Optimism (OP) Eyes $4.40 Surge as Falling Wedge Breakout Fuels Altcoin Rotation Hype

Pattern recognition traders just got a new dopamine hit—Optimism’s chart is screaming breakout.

The Setup:

A textbook falling wedge pattern snapped this week, historically a bullish reversal signal. Now, OP’s price action suggests a 20% rally toward $4.40 could be in play—assuming crypto’s usual ‘buy the rumor, sell the news’ circus doesn’t derail it first.

Altseason’s Shadow Play:

The move coincides with fresh capital rotating into mid-cap alts. Some call it diversification; others, desperate yield-chasing after Bitcoin flatlined for weeks. Either way, liquidity flows are shifting.

Reality Check:

Technical patterns work until they don’t—ask anyone who traded the ‘death cross’ that revived instead of killing the bull market. But with OP’s RSI not yet overheated, this breakout might actually have legs. Or it’ll join 90% of altcoin pumps that end in tears and ‘I’ll just HODL’ copium.

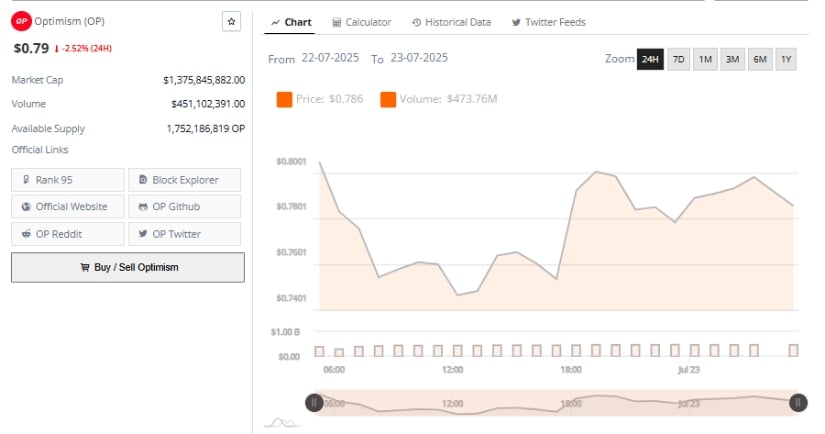

A breakout from a multi-month falling wedge pattern on the weekly chart has put the Layer-2 token back in focus. This bullish setup emerges at a time when capital is expected to rotate into L2 solutions amid a possible decline in ethereum dominance. At the time of writing, OP trades at $0.79, representing a 2.52% decrease over the past 24 hours.

Falling Wedge Breakout Sparks Mid-to-Long-Term Bullish Potential

On the weekly timeframe, OP/USDT has broken above the upper boundary of a falling wedge structure that had constrained its price action since late 2023. This pattern, known for indicating potential reversals, was breached with strong bullish momentum as the latest weekly candle closed decisively above resistance levels.

The breakout signals a change in the long-term trend and could set the foundation for an extended rally if supported by continued buying pressure and positive market sentiment.

Source: X

Analyst @manbitreal recently emphasized that Optimism could benefit from capital shifting into L2 ecosystems, particularly if Ethereum dominance declines. He noted that $0.82 is a critical resistance level and advised waiting for a confirmed breakout above it before initiating new long positions.

This aligns with the technical setup, where maintaining support above the breakout zone is essential for validating the pattern. Failure to stay above key pivot levels could result in renewed consolidation or pullback phases.

Market Activity and Resistance Zones Define the Road Ahead

The 24-hour chart highlights mixed performance, with OP declining -2.52% but maintaining a volatile intraday range between $0.74 and $0.81. Despite the negative daily close, trading volume reached $473.76 million, suggesting significant engagement from market participants.

The data shows that bulls attempted to defend the $0.75–$0.78 support zone throughout the day, while sellers capped upside moves below $0.82. This level has now emerged as the immediate resistance that must be breached for the next leg upward.

Source: BraveNewCoin

With a current market cap of $1.37 billion, Optimism ranks as the 95th-largest cryptocurrency, placing it in the mid-cap category. Price consolidation NEAR the $0.78 level will likely serve as the next short-term pivot.

A successful MOVE above $0.82 could lead to challenges at $2.14, $2.46, and $2.66—key historical resistance zones that align with prior volume spikes and consolidation clusters. If these levels are surpassed, the $3.60–$4.40 range becomes a potential target for a supply zone in late Q3 or early Q4 2025.

Indicators Show Bullish Momentum With Caution on Short-Term Pullbacks

The daily chart presents a stable bullish trend, with OP forming a series of higher lows and highs since early July. The MACD currently supports this structure, with its line reading 0.056 versus a signal line of 0.040, and a histogram value of 0.015. These metrics confirm the presence of upward momentum, although the histogram has yet to show sharp expansion, suggesting buyers are cautious amid resistance overhead.

Source: TradingView

The Chaikin Money FLOW (CMF) indicator stands at +0.15, reflecting consistent capital inflow into OP. A rising CMF from negative territory earlier in the month confirms that demand has been steadily building. However, a drop in either the CMF or MACD alignment could hint at exhaustion and increase the likelihood of a retest of the $0.70–$0.72 support area.

Overall, the breakout from the falling wedge and sustained volume support signal that Optimism may be positioned for a longer-term bullish trajectory. Holding above $0.78 and clearing $0.82 remains crucial for validating this setup and moving toward the $4.40 target zone.