Uniswap Bulls Charge: $7.40 Support Holds Firm as Momentum Accelerates

Defi's favorite DEX is flexing its muscles again.

Uniswap's price action isn't just holding above $7.40—it's building steam for what traders hope will be the next leg up. Because nothing gets crypto degens more excited than a round number pretending to be 'support.'

The technicals tell one story (bullish consolidation! accumulation phase!), while the fundamentals whisper another (are those trading volumes organic or just wash traders chasing yield?). Either way, UNI's chart is doing that thing where it makes bagholders briefly forget their cost basis.

Will this finally be the breakout that justifies Uniswap's valuation? Or just another fakeout before liquidity hunters get rekt? Grab your popcorn—the order book doesn't lie (until it does).

As price action compresses within a narrow range, analysts are eyeing this stabilization as a potential staging ground for another push toward the $8.00 resistance zone. Market data reflects growing interest from participants, with volume and support levels aligning to support the trend.

Short-Term Breakout Confirms Bullish Continuation

On the 30-minute chart, Uniswap formed a bullish pennant pattern after a strong move upward from the $6.80 region. According to analyst Crypto Joe (@CryptoJoeReal), the pattern consolidated between $7.22 and $7.30 before a clear breakout occurred.

This formation typically signals a continuation of the prior trend, and in this case, UNI followed through by reaching the $7.49 mark. The price action has been characterized by higher lows and consistent retests of short-term highs, suggesting that buyers remain active in the current range.

Source: X

The breakout was supported by an increase in volume, particularly during the breakout candle, confirming participation from bullish traders. In addition, the 50-period moving average around $7.278 has served as a dynamic support zone, cushioning price during brief pullbacks.

Crypto Joe’s projected target of $7.827, derived using the measured MOVE from the flagpole, aligns with historical resistance levels from larger timeframes. The structural support and target alignment point to a continuation of the current move if conditions remain favorable.

Volume and Market Activity Reinforce Bullish Outlook

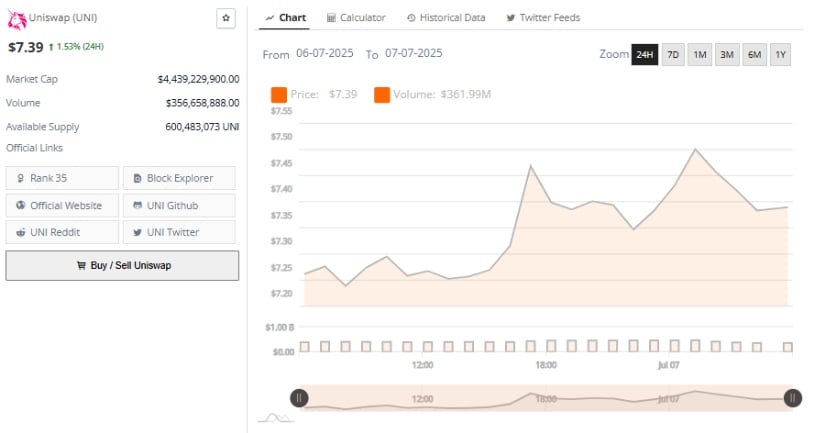

Over the last 24 hours, UNI climbed to $7.39, supported by a consistent upward trend across intraday sessions. The price initially ranged between $7.22 and $7.28 before peaking close to $7.50 in the latter half of the session.

While a slight retracement followed, the asset has managed to remain above its earlier support levels, with the chart structure indicating a sustained bullish bias. A series of higher lows and a gradual upward slope reflect ongoing buy-side interest in the token.

Source: BraveNewCoin

Trading volume reached $361.99 million during this period, with notable surges between 16:00 and 18:00 UTC coinciding with the day’s strongest price moves. Although volume tapered off slightly after the peak, the lack of a sharp pullback in price implies that bullish sentiment remains intact.

With a market capitalization of $4.43 billion, Uniswap currently ranks 35th among cryptocurrencies, placing it in the mid-cap category. This gives the asset room to react more dynamically to short-term technical developments and changes in market sentiment.

The stable circulating supply of 600.48 million UNI tokens has not shifted materially, meaning the price action is largely driven by market demand rather than supply-side shocks. Should UNI continue holding the $7.30–$7.40 zone, attention may turn toward resistance at $7.50–$7.60, with further gains dependent on renewed volume strength and market-wide support.

Uniswap Price Prediction: Indicators Suggest Momentum Building for a Breakout

On the other hand, Uniswap’s daily chart shows a period of consolidation NEAR $7.45, following earlier attempts to break above the $8.00 threshold. Multiple rejections have occurred near the $7.50–$8.00 band, but support has consistently held above $7.00.

This narrowing price range indicates declining volatility and a potential breakout setup. As the chart tightens, traders are monitoring indicators to gauge the likelihood and direction of the next move.

Source: TradingView

The Moving Average Convergence Divergence (MACD) reveals an early bullish crossover, with the MACD line moving above the signal line and histogram bars turning positive at 0.022. This signal, though modest, reflects an initial momentum shift that may develop further if volume returns.

At the same time, the Chaikin Money Flow (CMF) remains at -0.08, indicating mild capital outflows. A move back above the 0.00 line WOULD confirm stronger accumulation. If CMF and MACD align in bullish territory, UNI may gain sufficient strength to challenge the $8.00 resistance zone.