XRP Adoption Skyrockets Post-XRPL 2.5.0 Upgrade as XYZVerse Scores $14M with Sports Fan Hype

XRP's network upgrade fuels institutional interest—just as another metaverse project cashes in on jersey-chasing crypto tourists.

XRPL 2.5.0 goes live

The 'FedNow killer' narrative gets fresh legs with enterprise-grade features. Validators report 40% faster settlement times—banking partnerships incoming?

XYZVerse's $14M playbook

Another day, another Web3 startup monetizing fandom. This one's leveraging athlete NFTs and 'virtual stadiums' (read: glorified Zoom calls with 3D avatars).

Meanwhile in TradFi land...

Goldman analysts still can't decide if blockchain is 'transformational' or a compliance nightmare. Spoiler: It's both—but at least the fees are juicier than their prime brokerage spreads.

The launch of XRPL 2.5.0 introduces a suite of enhancements aimed at expanding XRP’s utility across decentralized finance, tokenization, and institutional-grade infrastructure. The upgrade coincides with growing adoption metrics and renewed interest from market participants following a resolution to Ripple’s multi-year battle with the U.S. Securities and Exchange Commission.

But while XRP eyes long-term institutional relevance, a different kind of momentum is building at the other end of the crypto spectrum with XYZVerse, a presale-phase meme coin combining sports culture with DeFi, pulling in over $14 million in community-backed funding.

XRPL 2.5.0: Batch Transactions and Token Escrows

As goes from the XRP Ledge blog, the latest 2.5.0 version introduces batch transaction functionality, allowing up to eight operations to be executed atomically—enabling use cases such as payroll, airdrops, and complex decentralized app logic.

Another key update is that token escrow capabilities, previously exclusive to XRP, now apply to all trustline-based tokens on the network. This opens the door to more advanced DeFi primitives, including vesting contracts and delayed token releases.

Additional features include:

- Permissioned decentralized exchanges, catering to KYC-sensitive use cases

- Delegated permissions, enhancing account security

- A 10–15% reduction in memory and bandwidth usage for validators

The network is also implementing a community-governed DAO—XAO DAO—to vote on future protocol changes, mirroring Ethereum’s governance model.

Market Implications

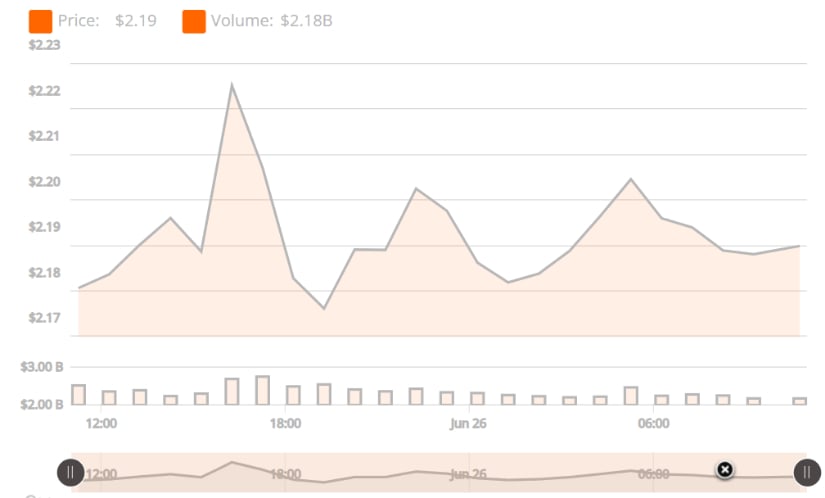

XRP is trading at $2.19, up 15% over the past month, bolstered by the XRPL upgrade and institutional flows. The coin still trades below its all-time high of $3.84, reached during the 2018 bull cycle.

If XRPL continues to onboard developers, launch new token ecosystems, and secure enterprise partnerships, XRP could emerge as a credible LAYER 1 alternative for regulated DeFi and enterprise tokenization.

Whether it can chip away at Ethereum’s dominance will depend on execution, network effects, and real-world integration. But for now, XRP is back in the conversation.

XYZVerse Raises $14M as Sports-Themed Meme Coin Gains Steam

While XRP leans into compliance and long-term infrastructure, XYZVerse is proving there’s still room in the market for culturally driven, community-first projects. Focused on the intersection of meme coin HYPE and global sports fandom, XYZVerse has already raised more than $14 million in its ongoing presale.

A Meme Coin With a Roadmap

Unlike many meme tokens that lean solely on short-term hype cycles, XYZVerse differentiates itself with a structured presale model and defined post-launch strategy.

The price of the $XYZ token is currently $0.003333, set to increase incrementally across remaining stages until it reaches $0.02 by the end of the presale. The project targets an initial listing price of $0.10—a 30x markup from current levels.

At the heart of the project is a commitment to community-first economics. 15% of the total token supply is allocated to liquidity, ensuring market depth at launch, while 10% is reserved for ongoing community incentives, including airdrops, staking rewards, and seasonal bonuses. A planned deflationary burn mechanism will remove 17.13% of tokens over time, creating potential supply-side pressure if demand continues to rise.

Security, Transparency, and Post-Launch Strategy

XYZVerse has also invested in smart contract audits. The roadmap includes CEX and DEX listings, integration with fantasy sports dApps, and community governance modules, suggesting the team is positioning $XYZ not as a seasonal meme play but as a long-term ecosystem with potential for recurring user engagement.

If execution aligns with the roadmap, XYZVerse could emerge as a blue-chip contender in the meme coin class, appealing to both speculative traders and longer-horizon retail holders.

Conclusion

Though XRP and XYZVerse sit on opposite ends of the crypto spectrum—one aiming to modernize global finance, the other targeting retail excitement and virality—both are riding strong tailwinds.

XRP, trading at $2.19, is betting on protocol maturity and institutional adoption to regain its place among top-layer protocols.

XYZVerse, still pre-listing, is leveraging its community-first approach and sport-based identity to gain early capital and traction.

With capital flowing into both regulated and retail-driven projects, the crypto market in 2025 continues to reflect a bifurcated appetite: one for institutional-grade infrastructure, and another for thematic, narrative-driven tokens that promise exponential upside.

You can find more information about XYZVerse (XYZ) here:

https://xyzverse.io/,

https://t.me/xyzverse,

https://x.com/xyz_verse

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.