Hedera (HBAR) Bulls Charge: $1.79B Trading Volume Fuels Rally Toward New Highs

Hedera's HBAR isn't just holding ground—it's carving a path upward with the momentum of a $1.79B trading frenzy. Forget 'quiet accumulation'—this is a full-throttle ascent.

Why Traders Are Betting Big

Network activity and institutional interest are converging like a perfect storm. The hashgraph protocol's enterprise-grade efficiency keeps pulling in serious capital while retail FOMO lurks around the $0.50 mark (because nothing excites like round numbers).

The Liquidity Factor

That $1.79B volume isn't just paper hands—it's the kind of liquidity that makes market makers salivate. Even traditional finance quants are sneaking HBAR into their algo models, though they'll never admit it at their next hedge fund mixer.

Watch These Levels

Key resistance sits at the Q2 2025 highs, but with this volume profile, HBAR could bypass those levels faster than a Wall Street exec dodging SEC questions. Support? Let's just say the 20-day moving average is looking suspiciously comfortable.

Closing Thought: In a market where most 'institutional adoption' claims are just PR fluff, HBAR's actual trading metrics suggest someone—maybe even someone in a suit—is putting real money to work. For once.

After reclaiming key resistance, the token is now pushing toward potential breakout targets ahead of crucial weekly confirmation. Market observers are focusing on whether HBAR can sustain this momentum and cross the current resistance threshold.

Weekly Resistance Holds Key to Next Move

The Hedera (HBAR/USDT) weekly chart, analyzed by Mihir (@RhythmicAnalyst), highlights a significant breakout above prior consolidation zones. This week’s candle closed at $0.24109, representing a 51.3% gain, and was supported by elevated weekly volume of 1.3 billion, affirming strong investor participation.

The rally has propelled HBAR into a historical resistance range centered on $0.24894, where several earlier attempts failed.

Source: X

A sustained close above $0.24894 WOULD mark a technical breakout and unlock new upside targets in the $0.30–$0.36 zone. Mihir’s analysis warns that a failure to break this barrier could result in a pullback toward support levels around $0.21–$0.18, which align with moving averages and prior demand zones.

For now, bulls maintain the upper hand as long as the price remains above $0.25 by week’s end.

Daily Momentum Reinforced by High Liquidity

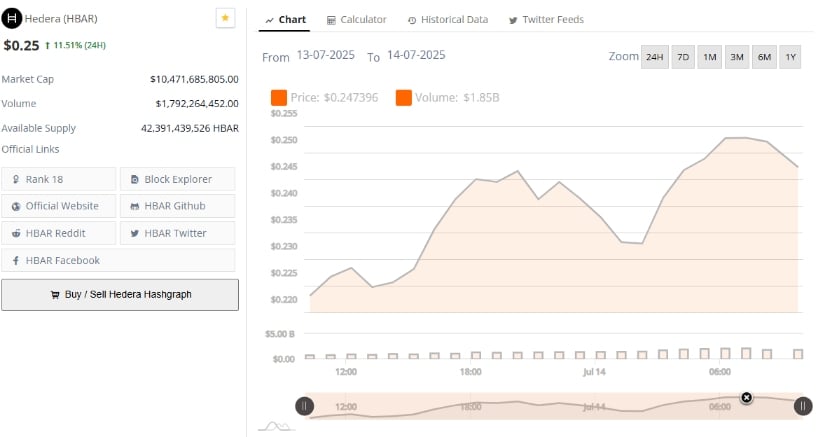

According to BraveNewCoin’s latest 24-hour data, HBAR ROSE 11.51% to $0.25, surpassing the critical $0.24894 resistance level. This movement was accompanied by a sharp increase in trading activity, with volume reaching $1.79 billion, reflecting broad participation from both retail and institutional investors. The upward price trend reached a high of nearly $0.254 before experiencing a minor pullback to $0.247, indicating disciplined buying on dips.

Source: BraveNewCoin

The market cap now exceeds $10.47 billion, securing Hedera’s position among the top 20 crypto assets. As the token approaches the $0.30 resistance area, volumes and price structure will be closely watched. Sustained action above $0.255 may push HBAR toward $0.30, while a downturn in volume might trigger a decline to the $0.225 support range established earlier this year.

Daily Chart Confirms Breakout Formation

On the other hand, LTS Trading’s analysis confirms a breakout from a descending wedge pattern that had held HBAR in a downtrend since late 2024. The breakout led to a 24.47% surge on the day of confirmation, taking the price to $0.24546. This technical reversal redefined market structure, with the MACD crossing bullishly and volume expanding. LTS Trading identified a medium-term projection between $0.30 and $0.38, contingent on the price sustaining above breakout levels.

Source: X

A key resistance region between $0.30 and $0.32 could come into focus in the coming weeks if current momentum holds. The bullish scenario remains valid as long as the price stays above $0.176, the analyst’s invalidation zone. The RSI trendline also shows consistent strength, supporting the continued development of higher lows. Combined with a shift in market structure and improving technical indicators, the setup reflects an environment conducive to sustained bullish pressure.

The ongoing increase in on-chain activity, coupled with institutional-grade volume, suggests Hedera’s network is experiencing broader adoption beyond speculative flows. This aligns with a growing number of enterprise-level integrations on the Hedera network, potentially strengthening the asset’s positioning within the altcoin market.