Dogwifhat (WIF) Primed for Breakout: Bulls Target $1.39 as Price Defends $1 Support

Memecoin momentum builds as Dogwifhat (WIF) defies gravity—holding critical support while eyeing higher highs.

Key Levels to Watch

The $1 psychological floor has become a battleground for WIF traders. Every dip below gets bought aggressively—retail FOMO meets algorithmic support in a perfect storm of speculative demand.

Technical Takeaway

Chartists note the ascending triangle forming since June, with $1.39 acting as the clear breakout target. A close above this level could trigger cascading liquidations—fueling the next leg up as overleveraged shorts get wrecked.

Market Sentiment

Options flow shows growing interest in August calls, though the real action remains in perpetual swaps. Funding rates stay positive—proof that degenerate gamblers still prefer leveraged longs over actual productivity.

The Bottom Line

WIF either rockets toward $1.39 or dies trying. No middle ground for memecoins in 2025—just glorious rallies or brutal rekt sessions. Place your bets.

The token has cleared important resistance areas and is forming a stable base NEAR its recent highs.

Market structure suggests further upside may be underway if current trendlines and volume levels remain intact. At the time of writing, WIF is trading at $1.077, maintaining structure above the mid-Bollinger Band on the daily chart.

Rounded Bottom Breakout and Short-Term Support Structure

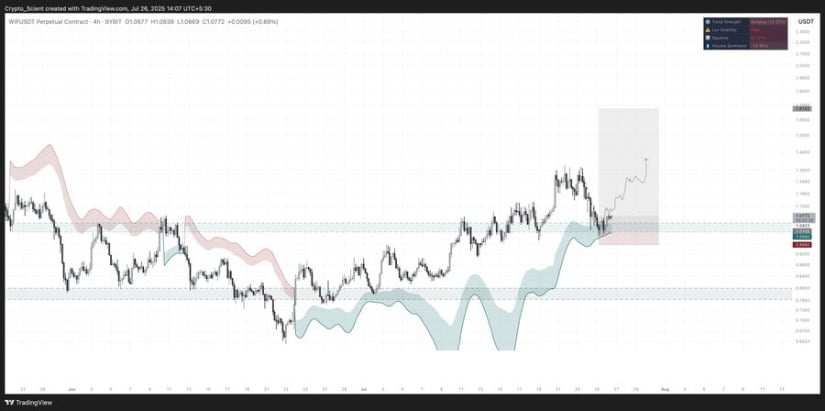

On the 4-hour chart, WIF/USDT has confirmed a breakout from a rounded bottom formation, rebounding sharply from a confluence zone that includes both a daily support/resistance flip and a 4-hour trendline retest.

This area around $1.03–$1.06 has acted as a consistent support region, validating the breakout with a series of higher lows. Price is now consolidating just below $1.10, with multiple tests indicating strong buying interest.

Source: X

Analyst @Crypto_Scient highlighted this setup as a potential V-reversal, with price recovering from the shaded accumulation zone toward projected resistance. If the token manages a clean breakout above the $1.10 threshold, it may enter the next leg up, targeting the $1.15–$1.20 range.

Volume and sentiment metrics tracked during the MOVE reflect sustained interest, with clear invalidation zones now established below $1.03. This structure presents a favorable setup for continuation, provided the price maintains above key intraday support.

Consistent Volume Reinforces Upward Pressure

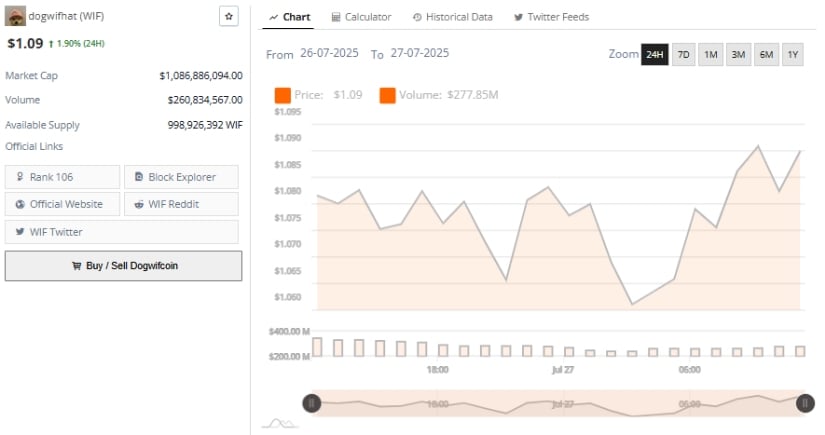

Across the past 24 hours, WIF gained 1.90% to reach a high of $1.09, with a notable increase in volume totaling $277.85 million. The trading session demonstrated controlled price action, maintaining higher lows and forming steady intraday swings between $1.06 and $1.09.

The latest peak came near the end of the cycle, suggesting accumulation into strength rather than speculative spikes.

Source: BraveNewCoin

The upward move coincides with broader market confidence, supported by WIF’s liquidity and available circulating supply of approximately 999 million tokens. Maintaining support above the $1.07–$1.09 region will be critical for continuation.

If volume remains stable and price extends above $1.10, the path toward the previously contested $1.26–$1.39 zone may open up. This volume-backed price action continues to reflect market engagement from both short-term traders and long-term holders.

WIF Holds Bullish Structure Above Mid-Bollinger Band

At the time of writing, WIF remains well-positioned above its mid-Bollinger Band ($1.061) on the daily chart, having recovered from a recent dip. The token is consolidating within the upper half of the Bollinger Band range, with the bands themselves beginning to widen.

This expansion indicates rising volatility, typically a precursor to directional movement. The upper band, now near $1.26, represents the next level of interest.

Source: TradingView

Meanwhile, the Relative Strength Index (RSI) currently reads 53.51, slightly below its moving average of 60.17. Though momentum has cooled, the RSI remains above the 50 mark, keeping the trend within bullish parameters.

A renewed RSI push above 60 WOULD signal a potential breakout attempt. If combined with a price surge above $1.10, this could set the stage for another test of the $1.26–$1.39 resistance band established during earlier highs.