Bitcoin (BTC) Price Prediction: The $90.4K CME Gap Emerges as the Critical Launchpad for a Major Rebound

All eyes are on a single number: $90,400. That's the level where the next major Bitcoin move could ignite.

The Gap in the Machine

Markets don't like unfinished business. The CME Bitcoin futures market closed with a gap down to that precise level—a void on the chart that acts like a magnetic pull for price. History shows these gaps get filled. The only question is when and how violently.

The Bull Case Scenario

For the rebound narrative to gain serious traction, Bitcoin needs to reclaim and hold above $90.4K. It wouldn't just be a technical checkbox—it would signal institutional flows overpowering short-term sell pressure and potentially unlock a new leg up. Think of it as the market's way of correcting its own clerical error, usually with momentum.

The Stakes at the Pivot Point

Fail to reach it, and the bullish thesis weakens, inviting a retest of lower supports. Capture it decisively, and you have a confirmed springboard. It's a clean, quantifiable line in the sand—rare in a space often driven by vibes and influencer tweets. (A welcome reprieve from the usual 'financial innovation' that just repackages old leverage in a new app.)

Watch the $90.4K level. It's not just a price; it's the next battleground.

Bitcoin price today slipped amid thin weekend liquidity, prompting market participants to reassess whether the move reflects a routine liquidity sweep or a more prolonged corrective phase. With volume continuing to compress and price holding within a defined range, analysts are increasingly focused on how Bitcoin reacts around specific technical levels rather than short-term volatility alone, shaping the near-term Bitcoin price prediction.

Key Support and Resistance Levels Shape Bitcoin Price Prediction

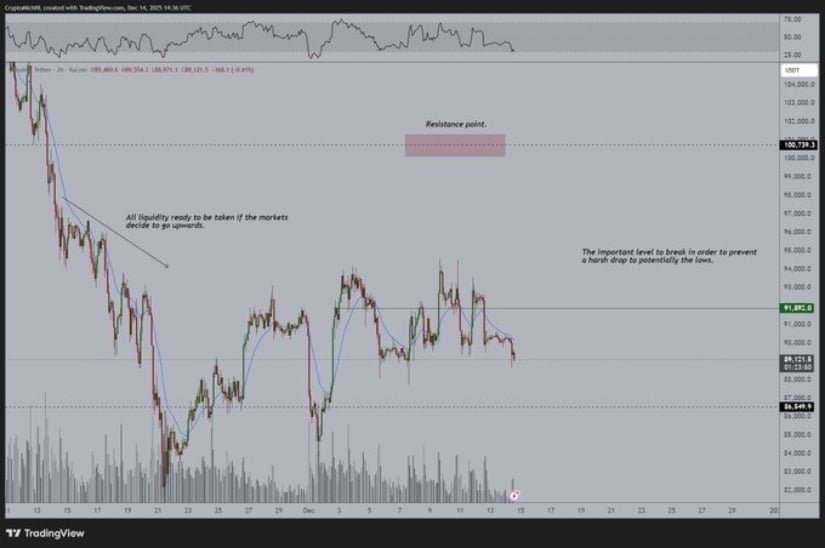

Market participants continue to anchor their Bitcoin price prediction to clearly defined support and resistance zones as BTC remains locked in a broad consolidation. Crypto trader Ted Pillows, who focuses on on-chain and macro-driven market signals, highlighted that Bitcoin has yet to establish directional conviction.

Bitcoin hovers NEAR $90,000, needing a push above $92K–$94K for upside momentum, while a drop below $88K–$89K could lead to $85K. Source: @TedPillows via X

“$BTC is still hovering around the $90,000 level. For strong upside momentum, Bitcoin needs to reclaim the $92,000–$94,000 range,” Ted noted. He added that a sustained move below the $88,000–$89,000 zone could open the door to a deeper retracement toward $85,000.

Bitcoin CME Gap at $90.4K Gains Importance

A central element of the current bitcoin forecast is the CME futures gap near $90,400, which has emerged as a key technical reference point. CME gaps form when Bitcoin trades over the weekend on spot markets while CME futures remain closed, creating price discontinuities that traders often monitor as potential liquidity targets once futures reopen.

Bitcoin ($BTC) is sweeping toward the $90.4K CME gap this weekend, with ETH showing relative strength, while a fast rebound is needed to avoid testing $80K support. Source: @CryptoMichNL via X

Analyst Michaël van de Poppe suggested the market may already be in the process of clearing short-term liquidity. “The sweep is already happening on $BTC. It’s great that it’s happening on Sunday, so then Monday will be positive,” he wrote, pointing to the $90.4K CME gap as a possible rebound area. While he cautioned that outcomes are never guaranteed, van de Poppe noted that the current structure does not resemble conditions typically associated with extended bearish weeks.

While CME gaps frequently attract price, the current setup differs from several gap-fill scenarios earlier this year. Volume has continued to compress rather than expand into the move, suggesting a more measured response from larger market participants rather than aggressive positioning.

Weekend Volatility and Market Structure

Weekend trading continues to exert a disproportionate influence on near-term bitcoin price action. Research from the Blockchain Research Institute indicates that nearly 60% of Bitcoin’s weekly volatility historically occurs over weekends, often driven by thinner liquidity conditions and stop-loss activity rather than sustained directional flows.

In the current context, the decline appears more consistent with a controlled corrective process than a structural breakdown. However, some market participants continue to flag downside risks toward the $70,000–$76,000 region if key supports fail to hold, particularly amid broader macro uncertainty and speculation surrounding potential Bank of Japan policy shifts.

These macro considerations matter because they can override technical setups, especially during periods when global risk sentiment changes faster than on-chain or chart-based signals.

Analysts Remain Cautiously Constructive

From a broader structural perspective, TradingView analyst EduwaveTrading described Bitcoin’s recent behavior as prolonged consolidation rather than trend exhaustion.

Bitcoin has been consolidating recently; after the current correction, a fill of the bearish weekly FVG could open room for upside, with traders watching for bullish order FLOW confirmation. Source: EduwaveTrading on TradingView

“The last weeks, Bitcoin is in a big consolidation. I still think it could fill the bearish weekly FVG above. After the correction finishes, more upside could follow,” the analyst stated. A fair value gap (FVG) refers to a price imbalance created during rapid moves, which markets sometimes revisit as liquidity normalizes.

However, the analyst emphasized the importance of waiting for lower-timeframe confirmation and a shift in order Flow before assuming bullish continuation, reinforcing a cautious rather than predictive stance.

Final Thoughts

Bitcoin’s near-term outlook remains closely tied to how the price behaves around the $90,400 CME gap, which has become a focal point in the current Bitcoin price prediction. Acceptance above this level, particularly with improving volume, WOULD strengthen the case for a rebound toward the $92,000–$94,000 resistance zone.

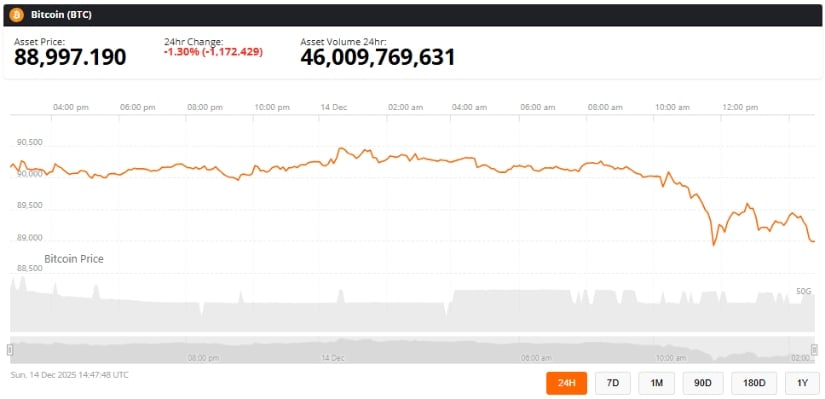

Bitcoin was trading at around 88,997, down 1.30% in the last 24 hours at press time. Source: Bitcoin price via Brave New Coin

Conversely, repeated rejection below the gap could signal that downside liquidity has not yet been fully absorbed, keeping the risk of a deeper pullback toward $85,000 in play. These scenarios remain probabilistic and contingent on broader risk sentiment, especially if unexpected macro developments begin to outweigh technical structures. As a result, Bitcoin appears positioned at a critical inflection point where market reaction, rather than prediction, is likely to define the next phase.