Trump’s $9 Trillion Crypto Gamble: Why Bitcoin Could Dominate Retirement Portfolios by 2025

Washington shakes as regulators clear a path for digital assets in 401(k)s—and Bitcoin’s poised to feast first.

The $9 trillion retirement market just got a backdoor to crypto. Trump’s latest policy shift lets pension funds and IRAs dive into Bitcoin ETFs—no more ‘too risky’ excuses from wealth managers allergic to 100x gains.

Hyperbitcoinization watch: With institutional custody solved and BlackRock’s stamp of approval, BTC could eat bonds for lunch. Gold bugs? Sweating. Financial advisors? Suddenly ‘blockchain experts.’

Of course, Wall Street will still take its 2% cut whether you HODL or panic-sell. Some traditions never die.

Rumors swirl that Donald TRUMP is set to make a historic move to revolutionize America’s retirement savings.

According to the Financial Times, the former president is preparing to sign an executive order that WOULD open up the $9T 401k retirement market to alternative investments such as cryptocurrencies, gold, private equity, and infrastructure funds, according to sources close to the administration.

This sweeping change would allow Americans to diversify beyond traditional stocks and bonds, potentially reshaping how millions prepare for retirement – and vastly expand potential markets and liquidity for crypto.

401K to 401x for Crypto?

The total crypto market cap is bearing down rapidly on $4T, its highest ever.

Opening the door for some of the $9T in American 401Ks would certainly inject even more energy into that market.

The proposed executive order should direct regulatory agencies (including the Department of Labor) to remove barriers preventing retirement fund managers from including alternative assets in 401k plans.

This marks another major step in Trump’s efforts to normalize cryptocurrency investments. His administration has already dropped enforcement actions against major digital asset platforms and supported a trio of crypto-related bills:

- The GENIUS Act provides a framework for stablecoin use: it passed the Senate earlier in the month, the House on July 17, and is expected to be signed into law soon.

- The CLARITY Act establishes and clarifies the rules for digital assets beyond stablecoins: it passed the House yesterday and now returns to the Senate.

- The Anti-CBDC Act also passed the House, though more narrowly, with a vote of 219–217.

Trump’s family has also taken an active role in crypto, with Trump Media & Technology Group reportedly investing over $2B in digital assets such as Bitcoin and launching its own stablecoin via its World Liberty Financial website.

Private Equity Titans Eye Billions

Beyond crypto, the MOVE would benefit private capital giants like Blackstone, Apollo, and BlackRock. These firms are positioning themselves to capture a wave of new funds by partnering with major 401k plan sponsors like Vanguard and Empower.

Industry insiders believe access to 401k savings could funnel hundreds of billions into private equity, offering savers the chance to tap into markets traditionally reserved for institutional investors.

But with crypto liquidity comes crypto risks. Critics warn of higher fees, illiquidity, and a lack of transparency. Private equity investments, for example, are harder to value and trade than public stocks, potentially exposing savers to additional risks.

And before anything else could happen, the labour department would need to create ‘safe harbor’ rules for fund managers to shield them from legal risk.

Yet for Trump, the move is about giving Americans more freedom to manage their savings – and carrying through on his goals to become the ‘Crypto President’ who brought crypto mainstream.And with bitcoin up 3% on the year, there’s never been a better time to launch a critical upgrade for the world’s largest crypto.

Bitcoin Hyper ($HYPER) – Blast into Bitcoin-Powered DeFi and Staking with Fastest Layer 2

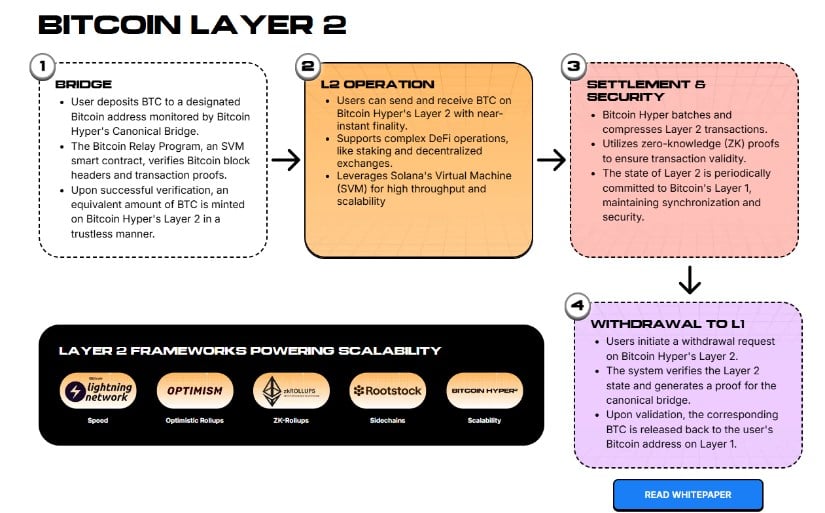

Layer 2 upgrades typically offer technological improvements on base LAYER 1 chains, while also trying to preserve whatever set the original chain apart.

In Bitcoin Hyper ($HYPER)’s case, that means combining the profitability and liquidity of Bitcoin with the speed and DeFi capabilities of the SVM (Solana VIRTUAL Machine). Bitcoin Hyper leverages the SVM through a canonical bridge, opening the door for everything from staking to meme coins.

Bitcoin Hyper will unlock proper staking for Bitcoin – and in the meantime, early investors can stake their $HYPER tokens in the presale for an estimated 270% dynamic APY.

The project will support near-instant finality, both on the Hyper Layer 2 and between Bitcoin and Bitcoin Hyper. It will also utilize zero-knowledge (ZK) proofs to preserve transaction security and validity.

The promise of a technically advanced Layer 2 for the world’s largest crypto has already drawn significant interest – $3.3M raised in the presale so far.

To learn more about Bitcoin Hyper and the potential of Bitcoin’s fastest-ever Layer 2, visit the presale page today.

A Crypto-Infused Retirement Revolution

Donald Trump’s plan to open the $9T retirement market to crypto, gold, and private equity isn’t just a policy shift – it’s a potential tidal wave for the entire digital asset ecosystem.

As Americans gain access to alternative investments in their 401ks, Bitcoin and next-gen projects like Bitcoin Hyper ($HYPER) could see unprecedented inflows.

Do your own research first – this isn’t financial advice.

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.