🚀 Bitcoin Shatters Records: Institutional Tsunami Pumps ATH as Retail Watches from the Bleachers

Wall Street's digital gold rush just sent Bitcoin into uncharted territory—again. The king of crypto isn't just mooning, it's rewriting the rules of engagement while Main Street investors scramble for binoculars.

The whales are feeding

Forget diamond hands—this rally runs on black-tie money. Hedge funds and corporate treasuries are plowing into BTC like it's 2021's SPAC craze (but with actual assets backing it). Meanwhile, retail traders are still waiting for Coinbase to process their KYC.

Liquidity without participation

The irony? This historic surge comes as small-time hodlers park cash in 'safe' 0.5% yield savings accounts—proof that traditional finance still trains people to lick crumbs off the floor.

As the institutional dam breaks, one thing's clear: the revolution will be capitalized. Whether you're in or out, Bitcoin's not asking permission—it's taking names.

Bullish Momentum and Potential Catalysts

Traders remain exceptionally bullish, pointing out that this week marks Bitcoin’s strongest weekly breakout since November 2024, a time that witnessed a 50% surge. With multiple positive catalysts, including record-breaking institutional inflows and significant upcoming events like the U.S. crypto Week, upside could continue. Additionally, swirling rumors about Federal Reserve Chair Jerome Powell’s potential resignation could further fuel market optimism.

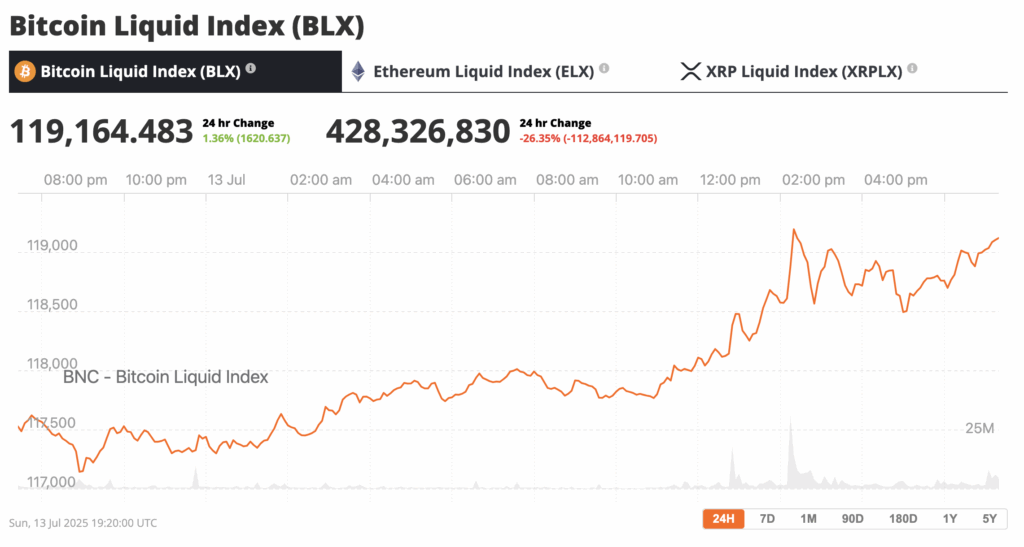

Bitcoin twice moved up above $119,000 on Sunday night, making fresh new all-time-highs. Source: Bitcoin Liquid Index

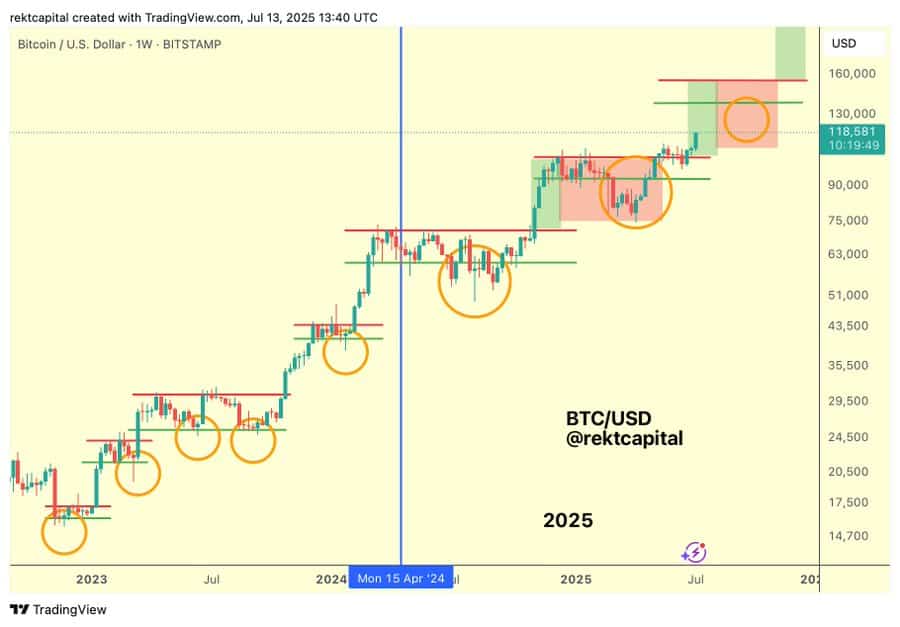

Analyst Rekt Capital added a historical lens, noting that bitcoin is only wrapping up week one of its “Price Discovery Uptrend 2,” reminding investors that the first phase of this rally lasted an impressive seven weeks. If history is a guide, Bitcoin’s current bullish momentum might still be in its early stages.

We’re in week two of Bitcoin price discovery, Source: X

Contrarian Voices Enter the Fray

As Bitcoin rockets higher, the ever-skeptical Gold advocate Peter Schiff took to social media to urge caution. Schiff sees Bitcoin’s latest high as an opportunity for holders to cash out and switch to silver, a commodity he claims offers greater upside and more limited downside risk. Schiff argues that Bitcoin, despite its explosive growth, remains vulnerable to sudden crashes, unlike tangible assets such as silver. However, Schiff failed to mention that Bitcoin has overtaken Silver in terms of total market capitalization.

Bitcoin has overtaken Silver in total market capitalization. Source: Infinite

Arthur Hayes, co-founder of crypto derivatives platform BitMEX, also introduced a cautious note, pointing to broader market conditions influenced by macroeconomic factors. Hayes highlighted the U.S. Treasury’s replenishing of the General Account through new debt issuance as potentially bearish for short-term liquidity in crypto markets.

Institutional Dominance and Retail Hesitation

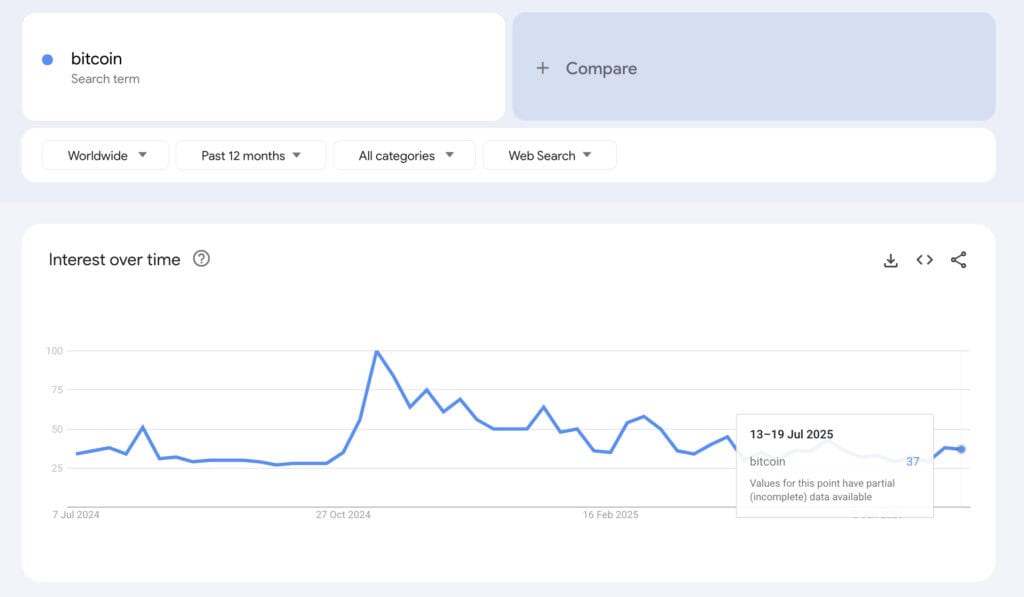

Interestingly, despite Bitcoin smashing record highs, retail investors have largely remained on the sidelines. Google search interest for “Bitcoin,” often considered a reliable indicator of retail engagement, remains muted compared to previous cycles. André Dragosch from Bitwise Asset Management noted a glaring discrepancy—while institutional money pours into Bitcoin spot ETFs with daily inflows surpassing $1 billion for two consecutive days, retail interest, as measured by Google search trends, has hardly budged.

Google Searches for Bitcoin are over 60% down since November’s peak, source: Google

The spike in Bitcoin’s price to NEAR $119,500 corresponds with an 8% increase in Google searches week-over-week, yet remains 60% below the peak observed shortly after Donald Trump’s presidential election victory in November 2024. This phenomenon suggests retail investors might perceive current prices as prohibitively expensive, believing they’ve “missed the boat.”

Bitcoin commentator Lindsay Stamp echoes this sentiment, asserting that retail investors often dismiss Bitcoin as an opportunity once the price exceeds certain psychological thresholds—in this case, the intimidating $117,000-plus price tag. Cedric Youngelman, host of the Bitcoin Matrix podcast, concurs, predicting that retail investors might remain hesitant for some time, perhaps waiting for a more dramatic correction or clearer entry point.

Now is the time To Buy Bitcoin

Bitcoin’s latest run has sparked both enthusiasm and caution across the investment spectrum. While institutions continue to demonstrate strong confidence, retail investors’ skepticism underscores a broader sentiment that this bull market is uniquely institutional-driven. As Bitcoin hovers near the critical $120,000 psychological level, the coming weeks could prove decisive in shaping whether retail investors finally join the rally or continue watching from the sidelines.

Despite concerns of missing out or buying at a peak, historical data shows that buying Bitcoin after it reaches new all-time highs often proves advantageous. With institutional support firmly entrenched, macroeconomic tailwinds, and clear skies ahead due to reduced downside risks, Bitcoin presents a compelling case for investors. The current risk profile is lower than at previous peaks, and with substantial upside potential still on the horizon, now is one of the best moments to enter the market. If you don’t own Bitcoin, now is a good time to buy some Bitcoin and crypto to take advantage of the current bull market.