressing, a decisive MOVE is expected soon.

“This triangle formation is classic consolidation before an explosive move,” said technical analyst Parshwa Turakhiya. “If bulls reclaim $121,000 with conviction, Bitcoin could be on track for a fresh leg higher.”

Fundamental Drivers: PayPal, ETF Flows, and Institutional Acceleration

While the charts suggest imminent volatility, it’s the macro and adoption trends that are laying the foundation for Bitcoin’s long-term bullish thesis.

PayPal enables millions of merchants to accept Bitcoin and 100+ cryptos — a major leap toward mainstream adoption! Source: Lucky via X

PayPal’s integration with major wallets like MetaMask, Coinbase, and Kraken enables merchants to accept and convert crypto into fiat or stablecoins like PYUSD, streamlining global crypto commerce. The addition of a 4% APY on PYUSD balances also incentivizes holding within the PayPal ecosystem.

“PayPal’s 400+ million users and millions of merchants now have frictionless access to Bitcoin. This is a serious shift in real-world utility,” noted crypto strategist Luciano BTC on X .

Additionally, Bitcoin ETF news continues to drive institutional demand. A recent Citigroup analysis found that ETF flows explain 41% of Bitcoin’s price returns in 2025. With nearly 7% of BTC’s total supply locked in ETF structures, sustained inflows are significantly reducing available circulating supply.

“Each $1 billion in ETF inflows correlates with a 3.6% price increase in Bitcoin,” Citi analysts Alex Saunders and Nathaniel Rupert reported. “This makes ETF activity one of the most powerful catalysts in today’s BTC market.”

Expert Insights: Bitcoin as an Inflation Hedge and Long-Term Forecasts

Beyond short-term price levels, experts see Bitcoin as a strategic inflation hedge amid global monetary shifts. With concerns over U.S. interest rates and inflation persistence, institutional portfolios are increasingly allocating to hard digital assets like BTC.

Bitcoin trends upward near $119K as traders eye a potential breakout to $135K — bullish momentum builds ahead of key U.S. crypto regulation report. Source: Adam_Scalping on TradingView

Citi’s base case puts Bitcoin at $135,000 by year-end, while its bull case projects nearly $200,000. Meanwhile, independent analysts from Bridge Capital and VanEck have similarly bold targets, estimating Bitcoin’s price could reach between $180,000 and $250,000 by mid-to-late 2025.

“Bitcoin has evolved from speculative play to a serious macro asset class,” said Antoni Skaramoty of Bridge Capital. “Its growing integration into traditional finance, particularly through ETFs and platforms like PayPal, changes the valuation model completely.”

Bitcoin Halving 2025 and Whale Activity Add to Bullish Thesis

Another major catalyst on the horizon is the Bitcoin halving in 2025, which will cut miner rewards from 3.125 BTC to 1.5625 BTC per block. Historically, halvings have preceded massive bull runs by limiting new supply.

Also worth watching is ongoing Bitcoin whale activity. Large on-chain transfers and accumulation patterns have increased steadily, with Bitcoin whale alerts tracking repeated purchases at current levels—often a precursor to long-term price appreciation.

Conclusion: BTC’s Next Move and the Road to $250K

In the short term, Bitcoin remains locked in a tight range just beneath resistance, but macro and structural forces hint at a much larger move brewing. The combination of ETF demand, halving dynamics, PayPal adoption, and bullish institutional sentiment supports the narrative that Bitcoin could reach $250,000 by 2025.

Bitcoin (BTC) was trading at around $118,099, up 0.02% in the last 24 hours at press time. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

Still, investors should remain cautious. As volatility remains compressed and macro risks persist, Bitcoin’s next move could hinge on upcoming Federal Reserve decisions and further ETF FLOW momentum.