Bitcoin Buy Zone Alert: Here’s Where Bulls Should Strike Now

Bitcoin's flashing buy signals—but will traders seize the moment?

The crypto king's latest dip has analysts whispering about a golden entry point. With volatility spiking and institutional money lurking, this could be the last discount before the next leg up.

Key levels to watch:

- The $58K-$62K range emerges as critical support

- Whale accumulation patterns mirror 2023's breakout setup

- Derivatives data shows shorts getting squeezed

Meanwhile, Wall Street's still trying to explain Bitcoin's 150% annualized returns using their 20th-century spreadsheet models. Some things never change.

One thing's certain: when this consolidation ends, it won't be quiet. The question isn't if—but when—the bulls charge.

With Bitcoin parked just below its all-time highs, hovering around $117,500, traders are left pacing at the gate. Should they jump in now and hope to ride the next leg up—or wait for the market to flinch and hand them a better entry?

Markus Thielen of 10x Research says patience might pay. In his view, the sweet spot for bullish entries lies around $111,673—Bitcoin’s May high that flipped from resistance to potential support. “We’d prefer to see BTC retest that breakout level to offer a more attractive risk/reward entry point,” Thielen wrote in a Monday note to clients.

That level isn’t arbitrary. Markets, like old dogs, love familiar spots. Retests of previous resistance-turned-support are classic launchpads for renewed upside—assuming bulls hold the line. It’s also a zone that offers traders a cleaner setup: tighter stop-losses, better upside potential, and fewer sleepless nights.

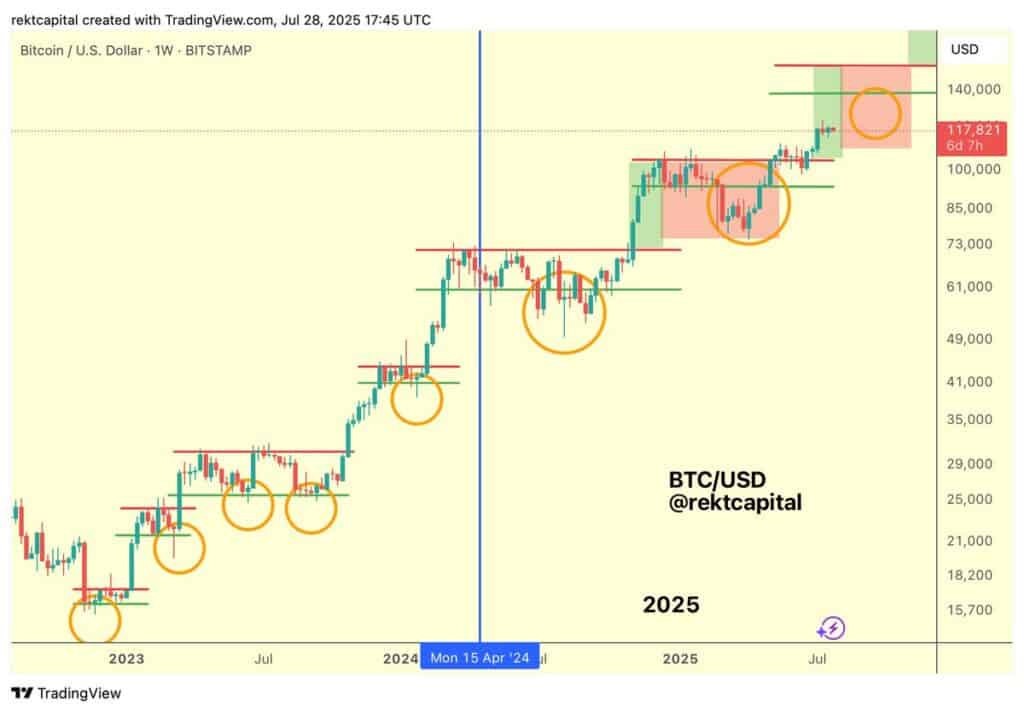

While Rekt Capital reports that bitcoin is technically in week four of Price Discovery Uptrend 2, there’s every possibility Bitcoin can dip further before resuming its uptrend. If it dips, that could be the best opportunity to buy Bitcoin in some time.

Bitcoin is technically in week four of Price Discovery Uptrend 2, Source: X

The Risk-Reward Game

Let’s break it down: traders are generally hunting for setups where they risk $1 to make at least $2 or more. That’s the classic 1:2 risk-reward ratio. Buying BTC at $119,000? That math gets shaky unless you believe in a moonshot soon. But buying closer to $111,673? That’s where the risk-reward math actually works in your favor.

Thielen’s call isn’t just technical nitpicking—it’s about strategic entry in a late-stage bull run where the easy gains are already in the rearview mirror.

With huge capital set to pour into Bitcoin treasury companies in 2025, buy opportunities will be rare.

But What If It Doesn’t Dip?

Here’s the tricky part: bull markets don’t always give you second chances. If Bitcoin keeps climbing without that anticipated pullback, Thielen points to $120,000 as the new line in the sand. A clean break and close above that descending trendline (linking the July 14 and July 23 highs) could be your go signal—but only with tighter stop-losses in tow.

“Re-engaging above $120K is justifiable,” Thielen notes, “but it requires unusually disciplined risk management.”

In other words, if you’re late to the party, you’d better stay NEAR the door.

Bigger Picture: Macro Tails and Catalysts

BTC’s modest 1% weekend gain came on the back of headlines about the U.S. and EU hashing out the largest trade deal in history—a rare dose of macro euphoria. If this Optimism sustains, risk assets like Bitcoin may not pull back at all. But macro tailwinds can be fickle, and crypto has a habit of punishing euphoria just as fast as it rewards it.

So what’s the takeaway? If you’re looking to ride the Bitcoin bull, don’t chase it up the hill with your shoelaces untied. Either wait for the pullback to $111K—or prepare to commit above $120K with surgical risk controls.

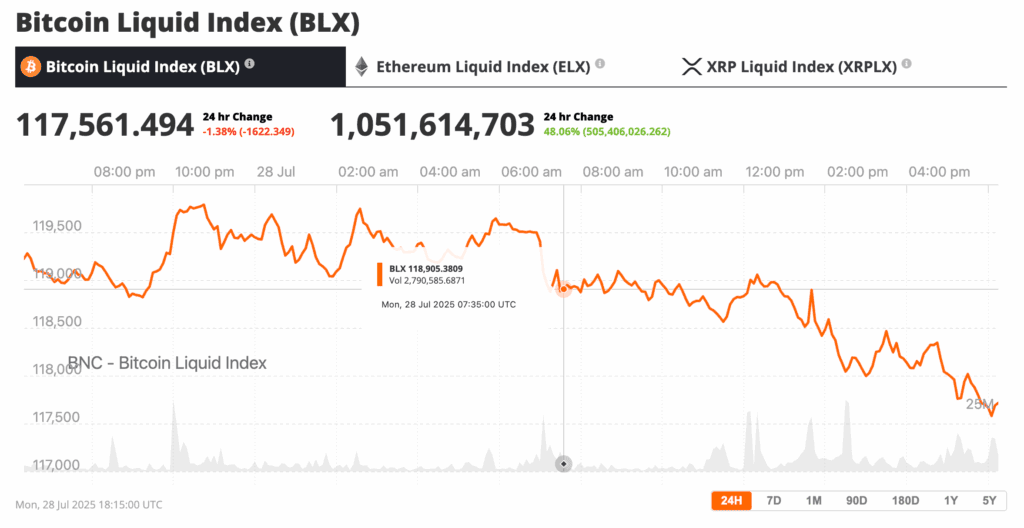

Bitcoin dropped on Monday, moving closer to the buy zone, Source: BNC Bitcoin Liquid Index