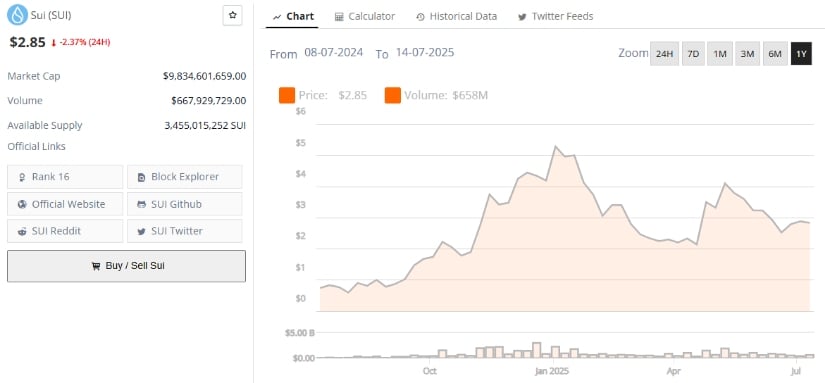

🚀 SUI (SUI) Price Surge: $3.20 in Sight After Shattering $2.85 Resistance

Sui isn't asking for permission—it's taking names. The Layer 1 blockchain's token just bulldozed past $2.85, and now traders are eyeing $3.20 like it's last call at a crypto conference.

Why the breakout matters

SUI's rally isn't just another dead-cat bounce. The resistance flip at $2.85 signals serious momentum—the kind that makes sidelined FOMO buyers start smashing limit orders.

What's fueling the fire

While the usual suspects (speculation, ecosystem growth) play their part, let's be real—half the trading volume probably comes from degens chasing the next +20% candle. Some things never change in crypto.

One thing's clear: Sui's price action just went from 'watchlist material' to 'main event.' Whether this holds or becomes another 'buy the rumor, sell the news' classic remains to be seen—but for now, the charts are screaming bullish.

After successfully clearing the key $2.85 resistance level, analysts are eyeing a possible MOVE toward $3.20, supported by technical momentum and improving market sentiment.

Sui Stabilizes Above Key Support Levels

Currently trading around $2.85, Sui has demonstrated resilience after bouncing off its $2.29 support zone. This rebound helped the token maintain a firm foothold above critical moving averages, such as the 5-period and 60-period MAs on the 4-hour chart. According to crypto analyst @the_wolf_mind, this price “coil” around $2.85 usually precedes a significant directional move, suggesting that Sui’s volatility may soon give way to a decisive trend.

$SUI is consolidating NEAR $2.90 in a low-volatility coil, signaling an imminent breakout as momentum cools and sentiment splits between accumulation and a potential bull trap. Source: Crypto Wolf via X

“With the 60 MA beneath the price, the setup shows a mildly bullish bias,” the analyst noted while cautioning that “momentum is fading, which can lead to volatile swings in either direction.”

Despite some sideways consolidation near the $3.00 mark, the token’s ability to hold above $2.85 has renewed confidence among short-term traders and long-term holders alike.

Technical Indicators Signal Imminent Breakout

Technical charts show a cautiously optimistic view. The 10 and 30-period moving averages have flattened out, an indicator of current market indecision, but the general trend is bullish. A clear breakout above the $3.00 resistance line, especially supported by rising trading volumes, WOULD unlock the way for a sustained rally.

Sui price signals a bullish breakout following a double bottom pattern formed in the hourly chart. Source: Filnft on TradingView

Such a move might trigger Sui’s return toward its previous highs seen earlier in 2025, with $3.20 emerging as the next significant resistance zone to watch. Conversely, failure to maintain support above $2.85 could result in a pullback to the $2.60–$2.70 range, where prior demand has appeared.

Market sentiment remains mixed, with some analysts warning of a potential bull trap aimed at catching late entrants, while others highlight the “silent buildup” suggesting a breakout is near.

Broader Crypto Momentum Lifts Sui

Sui’s upward momentum coincides with positive trends across the cryptocurrency market, notably from major players like Bitcoin and Ethereum. As these leading assets gain strength, altcoins such as Sui are benefiting from spillover interest and capital inflows.

On July 3, 2025, Cilinix Crypto noted that sui had surpassed key levels including the 7-day and 30-day VWAPs and breached a descending trendline on the 12-hour chart, reinforcing the bullish case.

“Sui could soon challenge resistance around $3.20,” Cilinix stated, emphasizing the token’s ability to capitalize on broader market optimism.

Caution Amid Macroeconomic Uncertainties

Although the technicals look good, there are a number of macroeconomic events that may impact Sui’s trajectory. US economic releases like non-farm payrolls and unemployment can affect market liquidity as well as investor risk appetite.

Sui (SUI) token was trading at around $2.85 at press time. Source: Brave New Coin

A lack of definitive signs for a near-future interest rate cut can temper the rally, possibly capping capital inflows into altcoins such as Sui. Trading volumes for SUI still lag behind its last rally in April 2025, when decentralized exchange activity and total value locked (TVL) metrics were much stronger.

Because of such uncertainties, there are also some analysts who recommend taking a conservative stance, expecting potential resistance at $3.10-$3.20, with subsequent consolidation or weak retracement.

Sui Price Prediction Summary

Sui’s fresh price action and charts suggest near-term breakout potential, with $3.20 as the ideal target after crossing above resistance at $2.85. The token’s ability to sustain gains will rely on continued volume backing, investor sentiment, and general macroeconomic environment.

Traders need to watch closely the all-important levels, particularly the $3.00–$3.20 zone, to see how strong this possible rally is. If Sui continues to perform with vigor, this will leave the door open for an even bigger uptrend throughout the rest of 2025.