Dogwifhat Teeters at $1 Support: Bullish Breakout or Bearish Trap Ahead?

Dogwifhat (WIF) dances on a knife's edge—the memecoin's $1 support level is either a springboard or a trapdoor. Here's what the charts scream.

Technical Tightrope

Bulls cling to the psychological $1 floor like Wall Street to outdated Fed policies. A bounce here could trigger a 20-30% relief rally, but failure? Say hello to sub-$0.80 territory.

Market Sentiment Split

Traders are divided—some see oversold RSI conditions, others spot descending volume patterns. Meanwhile, Bitcoin's sideways action isn't helping.

Memecoin Math

Let's be real: in a sector where 'utility' often means surviving another week, WIF's 24-hour trading volume ($250M) suggests this dog still has fleas—or fans.

Closing Shot

Whether this pup fetches gains or gets put down depends on whether crypto's degenerate gamblers still believe in magic internet money. Place your bets.

While some traders anticipate a reversal from current levels, others highlight bearish signals that suggest further downside risk. The recent WIF price action has attracted attention from technical analysts tracking both intraday and broader trend structures.

Analyst Ashikur sees the $1.00–$1.02 range as an ideal entry point for long positions, citing signs of bottom formation on the 30-minute chart. However, crypto BAKERY warns of declining momentum and lower highs forming on the 1-hour chart, pointing to possible support targets at $0.9993 and below.

Dogwifhat Price Hovering Near $1 Support as Chart Signals Mixed Outlook

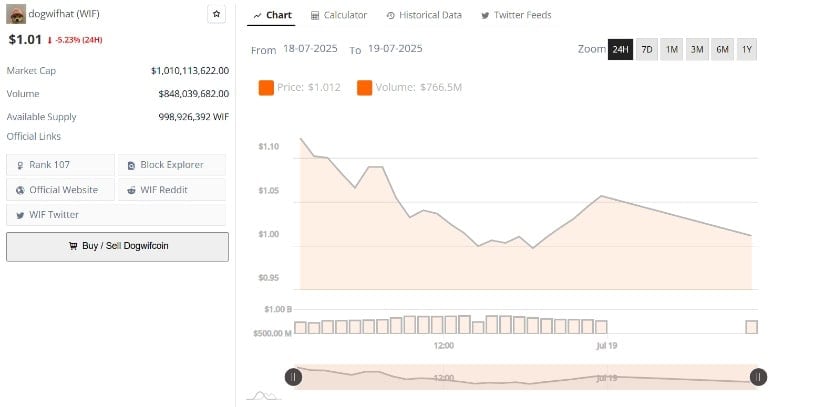

Dogwifhat (WIF) Price is currently trading NEAR the $1.01 mark after a gradual pullback from a recent high above $1.10. The 24-hour chart reveals a consistent downtrend, with price failing to maintain upward momentum following a short-lived recovery. During the early part of the session, WIF attempted to rebound and reached slightly above $1.05 before resuming its decline.

Source: BraveNewCoin

Despite the downward trajectory, trading volume has remained steady, with no signs of sharp liquidation or aggressive accumulation. Lack of extreme volatility suggests that market participants are waiting for a directional confirmation.

The $1.00 level has emerged as a psychological support zone. If this level holds, it could offer a base for a near-term bounce. However, a failure to maintain support may expose lower price areas.

Ashikur Identifies Ideal Entry Zone for Reversal

Analyst Ashikur posted a short-term 30-minute chart showing that WIF has entered what he refers to as an “ideal zone” for a bullish reversal. The current structure shows consolidation within a boxed area between $1.02 and $1.00. According to his analysis, this zone represents an opportunity for early long positioning based on favorable risk-reward dynamics.

Source:X

His projection includes a series of higher highs and higher lows emerging from the consolidation area, potentially pushing the price back toward the $1.10 level. This forecast assumes continued stability around $1.00.

Additionally, the setup resembles a classic accumulation phase, where price compresses before a possible breakout. Ashikur confirmed partial entries at the current range, suggesting confidence in the near-term potential for recovery if the zone holds.

Bearish Outlook From Crypto Bakery Points to Lower Targets

In contrast, analyst CRYPTO BAKERY suggested a bearish scenario forming on the 1-hour chart. His chart shows declining momentum and a series of lower highs developing after the price failed to sustain a MOVE above $1.0417. The pattern signals potential downside continuation if resistance remains intact.

Source:X

CRYPTO BAKERY’s analysis includes projected support targets at $0.9993, $0.9618, and $0.9071. He highlighted a possible bounce-rejection structure that may play out before further weakness. The short thesis remains valid unless WIF reclaims $1.0417 convincingly. The current chart structure indicates that any failed retest of resistance could reinforce downward pressure in the next sessions.

Market Participants Watch for Confirmation Around $1

WIF’s current position near $1.01 leaves it at a technical crossroads. The psychological $1.00 support is now a key level for both bullish and bearish traders. On one hand, a bounce from this zone could attract buyers, particularly those following the structure outlined by Ashikur. On the other hand, a breakdown below this area WOULD validate the bearish continuation model proposed by CRYPTO BAKERY.

With daily volume holding around recent averages and no major shifts in sentiment, short-term price direction will likely depend on whether $1.00 holds as support. Resistance levels remain at $1.05 and $1.10, while failure to defend the current level could shift attention to the sub-$0.96 region. Traders are awaiting stronger signals as dogwifhat navigates a technically mixed landscape.