Chainlink (LINK) Primed for Explosive Rally as $14 Breakout Looms—Here’s Why

Chainlink's native token LINK is gathering steam—and this time, the bulls might just get it right.

After weeks of consolidation, the oracle network's token shows textbook accumulation patterns. Traders are now betting big on a decisive flip of the $14 resistance level.

Why $14 matters

That magic number isn't just psychological resistance—it's the gateway to LINK's 2025 highs. A clean breakout could trigger algorithmic buying from quant funds always late to the party.

The institutional angle

With real-world asset tokenization gaining traction, Chainlink's oracle solutions are suddenly Wall Street's shiny new toy. Never mind that most bankers still can't explain how DeFi works.

Bottom line: When LINK moves, it moves fast. This could be your last chance to board before the next leg up—assuming the 'smart money' doesn't front-run retail again.

Therefore, Chainlink’s expanding role in decentralized finance and real-world asset tokenization is enhancing its long-term value proposition. Increased developer activity and protocol integrations are reinforcing its narrative as a critical Web3 infrastructure layer.

Chainlink Price Builds Momentum as Analysts Eye Breakout Above $14

Chainlink (LINK)price is gaining renewed attention from analysts as momentum indicators and price structure point to a possible breakout. After a prolonged correction earlier in the year, the token has stabilized above the $13 level and is beginning to show signs of strength.

At the time of writing, LINK trades NEAR $13.82 and continues to press against a descending trendline that has served as resistance since early 2024. Several analysts view a daily close above $14.00 as a potential confirmation point for a bullish reversal.

RSI Momentum Shift Suggests Accumulation

Daniel highlighted a clear shift in momentum through the Relative Strength Index (RSI), which has broken above its long-term descending trendline. The indicator currently sits above the 50 mark, a threshold often associated with bullish bias in trending markets. The MOVE above this level reflects renewed buying pressure and reduced distribution.

Source: DanielRamsey,x

In addition to the RSI trend, Daniel has identified key resistance targets at $19.40, $22.55, and $26.10. These levels reflect previous highs and Fibonacci retracement zones that may act as short-term checkpoints in the event of an upside move. He emphasizes that the current consolidation below the $14.00 resistance is structurally healthy, and if broken,could trigger a larger trend reversal.

Outperformance Signals Early Rotation Potential

Analyst OnlyCalls observed that chainlink price surged over 8% during a period when the broader market showed minimal movement. This type of price behavior may reflect decoupling, where chainlink gains strength independently of larger market drivers.

The analyst attributes this outperformance to Chainlink’s increasing relevance in decentralized finance and tokenized real-world assets, where reliable oracle networks are a foundational requirement.

OnlyCalls further notes that recent network developments, new integrations, and rising developer activity have supported a strong narrative for ChainLink.This, coupled with volume strength and RSI divergence, supports the idea that the rally is being built on structural buying rather than short-term speculation.

If Chainlink price can maintain this relative strength and extend beyond $14.00, it may become a top performer in the next altcoin rotation. The chart behavior is now being used as a reference point for early leadership within the Layer 1 and infrastructure token category.

Base Formation Reinforces Structural Recovery

Jacob James also commented on LINK’s recent price behavior, pointing to a strong base formation above the $13.00 mark. Using Heikin Ashi candles, he observed a reduction in volatility and a shift toward more neutral or green candles, which often suggests a transition from selling pressure to accumulation.

Source: JacobJames,x

According to the analyst, this kind of price action is consistent with early recovery phases, especially when paired with stable support zones and declining sell-side volume.The analyst adds that the structure above $13 has remained intact through several market fluctuations, reinforcing the level as a foundation for future upside.

Should the price move beyond the $13.80–$14.00 range, it could trigger a breakout supported by fresh volume and trader confidence. This WOULD mark a change in structure from lower highs to higher highs, and potentially bring back momentum that was lost during the previous quarter.

Chainlink Price Strengthens with Daily Gain

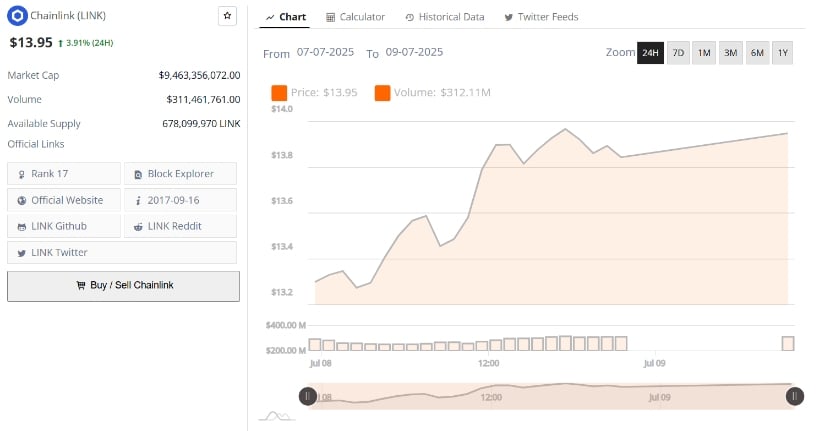

Chainlink (LINK) showed renewed bullish momentum over the past 24 hours, rising from approximately $13.20 to close at $13.95. The price action followed a consistent uptrend marked by higher lows and steady gains, suggesting strong participation from buyers.

Minor intraday corrections were quickly absorbed, reinforcing the strength of demand as LINK approached the key $14 psychological level.

Source: BraveNewCoin

Trading volume during the session reached $311.46 million, supporting the price increase with moderate market activity. Chainlink’s market capitalization also grew to $9.46 billion, solidifying its position among the top 20 cryptocurrencies.

If LINK price maintains its current trajectory, a breakout above $14 could pave the way for a test of higher resistance zones in the short term.