XRP Price Prediction: Whale Movements Surge—Is $16 the Next Target After Coinbase Exodus?

Whales are making waves in the XRP market—just as Coinbase users yank their holdings. Could this be the setup for a moonshot to $16?

Signs of Accumulation

Big-money players are circling XRP like sharks, with transaction volumes spiking as retail traders flee exchanges. Classic buy-the-dip behavior—or just another round of crypto musical chairs?

The $16 Question

Technical charts show a potential breakout pattern, but let's be real—this is crypto. That 'textbook bullish flag' could evaporate faster than a DeFi rug pull when regulators wake up.

Coinbase Effect Reversed

Mass withdrawals from the US exchange mirror 2020's Bitcoin exodus before its bull run. History doesn't repeat, but it sure loves charging consulting fees to retail bagholders.

One thing's certain: when whales move, markets tremble. Whether that means $16 or another 'we told you so' moment from the SEC remains to be seen.

Now trading above $2.27, XRP’s recent price action and on-chain developments are fueling expectations of a breakout—potentially leading to a 600% rally if historical patterns repeat.

Crypto analysts are now watching XRP closely as it emerges from a long consolidation phase, with tightening technical indicators and institutional interest aligning for what could be the biggest MOVE in years.

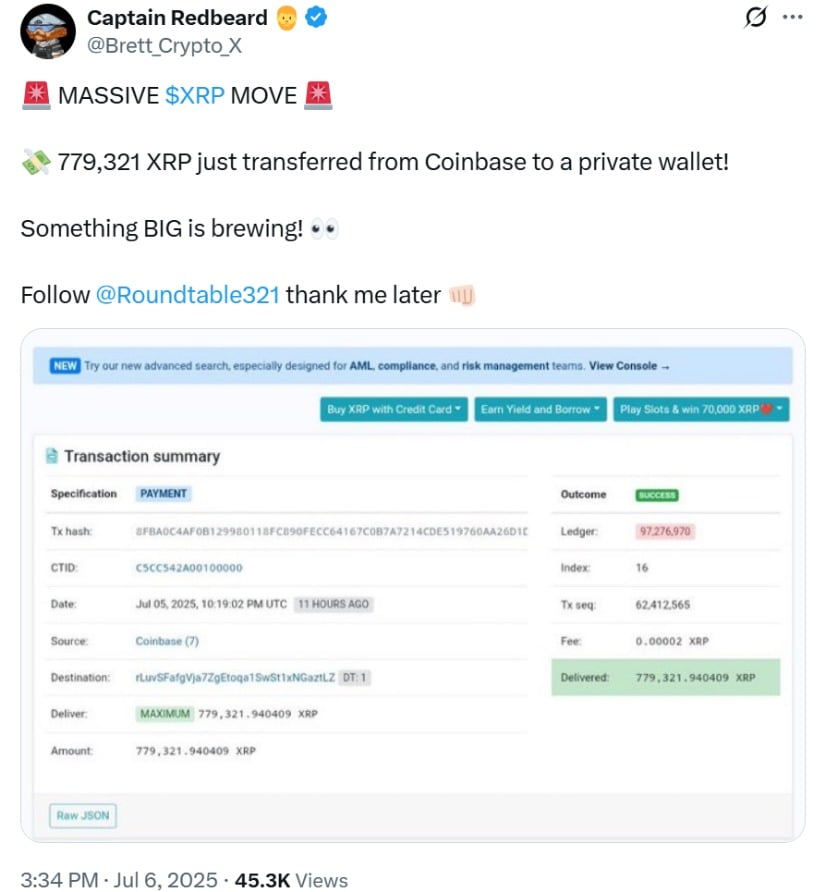

Massive Coinbase Withdrawal Triggers Whale Alert

A large XRP transaction on July 5 has caught the market’s attention. According to on-chain data, 779,321.94 XRP—worth over $1.7 million—was transferred from a Coinbase wallet to an unknown private address. While the fee was minuscule (just 0.00002 XRP), the timing and size of the move have led to speculation that a major player is preparing for a significant price breakout.

A transfer of 779,321 XRP from Coinbase to a private wallet has sparked speculation of a major upcoming move. Source: Captain Redbeard via X

Crypto commentators quickly flagged the move, with some calling it a signal that “smart money” is positioning ahead of a big market shift. Given XRP’s 32-week-long price consolidation and the narrowing of Bollinger Bands—now at their tightest in over eight months—this transfer is being interpreted by traders as more than a routine withdrawal.

“It’s not retail,” said one crypto commentator on X. “Someone’s gearing up for something major.”

This whale movement has reignited talk of a parabolic rally, especially as Ripple pushes forward with its U.S. banking license application and ETF speculation gains traction.

XRP Capital Inflows Hit $10.6 Million: Institutional Demand on the Rise

Adding to the momentum, XRP-related investment products saw $10.6 million in weekly inflows, according to CoinShares. That brings XRP’s total assets under management to $1.4 billion, part of a broader $1.03 billion influx into crypto markets last week—most of it from the U.S.

This institutional buying spree signals renewed confidence in XRP’s long-term prospects. “Price gains over the week pushed total assets under management to a new all-time high of $188 billion,” CoinShares noted, highlighting a wave of Optimism across the digital asset sector.

Futures and Technicals Confirm Bullish Setup for XRP

Futures market activity is mirroring this optimism. Open Interest in XRP futures surged by 25% to $4.69 billion, while daily trading volume hit $4.72 billion. These spikes in derivatives activity typically reflect increased speculative interest and a bullish shift in sentiment.

XRP’s weekly chart shows a double bottom with hidden bullish divergence, suggesting a breakout toward $4.50–$5 is increasingly likely. Source: Juan-Wick on TradingView

Technically, XRP is showing strength. It’s printed two consecutive green daily candles, and the MACD has issued a bullish crossover. The Relative Strength Index (RSI) has climbed to 57, suggesting sustained upward momentum. Key resistance levels lie at $2.33 and $2.47, with a potential retest of the May high at $2.65 on the horizon.

However, traders should keep an eye on macro risks, including potential volatility from expiring U.S. tariff exemptions. In the event of a dip, XRP has solid support between $2.00 and $2.22, bolstered by the 100-day EMA.

Could XRP Really Surge 600%? Analysts Weigh In

The idea of a 600% rally isn’t pulled out of thin air. Analysts are pointing to XRP’s explosive history as evidence it could repeat such a move. During the 2017 bull run, XRP surged from $0.0055 to $3.80—a staggering 68,990% gain. More recently, from November 2024 to January 2025, XRP rallied 580%, moving from $0.50 to $3.40.

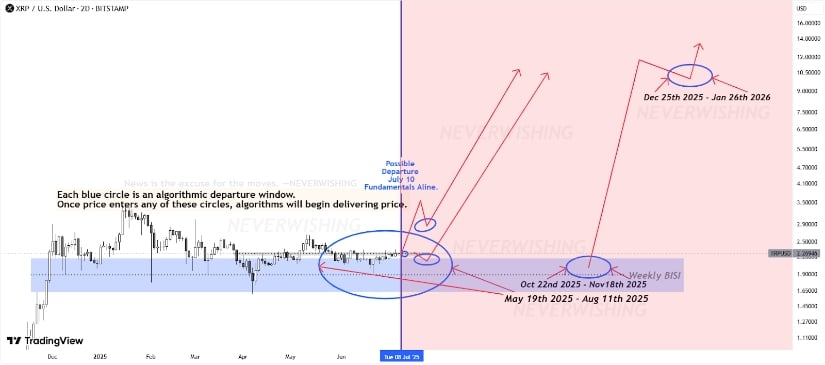

This XRP analysis identifies “algorithmic departure windows”—zones where price historically initiates explosive moves toward the $10-$16 zone. @Brett_Crypto_X on TradingView

Applying a similar growth model to the current price of $2.28, some analysts now project a possible move toward $16, while others see a more conservative target around $4.60, XRP’s previous all-time high.

XRP Price Prediction 2040: Could $5,000 Turn Into Millions?

Looking far ahead, forecasts for XRP’s long-term potential vary widely. According to Telegaon, XRP could reach $119 to $160 by 2040, turning a $5,000 investment today into $354,000. Changelly offers an even more bullish scenario, projecting XRP could hit $1,938 by 2040—transforming a $5,000 stake into over $4.28 million. Even Google’s Gemini AI predicts a more cautious but still impressive $64.20, which WOULD grow $5,000 into $142,000.

These forecasts highlight the high-risk, high-reward nature of XRP as a long-term asset.

Legal Landscape: XRP Lawsuit Update Still Influential

While the Ripple vs. SEC lawsuit is no longer front-page news, its resolution continues to shape sentiment. Any new update on the SEC appeal, XRP ETF approval, or Ripple’s regulatory progress could act as a major catalyst—or a stumbling block—for the token.

XRP was trading at around $2.28, up 0.46% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

For now, investor focus has shifted more toward capital flows, technical indicators, and real-world adoption. But legal clarity remains an essential part of XRP’s broader investment case.

Looking Ahead: Will XRP Go Up?

With a major whale transfer, institutional buying on the rise, tightening technical patterns, and Ripple’s push into U.S. banking and ETF territory, XRP appears poised for a major move. A breakout above $2.65 could pave the way for a rally toward $4.60, or even higher.

Still, volatility remains a factor. Investors should stay tuned to macro headlines and XRP court case developments that could sway sentiment. For now, the outlook remains decidedly bullish, and XRP continues to position itself as a leading contender in the evolving digital asset space.