5 Cryptocurrencies Primed to Explode in June-July 2025 – Don’t Miss the Rally

The crypto markets are heating up—here’s your cheat sheet for the hottest digital assets poised for action this summer.

Bitcoin (BTC): The OG crypto flexes its halving muscles as institutional inflows hit record highs. Watch for a potential ATH breakout if ETF demand keeps surging.

Ethereum (ETH): With the Dencun upgrade slashing Layer 2 fees by 90%, ETH’s deflationary mechanics could trigger a supply shock. DeFi degens are already front-running the move.

Solana (SOL): The ‘Ethereum killer’ keeps eating market share—its NFT volume just flipped ETH’s for the third straight month. Institutional validators are piling in like it’s 2021.

BNB: Binance’s native token quietly outperformed BTC last quarter despite regulatory FUD. The burn mechanism’s deflationary pressure is reaching critical mass.

XRP: The perpetual underdog’s legal clarity finally pays off? Banking partnerships are materializing faster than Jamie Dimon’s ulcer when he talks crypto.

Remember: In crypto, ‘fundamentals’ are what traders scream while chasing pumps. DYOR—or just ape in and pray like the rest of Wall Street.

This article explores key cryptocurrencies that might make significant movements in June and July 2025. Discover which tokens could shape the next phase of the digital currency market.

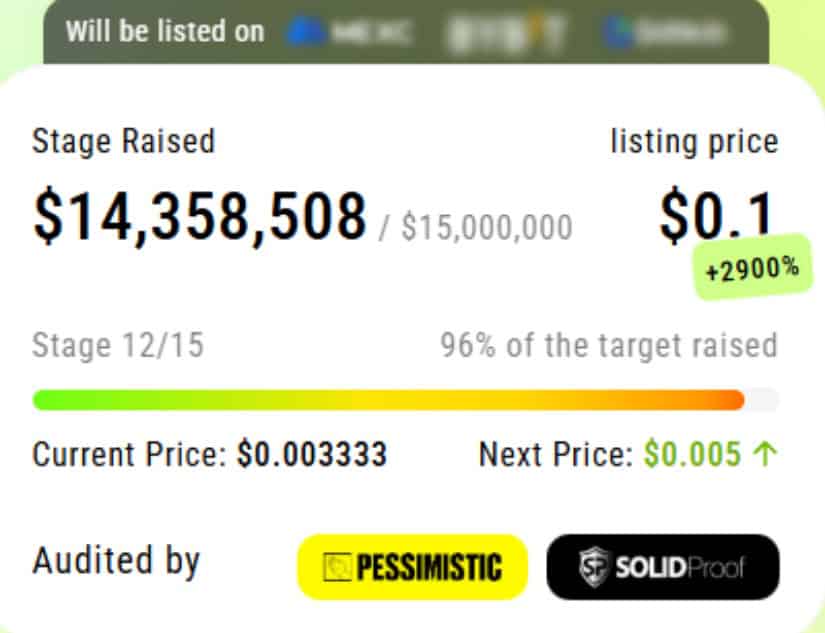

Undervalued $XYZ Eyes Major Exchange Listing as Presale Surges Past $14M

The meme coin market is no stranger to outsized ambitions, but XYZVerse ($XYZ) markets itself as more than just a fleeting phenomenon. With over $14 million raised during its ongoing presale and pricing now at $0.003333 per token, the Polygon-based asset is preparing for a high-profile entry into broader markets.

A listing on both centralized (CEX) and decentralized exchanges (DEX) is planned following the conclusion of its presale. While names of specific venues have not yet been disclosed, the team has issued a major launch teaser ahead of the next phase.

Presale Trajectory and Pricing Dynamics

The presale campaign, currently in its 12th stage, has seen significant investor participation. The token price is set to rise to $0.005 in the 13th stage, representing a 50% increase from current levels. If the project delivers on its post-launch momentum, early investors may realize potential returns that could rival those seen in previous meme coin breakouts.

Strategic Positioning: Sports Culture Meets Crypto

Branded as the first all-sports meme coin, XYZVerse aims to tap into the intersection of athletic fandom and crypto speculation. The project’s narrative is personified by its mascot, XYZepe, a character designed to symbolize resilience and competitive spirit — values that resonate with its target audience of football, MMA, and eSports enthusiasts.

The token is marketed as being “born for fighters, built for champions,” reflecting both the community’s aggressive trading mindset and the project’s ambition to join the ranks of Dogecoin and Shiba Inu.

Tokenomics and Ecosystem Buildout

In contrast to many meme coins that rely solely on hype, XYZVerse has introduced structured tokenomics. Each completed presale stage triggers a burn of 1 billion tokens, with 17% of the total supply (initially 100 billion tokens) slated for destruction by the end of the campaign — a deflationary mechanism designed to support long-term price stability.

The project has also allocated 10% of its total supply — approximately 10 billion $XYZ — toward community airdrops, signaling a strong commitment to early user acquisition and retention. The airdrop strategy is among the largest in the meme coin space to date. Further credibility comes from KYC verification by SolidProof and a smart contract audit conducted by Pessimistic, measures aimed at boosting investor confidence ahead of listing.

Join XYZVerse Presale Now

Bitcoin (BTC)

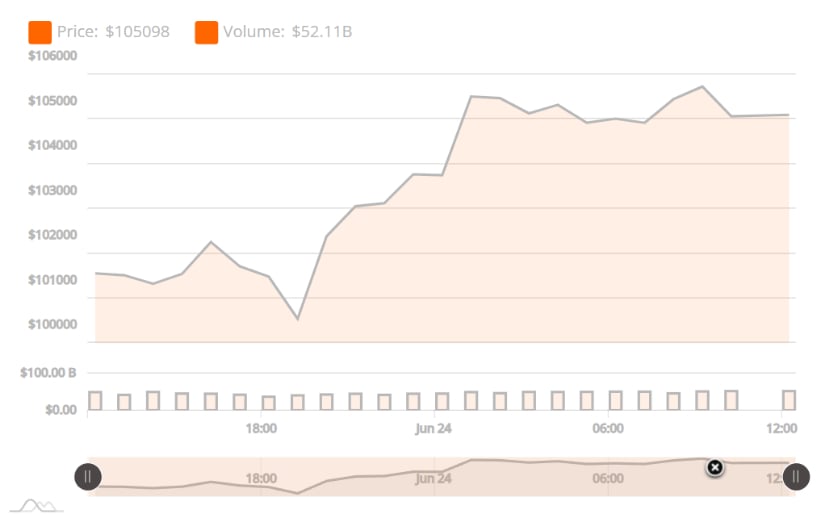

Bitcoin (BTC) has seen moderate changes recently. In the past week, it edged down by almost 0.92%. Over the past month, the decline was about 1.9%. However, over six months, the price has grown by around 6.44%. Currently, Bitcoin trades between $96,598.55 and $107,152.91.

Technical indicators suggest bitcoin may face challenges ahead. The Relative Strength Index is at 68.77, close to the overbought level. The Stochastic indicator stands at 91.72, also indicating overbought conditions. These signals hint at a possible price pullback. The 10-day Simple Moving Average is $105,381.68, slightly above the 100-day SMA of $102,973.55, showing recent upward momentum.

Bitcoin is nearing its nearest resistance level at $113,323.54. Breaking above this point could lead to a price increase of over 13%. On the downside, the nearest support level is at $92,214.82. Falling below this could result in a drop of about 7.8%. The second resistance and support levels are $123,877.90 and $81,660.46, representing potential moves of approximately 23.88% upward or 18.34% downward.

Ethereum (ETH)

Ethereum (ETH) has been on a downward trend over the past six months, decreasing by 30.69%. In the last month, it declined 4.15%, and over the past week, it fell 4.70%. Currently, ethereum trades between $2003.79 and $2567.93, showing consolidation after recent losses.

Technical indicators show mixed signals. The 10-day simple moving average is $2412.16, slightly above the 100-day average of $2352.67, indicating short-term upward momentum. However, the RSI is 69.90, nearing overbought territory. The Stochastic oscillator at 93.35 also suggests overbought conditions. The MACD level of 42.70 shows bullish momentum, but caution is advised.

Ethereum faces resistance at $2906. If the price breaks above this, it could target $3470, a potential gain of about 35%. Support lies at $1778.21; a drop below could see it testing $1214.07, a decline of around 40%. Given current indicators, Ethereum’s price may be influenced by these levels in the short term.

Solana (SOL)

Solana (SOL) has seen a significant decline over the past six months, dropping nearly 26%. In the last month, it fell by about 17%, and the past week saw a decrease of almost 3%. Currently, SOL trades between $119.09 and $151.70, reflecting market volatility.

Technical indicators offer mixed signals. The Relative Strength Index is at 71.55, suggesting overbought conditions and potential for a pullback. The Stochastic oscillator is high at 93.06, indicating possible downward pressure. However, the positive MACD level of 2.94 hints at bullish momentum.

Looking ahead, Solana’s nearest resistance is at $171.56. Breaking this could lead to the next resistance at $204, potential gains of approximately 13% and 34% from current prices. On the downside, support levels are at $106.34 and $73.73, implying possible declines of about 11% and 38%. The close 10-day and 100-day moving averages suggest price consolidation before a significant move.

Ripple (XRP)

XRP is trading between $1.84 and $2.27. Over the past week, its price dipped by 1.67%. In the last month, it decreased by 5.49%, and over six months, it fell by 4.20%. These numbers show a slight downward trend in recent times.

Despite this, signs point toward a possible rise. The Relative Strength Index (RSI) is at 71.98, hinting at strong momentum. The 10-day Simple Moving Average (SMA) is $2.17, above the 100-day SMA of $2.08, suggesting a short-term upward trend. If XRP breaks the nearest resistance at $2.52, it could reach the second resistance at $2.95. This WOULD be increases of about 23% and 44% from the current price.

However, if XRP drops below the support level of $1.66, it might reach the second support at $1.24. This would mean declines of around 19% and 39% from current levels. The Stochastic indicator is at 70.79, showing the market might be overbought. The next few days will be key to see if XRP moves above resistance or falls below support.

Why Watch These 5 Cryptos in June and July 2025

|

Crypto |

Key Catalyst |

Why Watch |

| XYZ | Exchange Listing + Token Burns | Early investor ROI, strong hype-to-utility ratio |

| BTC | Nearing Resistance | Big move likely if $113K breaks |

| ETH | Oversold Reversal Setup | High-risk, high-reward near key support |

| SOL | Tight Trading Range | Breakout or crash scenario brewing |

| XRP | Technical Breakout Potential | Low volatility may not last — watch for expansion |

Conclusion

BTC, ETH, SOL, and XRP are promising in this bull run, but XYZVerse (XYZ) emerges as the pioneering memecoin uniting sports and esports fans.

You can find more information about XYZVerse (XYZ) here:

https://xyzverse.io/,

https://t.me/xyzverse,

https://x.com/xyz_verse

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.