🚀 XRP ETF Breakthrough: 3iQ Debuts Canada’s First XRP ETF as U.S. SEC Nears Historic Approval

Wall Street's sleeping—again. While U.S. regulators drag their feet, Canada’s 3iQ just launched North America’s first XRP ETF. Traders are piling in, and the SEC’s approval stamp might finally be coming—right after they finish their 47th coffee break.

### The Great ETF Race Heats Up

3iQ’s XRP ETF went live on the Toronto Stock Exchange today, giving institutional investors a backdoor into Ripple’s embattled crypto. Meanwhile, stateside filings inch toward approval—because nothing says 'financial innovation' like waiting 84 years for a yes-or-no answer.

### Why This Matters More Than Your Portfolio’s 2022 Trauma

XRP’s legal clarity post-SEC lawsuit makes it the golden child for ETFs. Unlike Bitcoin’s wild swings, Ripple’s token has regulatory daylight—and Wall Street’s finally noticing. Cue the institutional money printers.

### The Punchline? Follow the Money

Canada’s move forces the SEC’s hand. Either approve and join the party—or watch another $10B asset class bloom offshore. Your move, Gary Gensler.

Meanwhile, in the United States, regulatory developments are signaling that approval for similar XRP ETFs may not be far behind, potentially unlocking a new era of institutional access to the Ripple-backed digital asset.

3iQ Debuts Canada’s First XRP ETF with Ripple’s Backing

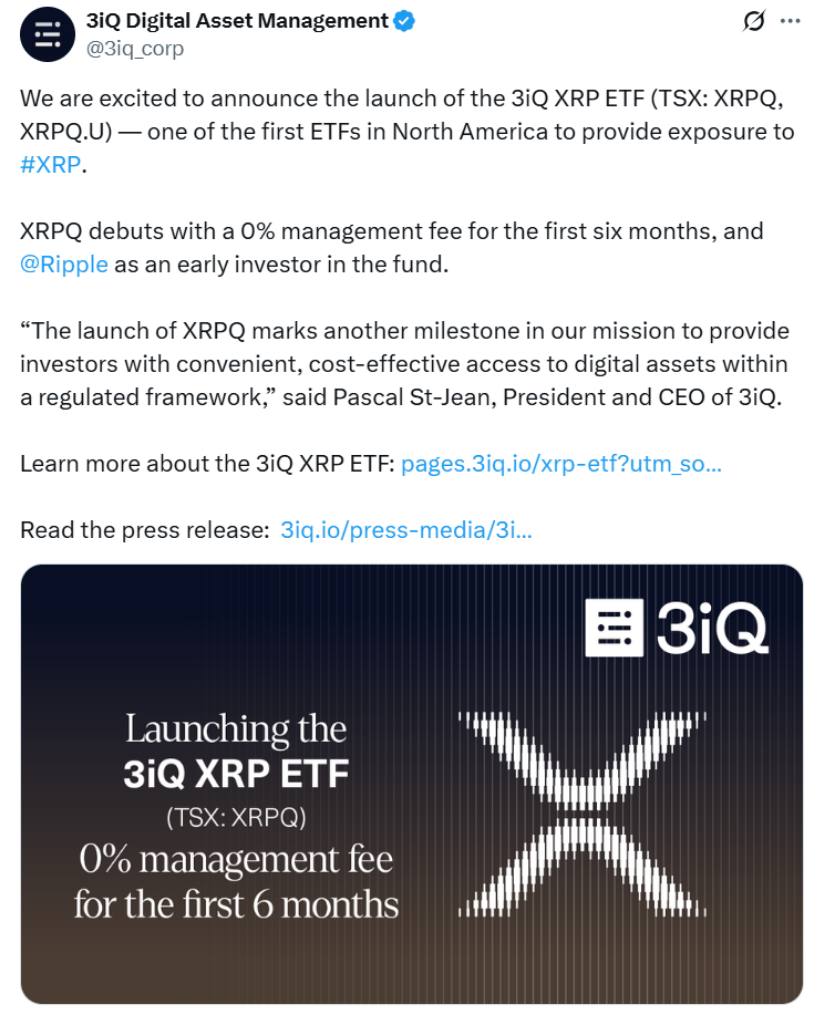

Canadian digital asset manager 3iQ has officially launched North America’s first exchange-traded fund (ETF) focused solely on XRP, marking a major step forward for institutional adoption of Ripple’s native token. The new fund, named XRPQ, began trading this week on the Toronto Stock Exchange (TSX) and is backed by Ripple, the blockchain company behind the XRP Ledger.

3iQ has launched the XRPQ ETF on the TSX with Ripple as an early investor and a 0% management fee for the first six months. Source: 3iQ Digital Asset Management via X

The ETF provides investors with regulated exposure to XRP, currently the fourth-largest cryptocurrency by market capitalization. Notably, 3iQ is waiving management fees for the first six months to attract early investors. According to 3iQ’s CEO, Pascal St-Jean, this initiative is part of the firm’s mission to deliver “convenient, cost-effective access to digital assets within a regulated framework.”

“XRP has demonstrated significant growth potential over the past decade,” said St-Jean. “This groundbreaking strategy offers Canadian and qualified global investors a transparent, low-cost, and tax-efficient way to access that opportunity securely.”

All holdings in the fund are acquired from reputable exchanges and over-the-counter (OTC) platforms, with assets stored securely in cold storage. XRPQ is accessible to Canadian residents through registered investment accounts and is available to certain international investors, depending on local regulations.

Ripple-Backed ETF Launch Coincides with U.S. Progress

The launch of XRPQ comes amid a wave of institutional interest in crypto ETFs globally, particularly those offering clarity on regulatory treatment. Meanwhile, in the United States, the Securities and Exchange Commission (SEC) is reviewing multiple proposals for spot XRP ETFs, with Optimism growing among analysts and market participants.

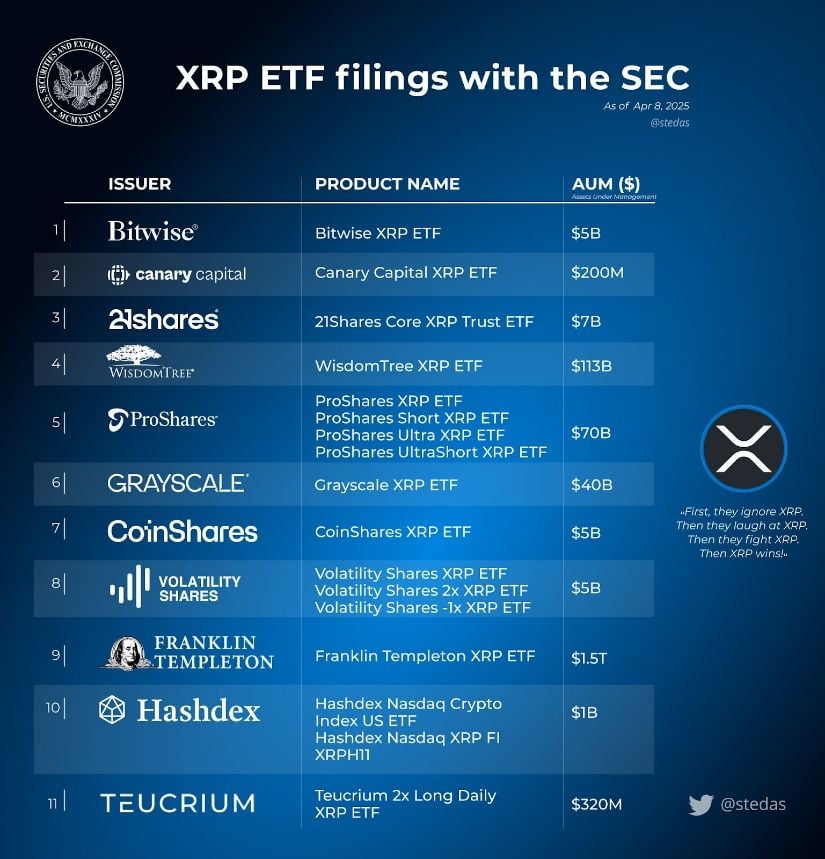

List of companies seeking XRP ETF approval in the U.S. Source: UKSNOW via X

Most notably, the WisdomTree XRP Trust, a proposed U.S.-based spot ETF, has been filed for listing on the Cboe BZX Exchange. If approved, it WOULD become the first XRP spot ETF available to American investors. The SEC has up to 240 days to decide on the application and is currently soliciting public feedback on investor protections and market manipulation concerns.

The ETF would track the CME CF Ripple-Dollar Reference Rate, allowing investors to gain exposure to XRP value without the need for self-custody or direct token ownership.

“Rules must be clear not just for issuers, but for all market participants,” said Stuart Alderoty, Ripple’s Chief Legal Officer, in a letter to the SEC. He added that vague terms like “fully functional” or “decentralized” only contribute to regulatory confusion.

Analysts See High Approval Odds for U.S. XRP ETFs

According to Bloomberg Intelligence analysts James Seyffart and Eric Balchunas, the odds of approval for most pending crypto ETFs—including those for XRP, Solana (SOL), and Dogecoin (DOGE)—now stand at 90% or higher. Their assessment is based on the SEC’s increasing engagement with ETF issuers and a steady stream of amendment requests, which suggest a more cooperative regulatory stance.

Analysts James Seyffart and Eric Balchunas have raised approval odds for most spot crypto ETFs to 90%+, citing increased SEC engagement as a positive signal. Source: James Seyffart via X

On prediction markets like Polymarket, bettors give the XRP ETF a 98% chance of being approved before the end of 2025.

Ripple’s Broader Strategy and ETF Implications

The ETF developments come as Ripple continues to expand its institutional presence and fight regulatory battles in the United States. The Ripple lawsuit with the SEC, which began in late 2020, remains a focal point of XRP lawsuit news. However, the SEC’s increasing willingness to consider ETFs for XRP could signal a shift in the broader XRP SEC lawsuit narrative.

Ripple CEO Brad Garlinghouse has long been a proponent of more open digital asset regulations and sees ETFs as a bridge between mainstream finance and crypto innovation. The growing utilization of XRP ETFs can have a bullish influence on Ripple price action and boost market confidence in XRP.

Ripple’s partnership with Canadian institutions also lends credence to its global ambitions. As an early investor in 3iQ’s new fund, Ripple is taking advantage of the opportunity to extend the application of XRP beyond cross-border payments and remittances—a further reinforcement of its position in the Ripple exchange and digital finance system.

Outlook: What’s Next for XRP Price and Market Impact?

With Canadian ETFs already listed and U.S. approvals imminent, XRP faces a decisive moment. While response in the market has been muted, analysts say an SEC nod would be a catalyst for upgrades in xrp price forecasts, as ETF inflows have a tendency to boost liquidity and mainstream investor exposure.

XRP was trading at around $2.189, up 0.4% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

The constant evolution of the Ripple XRP news environment—spanning from ETFs, regulatory news, and new uses—could be changing the story around Ripple cryptocurrency and further detaching XRP from other altcoins that are still stuck in regulatory limbo.

As the XRP lawsuit news and ETF timelines come to fruition, institutions and investors alike will be watching closely. Whether the next chapter in the story features a key U.S. approval or further integration into global markets, XRP is certainly back in the limelight.