🚀 XRP Rockets Past $2.25 as Ripple Guns for U.S. Banking Charter – Bull Run Incoming?

XRP just smashed through the $2.25 barrier – and Ripple's playing for keeps. The fintech heavyweight is making a power move to secure a U.S. national banking license, sending shockwaves through both crypto and traditional finance circles.

Wall Street bankers clutching their pearls? Check. Crypto degens FOMOing in? Obviously. This could be the regulatory legitimacy play that finally bridges the gap between digital assets and mainstream finance. Or just another paperwork nightmare that gets buried in SEC purgatory – because nothing says 'financial innovation' like waiting 18 months for a rubber stamp.

One thing's certain: when Ripple makes moves, markets react. The question is whether this surge has legs, or if we're watching another 'buy the rumor, sell the news' setup unfold. Either way, grab your popcorn – things are getting interesting.

This significant development places Ripple among a growing list of crypto firms seeking to integrate more deeply into the traditional financial system, fueling Optimism among investors and analysts alike.

XRP Price Breaks Through $2.25 Resistance

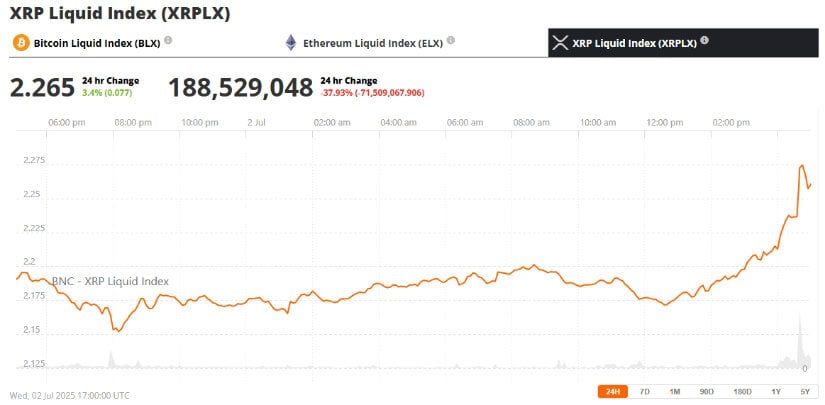

The xrp price rallied more than 4% in intraday trading, breaching the critical $2.25 resistance zone and briefly reaching $2.27—its highest level in weeks. This move has placed XRP firmly back on the radar for traders, with many interpreting the breakout as a bullish signal amid rising speculation surrounding Ripple’s regulatory trajectory.

XRP was trading at around $2.265, up 3.4% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

The rally follows a technical breakout from long-term resistance, backed by elevated trading volumes and renewed investor sentiment. However, caution remains. Technical analysts highlight the Connors RSI (CRSI) is now flashing overbought conditions, suggesting the potential for short-term pullbacks.

“A breakout is only as strong as the confirmation behind it,” one analyst commented. “We’re seeing strong momentum, but the market may cool off if the overbought signals persist.”

According to Phemex-backed research, CRSI setups below 15 have a 75% win rate, but current levels well above 85 warrant careful monitoring. Nonetheless, traders remain optimistic as broader market narratives strengthen.

Ripple’s Banking Bid Mirrors a Growing Industry Trend

Ripple has officially applied for a U.S. national banking license through the Office of the Comptroller of the Currency (OCC), a move first reported by the Wall Street Journal. If approved, Ripple would gain the authority to operate under a unified federal regulatory framework—sidestepping the complex patchwork of state-level licensing.

Ripple is seeking a U.S. banking license, joining other crypto firms pursuing regulatory integration, according to the Wall Street Journal. Source: DEGEN NEWS via X

This WOULD mark a pivotal milestone for Ripple Labs, positioning it alongside major players like Circle, Coinbase, and Fidelity Digital Assets, which are also seeking charters. The decision reflects Ripple’s growing focus on compliance and regulatory clarity, particularly in the wake of its partial legal victory in the Ripple vs. SEC case.

Ripple CEO Brad Garlinghouse called the MOVE “a unique benchmark” for the company, underscoring its transformation into a regulated financial entity. The license would enable Ripple to self-custody reserves for its regulated stablecoin RLUSD, support blockchain-based financial products, and scale its cross-border remittance services.

The development follows Ripple’s December launch of the RLUSD stablecoin, which already operates under New York Department of Financial Services (NYDFS) approval. With a current market cap of $440 million, RLUSD is central to Ripple’s strategy to offer dollar-backed digital assets under full compliance.

XRP ETF Momentum Adds Fuel to the Bullish Sentiment

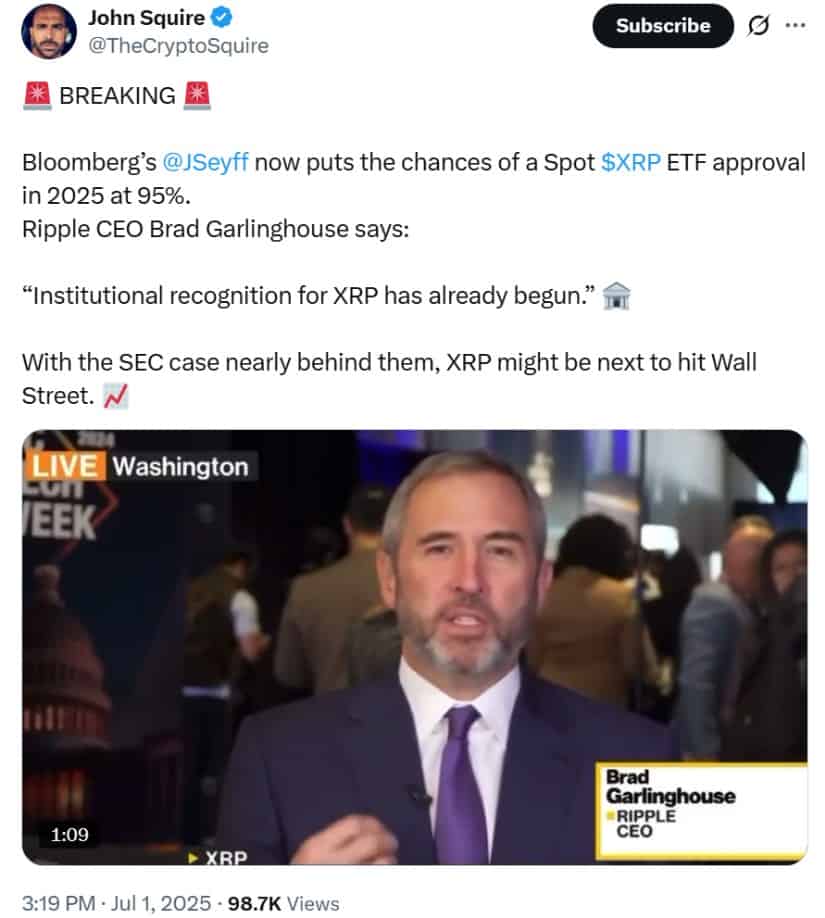

Alongside banking developments, the XRP ETF news narrative continues to build steam. Bloomberg now places a 95% probability on XRP ETF approval, citing Ripple’s growing regulatory presence and recent legal clarity as key drivers.

Bloomberg’s James Seyffart estimates a 95% chance of a spot XRP ETF approval in 2025, as Ripple CEO Brad Garlinghouse highlights growing institutional recognition. Source: John Squire via X

Research firm DeepSeek forecasts XRP could hit $5 by the end of 2025, depending on the pace of institutional inflows and the success of Ripple’s ongoing integration with mainstream finance. The dual push toward federal licensing and ETF eligibility is seen by analysts as a sign that XRP may finally be shedding its legal baggage.

“The ETF narrative is growing stronger by the day,” said a DeepSeek strategist. “Ripple securing a banking license would only add legitimacy and encourage more traditional institutions to enter the XRP ecosystem.”

Breakout Puts XRP Back in Focus

This technical victory for XRP traders in breaking out above $2.25 is also symbolic, coming on the heels of Ripple’s recent bid for increased regulatory credibility. Momentum on various fronts—from rumors of an ETF to bank rollout—means the XRP price today is representative of a market that is rethinking its perception of Ripple’s place in finance worldwide in the longer term.

XRP price must defend the $2.21 support and exceed the $2.27-$2.29 resistance zone to initiate a fresh bullish rally targeting the $3 milestone. Source: Kyle_Kinnaird on TradingView

However, investors are warned to exercise prudence. While bullish catalysts are building up, overbought technicals and the still-pending status of regulatory filings provide a touch of uncertainty.

Looking Ahead

XRP price predictions in 2025 are positive, with forecasts ranging from $3 to $5 based on Ripple’s implementation strategy. Whether this is the start of a long-term bull trend or another speculative spurt, only time will tell and will depend on regulatory clarity and delivery from both Ripple and the market participants.

For now, XRP coin holders are watching closely as Ripple reshapes its place in the nascent crypto-finance landscape.