Floki Teeters at Key Resistance – Is a Explosive Breakout Imminent?

Floki's price action is tightening like a coiled spring—testing a critical resistance level that could trigger the next major move. Meme coin traders are watching the charts like hawks, waiting for that decisive signal.

Will the breakout follow the playbook—or will it be another 'buy the rumor, sell the news' circus? Only time will tell if this dog-themed token has real bite or just barks at shadows.

Meanwhile, Wall Street 'experts' are still trying to figure out why a Shiba Inu mascot outperforms their over-engineered ETFs. Crypto wins again.

Analysts view this region as a key breakout zone, noting FLOKI Price has surged after past consolidations below similar levels.

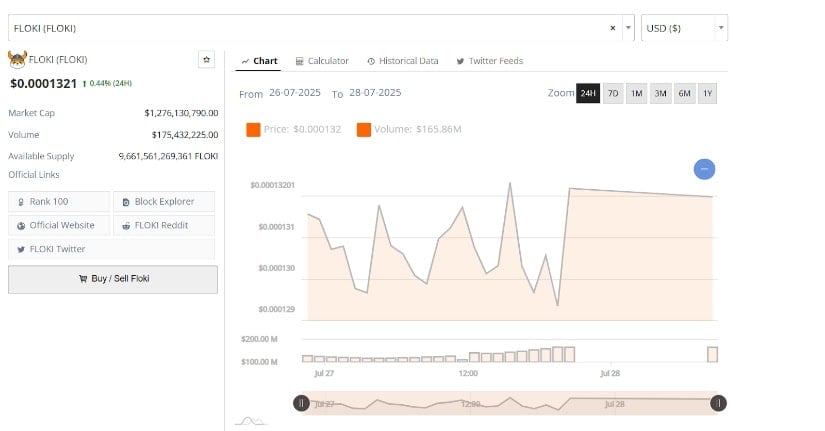

Market participants are closely monitoring this zone for a potential breakout or rejection, with trading volume holding above $175 million in the last 24 hours. As FLOKI hovers near resistance, its price structure, volume trends, and recent retest of $0.00011200 support may drive the next move.

Floki Price Consolidates Near Resistance Awaiting Breakout Signal

According to analyst Tryrex, Floki (FLOKI/USDT) is consolidating just beneath a critical resistance band on the 150-minute chart. The horizontal resistance range between $0.00013150 and $0.00013250 has capped upward moves in recent sessions, with price action clustering directly below the barrier. This repeated testing suggests that buyers may be gaining strength ahead of a potential breakout.

Source :X

The chart shared by the analyst shows that the price has remained within a narrow zone, with a green arrow indicating the potential for continuation if the ceiling is breached. Historical price behavior in similar conditions—particularly in meme tokens—has often led to quick upward extensions. However, confirmation will likely require a decisive close above the marked resistance level. Until then, the current structure suggests traders are waiting for a clearer directional cue.

Support Retest Seen on Weekly Structure

Analyst Crypto Tony provided additional context from a broader time perspective, identifying the $0.00011200 level as a critical horizontal support on the weekly chart. This level previously served as a resistance area during earlier stages of the cycle. The recent pullback from local highs has seen FLOKI price revisit this zone, which may now function as a structural base if bulls maintain interest.

Source :X

The pattern under observation resembles a breakout-retest scenario, where a former resistance becomes support before a continuation move. Floki Price activity around this area has been accompanied by narrowing candles, reflecting market hesitation.

If the zone holds, it may validate the bullish setup seen earlier in July, providing a platform for further upward movement. Conversely, failure to defend this support could return the token to the lower consolidation range.

Floki Trades Sideways as Momentum Softens

At the time of reporting, FLOKI is trading at $0.0001321, representing a 0.44% gain over the past 24 hours. While the percentage change is minor, intraday movement has shown noticeable volatility. The asset fluctuated between $0.0001290 and $0.0001328, with multiple price swings met by quick rejections. This behavior suggests that market participants remain cautious, with no clear control between buyers and sellers.

Source: BraveNewCoin

The latest session ended with price flattening NEAR the top of the recent range. This stalling near resistance may either signal exhaustion or a buildup phase. Given the lack of breakout confirmation, traders appear to be watching closely for volume-supported movement before committing to directional bias. The current tight spread also reflects a possible equilibrium zone as buyers and sellers await resolution.

Volume and Market Positioning Reflect Cautious Sentiment

Floki daily trading volume reached $175.43 million, indicating sustained market interest despite the lack of directional clarity. The modest rise in volume paired with range-bound price action suggests that activity remains driven by short-term sentiment rather than trend conviction. Each attempt to MOVE above $0.0001321 has been quickly countered, showing that sellers remain active at these levels.

Floki maintained a market capitalization of approximately $1.27 billion, with a circulating supply exceeding 9.66 trillion tokens. The Floki price structure shows brief rallies that reverse quickly, and this back-and-forth activity may persist until a breakout is confirmed. A break above $0.0001328 could confirm upside momentum, while falling below $0.0001290 may trigger short-term bearish pressure.