Arbitrum (ARB) Primed for Breakout: Falling Wedge Pattern and Surging On-Chain Activity Signal $4 Rally Ahead

Arbitrum's ARB token is painting a textbook bullish reversal—and on-chain metrics suggest this Layer 2 heavyweight isn't done climbing.

The Wedge Play: That weekly chart? A tightening falling wedge, the kind that typically snaps back hard. No guarantees in crypto, but the setup screams 'accumulation zone.'

Chain Reaction: Developer activity and TVL growth are outpacing most Ethereum L2 rivals. Funny how fundamentals matter... eventually.

Price Target: A clean breakout could send ARB toward $4—assuming Bitcoin doesn't throw another tantrum and tank the alts. Because that never happens.

Arbitrum is starting to turn heads again as price action tightens and momentum begins shifting in favor of the bulls. Market participants now believe that ARB coin may be setting up for a fresh rally, with multiple indicators flashing early signs of strength.

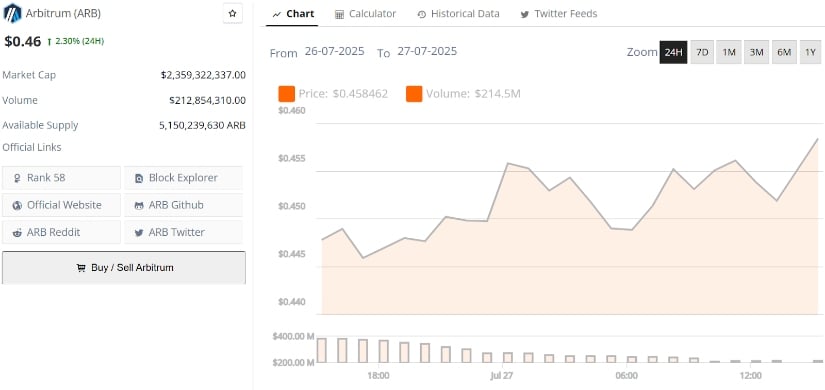

Arbitrum’s current price is $0.46, up 2.30% in the last 24 hours. Source: Brave New Coin

Arbitrum Mirrors Early AVAX Structure as First Cycle Top Eyes $4

Arbitrum is beginning to echo early AVAX fractals. As shared by The Wyckoff Architect, ARB appears to be tracing a five-wave impulsive move from its base structure, with Wave 1 and 2 already behind us and Wave 3 potentially underway. The macro setup reflects a familiar slope-break and retest pattern seen during AVAX’s early breakout phase, giving this fractal a bit more weight than usual speculation.

Arbitrum’s fractal mirrors early AVAX, with Wave 3 eyeing the $4.00 mark as a key Fibonacci extension target. Source: The Wyckoff Architect via X

What stands out in the projection is that the initial cycle top is expected around the $4.00 mark. That level not only aligns with the top of Wave 3 but also sits at a key Fibonacci extension zone, hinting it could act as both a target and resistance.

Arbitrum Breaks Imminent as Structure Targets $3.70–$5.55 Range

Arbitrum is starting to flash early signs of structural strength, but the breakout hasn’t quite confirmed just yet. As highlighted by ShinoXBT, ARB is still sitting just beneath the key diagonal trendline and remains below the Ichimoku Cloud, both of which have acted as persistent resistance in recent months. However, price action is tightening, and the momentum tilt is shifting upward, especially with ARB’s on-chain fundamentals improving fast. Market cap just hit $32.6 billion, the highest in six months, and daily revenue is holding above $100K, showing the protocol’s Core engine remains strong.

Arbitrum’s structure tightens below key resistance, with targets at $3.71 and $5.55 if a breakout confirms. Source: ShinoXBT via X

The technical roadmap, if confirmed, suggests a climb toward the 1.618 and 2.618 Fibonacci extension levels at $3.71 and $5.55, respectively. But for that to materialize, bulls still need to flip both the trendline and cloud resistance into support.

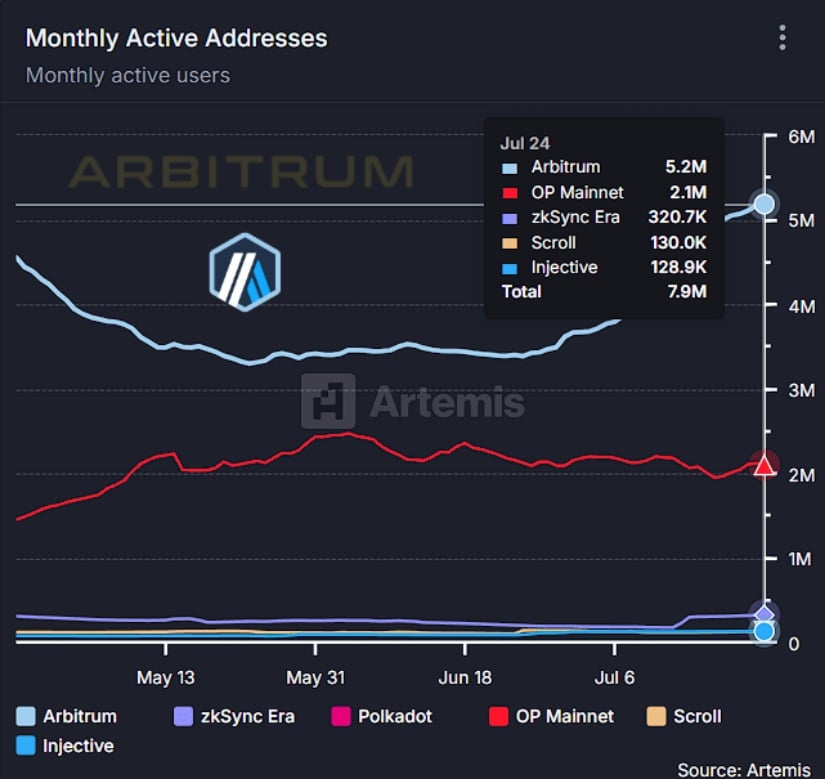

Arbitrum Dominating L2 Activity

Arbitrum just crossed a major adoption milestone, now dominating LAYER 2 activity with 5.2 million daily active addresses. As shown in the chart shared by ShinoXBT, that puts ARB is far ahead of its competitors, with more than double the user base of OP Mainnet and nearly 66% of total active users across all top L2s.

Arbitrum leads the Layer 2 race with 5.2M daily active users, surpassing all major L2 competitors. Source: ShinoXBT via X

When paired with earlier technical setups, like the tightening structure below resistance and the growing parallels to early AVAX cycles, this level of user growth adds another layer of credibility to the bullish narrative.

Technical Outlook: ARB Weekly Falling Wedge Breakout Targets $1.10–$1.50 Mid-Term

Solberg Invest’s chart puts a spotlight on a potential bullish reversal for Arbitrum, as the price begins to break out of a long-standing falling wedge on the weekly timeframe. The structure stretches back nearly a year, and now with ARB attempting to flip the wedge’s top line into support, eyes are turning to mid-term targets of $1.10 and $1.50. These levels align with historical price clusters and round psychological figures, making them targeted checkpoints.

Arbitrum attempts a breakout from a year-long falling wedge, with mid-term targets set at $1.10 and $1.50. Source: Solberg Invest via X

This setup flows well from earlier insights, where ARB’s growing user base and structural tightening set the tone. While macro projections eye $3.70 to $5.55 in a full cycle move, this wedge pattern offers a closer-term roadmap.

Final Thoughts

Arbitrum isn’t just riding a wave of hype; it’s stacking real metrics behind its price action. From a clear five-wave impulsive structure to dominance in Layer 2 activity, ARB is showing signs of maturing into a serious contender for the altcoin run.

If price flips the diagonal trendline and the Ichimoku Cloud into support, the door opens to the $3.70–$5.55 zone, right where the Fibonacci extensions targets land.