Solana Price Prediction: SOL Targets $220 as Golden Cross Meets Stablecoin Surge – Breakout Imminent

Solana's SOL token isn't just flirting with bullish territory—it's charging toward $220 with a golden cross formation and a tidal wave of stablecoin liquidity. Forget 'quiet accumulation'—this is a full-throttle breakout play.

Golden Cross Triggers Algorithmic Buying

The 50-day MA just sliced through the 200-day like a hot knife through butter. Traders are front-running the textbook momentum signal—because nothing screams 'buy' like hedge funds chasing their own tail.

Stablecoin Onramps Fuel Rocket Fuel

USDC and USDT inflows to Solana hit record highs this week. Retail might still be licking their 2022 wounds, but smart money's building positions where the gas fees don't murder your ROI.

Short Squeeze Potential at $200 Resistance

Funding rates suggest leveraged bears are clinging to this psychological level. One clean breakout could trigger cascading liquidations—and you know what happens when crypto shorts get steamrolled.

Just don't mention the last time SOL danced with a golden cross before FTX imploded. Some chart patterns come with baggage.

Solana is starting to show serious signs of strength, and it’s not just about price anymore. From a rare CNBC spotlight to record-breaking USDC mints and a golden cross forming on the charts, momentum is building across the board.

Solana Summer Heats Up With Mainstream Spotlight

Solana just grabbed a front-page feature on CNBC, one of its rare moments. It’s a sign that SOL is now firmly on the radar of mainstream media and institutional eyes alike. The mention on CNBC shared by Parker highlights expanding global reach through Solana-based DeFi, particularly with projects scaling via treasury mechanisms. It’s the kind of attention that tends to come late in the game for most chains, but for Solana, it may just be ramping up.

Solana lands a rare CNBC front-page feature, signaling growing mainstream and institutional interest. Source: Parker via X

This media spotlight doesn’t move charts directly, but it often acts as a sentimental catalyst. With broader exposure and favorable narratives hitting the news cycle, solana has extra momentum at its back.

Solana Golden Cross Setup Signals Uptrend Ahead

Solana’s momentum just got a technical boost, with a potential golden cross forming on the daily chart. Its a classic bullish signal spotted by TheJessePeralta where the 50-day moving average is set to cross above the 200-day. That kind of crossover usually indicates a shift in medium-to-long-term trend, often aligning with bullish continuation. With price currently pushing past $174, the setup strengthens the case for a MOVE towards $200 if buyers can keep control.

Solana forms a potential golden cross on the daily chart, signaling a bullish shift in medium-term momentum. Source: TheJessePeralta via X

If SOL can maintain this pace and the crossover confirms, the golden cross could act as a magnet toward the $200 mark, not because it guarantees upside, but because it often brings renewed confidence and technical buying pressure.

Solana Technical Outlook: $220 Still in Play

This latest 1-hour chart from EasychartsTrade maps out a short-term structure that’s hard to ignore. SOL has carved out a textbook cup-and-handle pattern, and price is now breaking above neckline resistance around the $181 to $183 zone. The roadmap points toward a move to $201.5 as the first extension, with a potential continuation into $220, backed by a Fibonacci retracement alignment and clean Elliott Wave impulse structure.

Solana breaks above cup-and-handle neckline, eyeing $201.5 and possibly $220 on strong technical momentum. Source: EasychartsTrade via X

Momentum looks well-supported by both pattern psychology and volume trends. If SOL can flip this breakout level into support on a retest, the market may not wait long to price in the next leg up. While short-term volatility always remains a factor, the technical layout is clean and measured.

Stablecoin Minting on Solana Is Becoming the New Normal

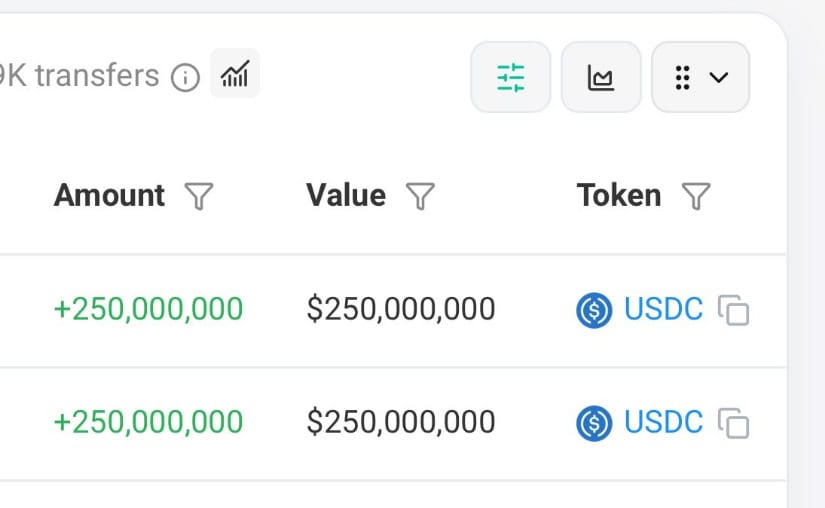

Another day, another massive USDC mint, this time $500 million in just ten minutes. But this isn’t a headline event anymore, it’s becoming routine. Over the past two months, multiple large-scale mints like this have taken place on Solana, bringing the total USDC minted on the network this July alone to $3 billion. That kind of consistency signals more than just short-term interest. This new norm in the longer term is likely to have a positive impact on the price.

Solana sees $500M USDC minted in 10 minutes, pushing July’s total to $3B as large-scale mints become routine. Source: SolanaFloor via X

Solana Liquidation Map Flags Short-Term Risk

The latest liquidation heatmap from 5.0 Trading adds a layer of caution to the ongoing bullish Solana setup. While the trend remains firmly upward, the clustering of liquidation levels just below current price suggests that a short-term pullback wouldn’t be out of the question. Liquidity zones around the $170 to 175 region may attract price before continuation, especially if Leveraged longs start getting too aggressive. After such a strong run, a healthy reset could actually clear the way for a more sustainable push toward $200 and beyond.

Solana’s liquidation heatmap shows clustered risk NEAR $170–$175, hinting at a possible short-term pullback. Source: 5.0 Trading via X

Final Thoughts: Bullish Scenario or Bearish Outlook?

Solana’s recent run has been impressive, with front-page media attention, a clean golden cross setup, and surging stablecoin activity are all pointing in the same direction. However, even in the most bullish trends, the price can always experience a correction.

With liquidity clusters forming just below the current price, a quick dip toward the $170 zone wouldn’t be surprising. In fact, it might be just the kind of reset needed before the next leg towards $200 and beyond. Still, the broader structure remains strong. Cup-and-handle patterns, rising volume, and consistent DeFi activity all suggest Solana isn’t running out of steam just yet.