Michael Saylor Doubles Down: MicroStrategy’s Latest Cash Grab Fuels Another Bitcoin Buying Spree

MicroStrategy’s CEO is at it again—turning corporate treasury into a Bitcoin war chest while traditional investors clutch their pearls.

The Saylor Playbook: Raise, Convert, HODL

Another quarter, another nine-figure capital raise funneled straight into cold storage. Wall Street analysts sigh as convertible debt deals become de facto Bitcoin ETFs.

Liquidity? Never Heard of Her

The tech firm’s balance sheet now resembles a crypto maximalist’s Trezor—87% illiquid, 100% unapologetic. Meanwhile, Fortune 500 CFOs still think ‘proof-of-work’ refers to their weekend golf handicap.

When the SEC finally greenlights spot Bitcoin ETFs, they’ll just be expensive Saylor tribute acts.

The securities are being marketed at USD 90 per share with an initial 9 % dividend and a total of 5 million shares are on offer. Proceeds will be used to purchase additional Bitcoin for the company’s treasury. Morgan Stanley, Barclays, TD Securities and Moelis & Co. are joint book‑runners on the deal. Strategy’s common equity (ticker MSTR) traded near USD 413 on Thursday, little changed on the day. Year‑to‑date the stock is up 37 %, and over the last twelve months it has gained 146 %, lifting the firm’s market capitalisation to roughly USD 116 billion.

The capital raise deepens Strategy’s position as the largest corporate holder of bitcoin: the company owns 607,770 BTC, representing about 66 % of the bitcoin held by all publicly listed firms. Broader corporate adoption is building; Tokyo‑listed Quantum Solutions has outlined plans to accumulate 3,000 BTC over the next year as a long‑term reserve asset. Meanwhile, institutional appetite for digital assets continues to expand—JPMorgan estimates net inflows across funds, CME futures and venture investment have reached USD 60 billion year‑to‑date, supported by recent U.S. legislation that clarifies the regulatory status of stablecoins and other tokens.

Strategy leads the Treasury companies’ Bitcoin holdings, source: X

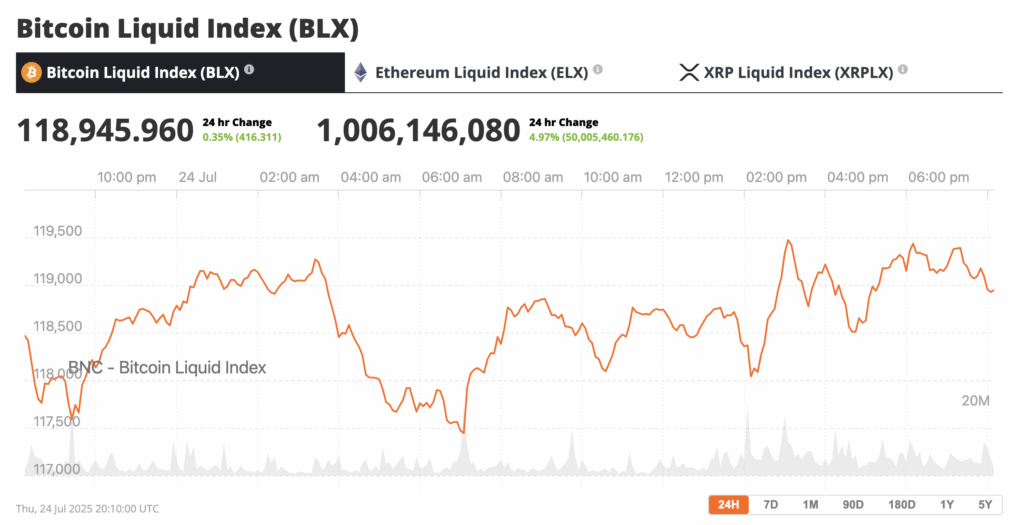

Bitcoin has held up strong in this week’s crypto market dip. Altcoins such as DOGE, and XRP dropped hard, but bitcoin has held steady, indicating market strength and consolidation before the next leg up. With treasury companies such as Strategy intensifying their Bitcoin market buying, the bull Bitcoin bull market looks set to continue. Bitcoin price predictions of $200,000 in 2025 seem every more likely, so act accordingly.

Bitcoin has held up strong in this week’s crypto market dip, holding steady at under 120,000, Source: Bitcoin Liquid Index