XRP Price Prediction: Symmetrical Triangle Breakout Imminent Between July and September—Analysts Bullish

XRP traders, buckle up—the charts are whispering about a major move.

Technical analysts spot a symmetrical triangle forming, with a potential breakout window between July and September 2025. These patterns rarely exit quietly.

The Setup:

Classic consolidation pattern. Lower highs meet higher lows. Volume’s coiled like a spring. When it snaps, the move could be violent—in either direction (though bulls are placing their bets).

Why This Matters:

Symmetrical triangles often precede explosive price action. A clean breakout could confirm the next leg of XRP’s trend—whether that’s a moonshot or a nosedive. No guarantees, just probabilities and leveraged dreams.

The Punchline:

Wall Street’s still debating whether crypto is ‘real.’ Meanwhile, traders are busy printing life-changing gains from these setups. Your move, boomers.

After consolidating for over 330 days, technical indicators now suggest that XRP could be on the verge of a significant move—possibly as soon as July and no later than mid-September.

Symmetrical Triangle Formation Points to Imminent Move

The current xrp price action shows a tightening trading range between $2.00 and $2.40, indicating a classic symmetrical triangle structure—a chart pattern known to precede strong breakouts. According to crypto analyst Egrag Crypto, “XRP breakout is coming,” noting that symmetrical triangles often resolve between 75% and 95% of their lifespan.

Analyst Egrag crypto says XRP’s 330-day triangle pattern points to a potential breakout between July and September. Source: EGRAG CRYPTO via X

In XRP’s case, the 334-day formation translates into a potential breakout window starting around early July (Day 251) and extending to mid-September (Day 317). August appears to be the “sweet spot,” where many expect a shift in momentum. If XRP breaks above the $2.40 mark, the price could accelerate toward major Fibonacci extension targets ranging from $8 to $27.

Key Levels to Watch: Support and Resistance

Despite recent volatility, XRP has managed to rebound from a low of $1.91 and now trades above $2.20. The next immediate resistance lies at $2.22 (100-day SMA) and $2.40 (200-day SMA), two levels that analysts say must be breached for a confirmed bullish reversal.

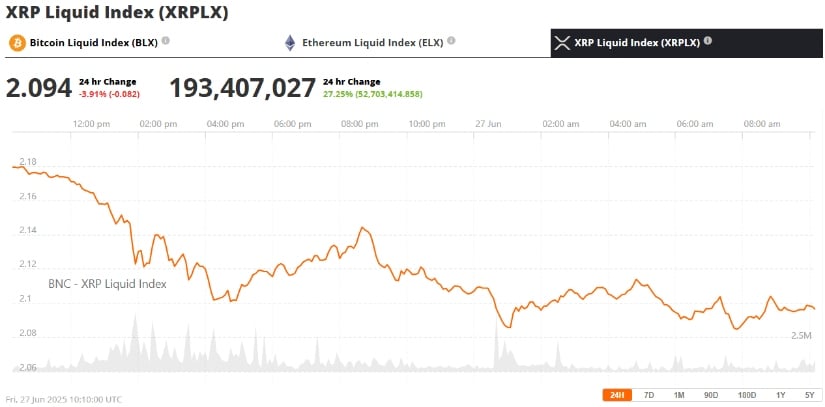

XRP is trading NEAR $2.09 with overbought signals; a drop below $2 may trigger a move to $1.91, while a close above $2.21 could target $2.33. Source: FenzoFxBroker on TradingView

“These are important macro levels and clearing them with strength WOULD confirm a true trend shift,” said analyst CasiTrades. They also pointed to $2.25 and $2.69 as critical retracement points before any larger breakout scenario materializes.

However, failure to push past $2.40 could lead to downside pressure. Key support sits between $2.05 and $2.10, with lower safety nets near $1.92 and $1.79. If XRP closes below these levels, a deeper correction could unfold.

XRP Lawsuit Update Adds Uncertainty

The legal backdrop continues to play a major role in Ripple XRP news. Just days ago, Judge Analisa Torres rejected a joint request from Ripple and the SEC for an indicative ruling, reigniting tensions in the long-standing XRP lawsuit.

Judge Torres rejected the joint SEC-Ripple motion, reaffirming that existing securities laws still apply to crypto despite recent policy shifts. Source: @DigitalGal_X via X

The market responded swiftly, with XRP price dipping over 5% to around $2.10 following the news. While Ripple maintains confidence in a favorable outcome, the development has added short-term pressure on investor sentiment. Legal watchers noted that until the Ripple-SEC case reaches full resolution, price reactions to court developments will remain a constant variable in the Ripple market.

Ripple Ecosystem Growth Could Fuel Bullish Momentum

Beyond the courtroom, Ripple is building fundamental strength. The APEX 2025 summit in June showcased upcoming upgrades to the Ripple Ledger, including new features like TokenEscrow and Batch transactions. Five new stablecoins were also announced on XRPL, along with progress on tokenized real-world assets—a theme championed by CTO David Schwartz.

This growing utility, especially in the face of growing institutional interest, could be the trigger needed for XRP to sustain higher valuations. As Ripple expands its partnership base—reportedly including big names like Bank of America—analysts believe the underlying demand for Ripple crypto could increase dramatically.

Market Sentiment Remains Bullish Amid Short-term Correction

Despite ongoing uncertainty, sentiment in the XRP community appears to be shifting. Crypto influencer DustyBC labeled XRP as “incredibly cheap under $2,” forecasting a strong upside within six months. Another analyst, Mikybull Crypto, compared the current setup to XRP’s explosive 2017 bull run, suggesting the token could rally to $14 if history rhymes.

XRP was trading at around $2.09, down 3.91% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Volume patterns support this growing optimism. Analysts note that sellers have failed to establish new local lows since the consolidation began, while compressed volatility often leads to powerful directional moves.

Final Thoughts on the XRP Price Prediction

With XRP trading inside a well-defined symmetrical triangle, both technical indicators and community sentiment align on the likelihood of a breakout. The $2.40 resistance remains the critical level to watch. A confirmed MOVE above it could spark a sharp rally toward prior highs near $3.40, and potentially even double-digit targets.

Still, the broader outcome remains tied to macroeconomic shifts, legal developments, and the evolving Ripple lawsuit news. Whether it’s July, August, or September, XRP appears to be nearing a defining moment. For traders, this symmetrical triangle may prove to be the calm before a major market storm.