GameSquare’s $100M Ethereum Treasury Bet: The Top ERC-20 Token to Watch for 14% Yields

GameSquare just parked $100M in Ethereum’s treasury—and they’re gunning for 14% yields. Here’s the ERC-20 token that could ride the wave.

Why This Token Stands Out

While the crypto crowd chases memecoins, smart money’s stacking this under-the-radar asset. It’s got the liquidity, the utility, and the institutional backing to thrive in a yield-hungry market.

The Yield Playbook

GameSquare’s move isn’t just bullish—it’s a masterclass in treasury diversification. Their target? A cool 14% return in a market where banks still offer 0.5% on savings accounts (thanks for nothing, legacy finance).

The Bottom Line

This isn’t your grandma’s safe-haven asset. It’s a high-octane yield machine—and it’s just getting started. Buckle up.

Ethereum, the second-largest crypto by market cap, still often goes unnoticed. It doesn’t help that Bitcoin’s price is 40 times higher; it’s easy to overlook a $3K crypto when Bitcoin’s $121K giant dominates.

But percentage-wise, ethereum actually outperformed Bitcoin over the past month. Bitcoin rose 16%, while Ethereum saw a 20% increase.

What’s happening with Ethereum? There’s a sense of renewed momentum as some companies consider Ethereum as a potential crypto treasury reserve, while the Ethereum Foundation itself prepares for a major technical upgrade.

And with those improvements, these ERC-20 tokens could surge.

GameSquare: An Institutional-Grade DeFi Pivot

GameSquare, a gaming and tech company, is moving toward a crypto reserve strategy. However, they are taking a slightly different approach than (Micro)Strategy and Metaplanet; instead of building their treasury around Bitcoin, GameSquare is focusing on Ethereum.

The company just announced that it was issuing 8.42M shares at $0.95, raising $8M toward its broader $100M $ETH goal.

Why Ethereum? Because GameSquare seeks a treasury that is more than just a bank vault. It wants a treasury that produces passive income, which is achievable within the broader DeFi ecosystem.

GameSquare’s ETH-focused yield generation strategy is built on top of Dialectic’s proprietary platform Medici, which applies machine learning models, automated optimization, and multi-layered risk controls to generate best-in-class risk-adjusted returns. Targeted yields of 8-14% significantly exceed the current ETH staking benchmarks of 3-4%.

—GameSquare, GameSquare Announces Pricing of Underwritten Public Offering

The strategy, built in partnership with Dialectic’s Medici platform and Lucid Capital, seeks yield via algorithmic DeFi. The intent, according to CEO Justin Kenna, is to ‘generate real, on‑chain yield while deepening our expertise in DeFi’+3

And GameSquare isn’t the only company making moves in Ethereum. Sharplink, which claims to be the largest publicly traded company with an Ethereum treasury, currently holds over 200K $ETH. All of it is allocated to $ETH staking and re-staking protocols. So far, the strategy has paid off in 322 ETH generated.

GameSquare’s stock spiked 60% on the announcement.

Ethereum Foundation: Privacy and Scalability Via zkEVM

At the same time, Ethereum’s Core developers are developing a foundational upgrade: a Layer‑1 zkEVM that allows validators to use zero-knowledge (ZK) proofs instead of full re-execution. The upgrade is expected to bring significant improvements in throughput, cost, and privacy.

Set for a full rollout by end-2025, the plan includes a phased approach, beginning with optional zk-enabled clients and maturing into broad adoption.

Core performance benchmarks include generating proof in under 10 seconds, open-source implementations with proof sizes below 300 KiB, affordable hardware requirements, and low energy use, enabling ‘home proving’ by individual stakers.

Ambitious? Yes – but for the Ethereum Foundation, zkEVM is a critical part of their vision for Ethereum as the foundation of a decentralized society.

Three ERC-20 crypto presales could play key roles in that society: SUBBD Token, Best Wallet Token, and Chainlink.

SUBBD Token ($SUBBD) – Blockchain-Enabled Content Creation Platform with AI Toolsuite

There’s a hot market segment that no one talks about: the $85B content creation industry. Human creators attract thousands of fans to their content, but access is usually controlled by middlemen platforms.

The SUBBD platform and token ($SUBBD) empower both fans and content creators with more ways to connect and earn. $SUBBD holders benefit from:

- Access to exclusive content

- VIP staking benefits

- Loyalty programs and rewards

- XP multipliers on platform benefits

- Discounts on platform subscriptions

Creators gain the ability to gatekeep their own content, restricting it to $SUBBD token holders, while fans can use $SUBBD to pay for custom creator requests and exclusive content.

The $SUBBD presale has pulled in nearly $800K so far; tokens are currently available for $0.055925. The roadmap includes a fully-developed suite of AI tools, from content management assistance to AI profile creation.

Don’t miss the SUBBD Token presale.

Best Wallet Token ($BEST) – Utility Token for Leading Web3 Self-Custody Wallet

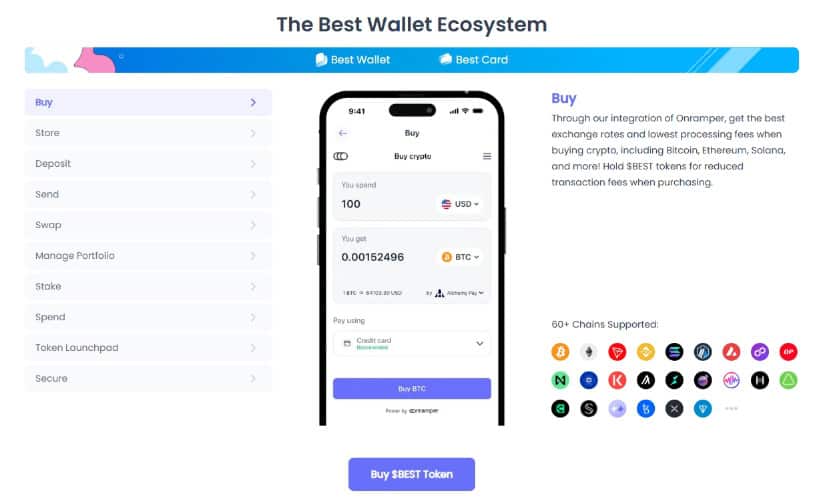

Best Wallet Token ($BEST) is the utility token for the Best Wallet app, a no-KYC, self-custody crypto wallet that serves as your gateway to the broader web3 world.

Use the Best Wallet App to buy, sell, and swap your crypto, and the $BEST token adds:

- Better staking rewards

- Lower transaction fees

- Advanced research into key upcoming crypto presales

The $BEST presale also sets the stage for the steady growth of the broader ecosystem, including Best Card. $BEST has already brought in over $13.8M, with tokens currently priced at $0.025325.

The roadmap calls for Best Card shortly after the token launch, with a $BEST airdrop also expected at some point.

Visit the Best Wallet Token presale page.

Chainlink ($LINK) – Oracles to Connect the EVM with Everything

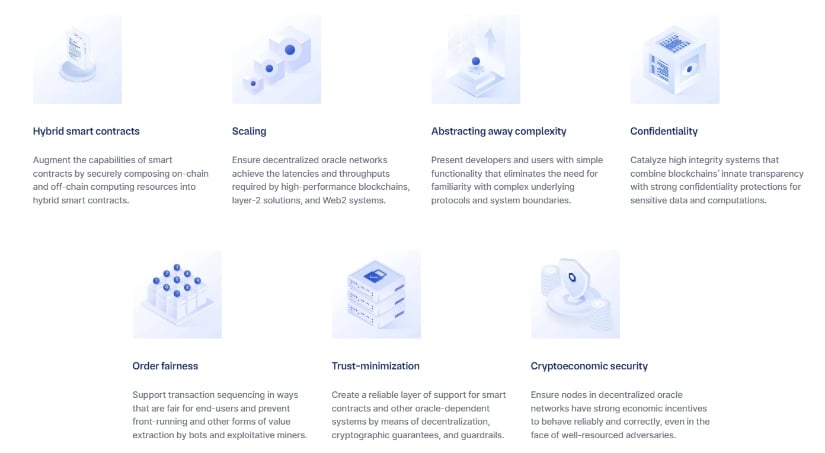

Chainlink is one of the leading crypto oracles, programs that connect and power core functions of the blockchain. Like Ethereum, chainlink is interested in not only succeeding as a project, but also building the foundation for broader crypto success.

The seven areas of focus for Chainlink 2.0 include:

- Deploying hybrid smart contracts

- Scaling

- Reducing complexity

- Preserving confidentiality

- Ensuring order fairness

- Minimizing trust requirement

- Improving security

As a result, the $LINK token could continue to play a vital role for crypto writ large; a utility token for the broader ecosystem.

Why Treasuries, zkEVM Both Matter

Corporate confidence and treasury yields align in GameSquare’s aggressive ETH allocation.

Technological robustness is demonstrated by Ethereum’s zkEVM rollout, enhancing on‑chain performance and security.

Together, financial deployment and protocol improvements FORM a positive feedback loop that further strengthens Ethereum’s ecosystem vitality and helps explain why $ETH is finally on the move.

Don’t miss $SUBBD, $LINK, or $BEST – but always do your own research. This isn’t financial advice.

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.