Ethereum (ETH) Price Prediction: The $3,000 Retest That Could Unleash a Massive Wave 3 Breakout

Ethereum stands at the precipice. A crucial retest of the $3,000 level is in play—and the outcome could dictate the next major move for the world's leading smart contract platform.

The Setup for the Next Leg

Market structure suggests this isn't just another pullback. Technical analysts are watching the $3,000 zone with intense focus, viewing it as the critical support that must hold to validate a bullish Elliott Wave count. A clean bounce here wouldn't just be a recovery; it would be the springboard for what's known as Wave 3—typically the most powerful and extended impulse wave in a sequence.

What a Breakout Actually Means

Forget sideways chatter. A confirmed breakout from this consolidation phase targets significantly higher valuations, with momentum that could leave latecomers scrambling. It's the kind of move that redefines ranges and, for once, might make those hyperbolic price prediction models look conservative. Of course, this all hinges on Ethereum holding that key psychological and technical floor—a level where both hope and stop-losses cluster.

The Other Side of the Trade

Failure isn't off the table. A decisive break and close below $3,000 would scramble the bullish wave count, potentially signaling a deeper corrective phase. It's the perpetual tension in crypto trading: the promise of parabolic gains versus the reality of swift, unforgiving drawdowns. Traders are essentially betting on whether the smart money is accumulating or distributing at this level—a classic game of who's fooling whom.

The Verdict: Watch the Level, Not the Noise

The narrative is simple. Ethereum's path hinges on its performance around a single, round number. A successful retest sets the stage for a potential momentum surge that could captivate the entire digital asset sector. A failure resets the timeline. In a market obsessed with complex narratives, sometimes the most important signal is the price action at one critical line on a chart. After all, in traditional finance, they'd charge you a 2% management fee just to tell you that.

This consolidation raises concerns among traders about a potential retest of the $3,000 support zone, particularly as trading volumes have declined in recent sessions.

Unlike earlier consolidation phases this year, Ethereum’s current range has formed alongside lower trading volumes, suggesting reduced speculative participation rather than aggressive distribution. Analysts note that how ETH reacts around the $3,020–$3,150 levels will likely determine its next meaningful price movement, potentially setting the stage for either a breakout or a deeper correction.

Ethereum Consolidation and Market Sentiment

Crypto analyst Ted (@TedPillows) highlighted Ethereum’s persistent sideways trading on X: “$ETH has been going sideways for now. Until $3,400 is reclaimed, Ethereum’s chances of retesting $3,000 is very high.”

Ethereum (ETH) trades sideways, facing a potential retest of $3,000 unless it reclaims $3,400. Source: @TedPillows via X

Ethereum trades NEAR $3,089 USD, down 1.2% in the last 24 hours, with a 24-hour volume of approximately $11 billion. This stagnation follows Bitcoin’s recent highs, and traders are divided on whether the dip is a buying opportunity or a signal of continued weakness.

When interpreting these dynamics, it’s important to note that sideways ranges accompanied by declining volume often indicate indecision rather than imminent distribution. Acceptance above resistance or breakdown below support should be considered in the context of volume behavior.

ETH Key Support Levels

Ethereum’s $3,020 support has historically served as a critical floor. TradingView analyst Bahardiba notes: “It has once again reached its static support floor at $3,020. This is an important support for Ethereum, which has reacted to it multiple times, so for now, this support could slow down the correction.”

Ethereum (ETH) rests on key $3,020 support, with a potential breakout above $3,150 aiming for $3,380. Source: bahardiba on TradingView

For ethereum to regain bullish momentum, it must break above the $3,150 trendline resistance. A confirmed breakout with expanding volume could push ETH toward $3,380, signaling renewed upward pressure. Conversely, repeated rejection at this level or a drop below $3,020 would suggest the consolidation remains unresolved.

Elliott Wave Analysis and Potential Breakout

Technical strategist Merlijn The Trader (@MerlijnTrader) suggests that Ethereum is entering Wave 3 in an Elliott Wave sequence: “Wave 1 built the base. Wave 2 faked everyone out. Wave 3 sends it vertically. Every major Ethereum breakout started this way. $ETH is entering vertical mode. You either catch it… or chase it.”

Ethereum (ETH) may be entering Wave 3, poised for a potential vertical breakout. Source: @MerlijnTrader via X

While Elliott Wave analysis can offer insights, it is inherently interpretive. The Wave 3 thesis WOULD weaken materially if ETH loses the $3,020 support on expanding volume. Historical patterns indicate Wave 3 rallies have sometimes led to substantial gains, but success is conditional on technical confirmation and market sentiment, not a guaranteed trajectory.

Analysts suggest a cautious framework: maintaining support while achieving acceptance above resistance is key to validating any bullish scenario.

Market Reactions and Trader Sentiment

Investor sentiment remains mixed. Some traders view the current range as a buying opportunity, targeting short-term levels of $5,000–$6,000, while others remain cautious due to macroeconomic uncertainty and potential Bank of Japan rate adjustments.

Whale activity could amplify short-term swings. Significant liquidations or accumulation by large holders can influence ETH’s trajectory. Traders should watch for volume spikes, repeated support tests, and rejection patterns, rather than relying solely on price targets.

Final Thoughts

Ethereum currently faces the risk of a $3,000 retest, but technical analysis and Wave 3 projections indicate a potential rebound if key resistance levels are broken. Traders should consider $3,020 support, trendline behavior, and volume confirmation when assessing breakout probability.

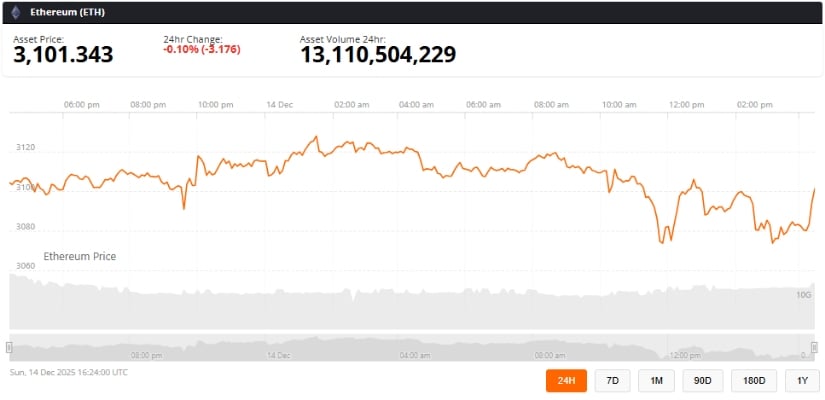

Ethereum was trading at around 3,101, down 0.10 in the last 24 hours at press time. Source: ethereum price via Brave New Coin

Acceptance above $3,150 with increasing volume would strengthen the case for a sustained upward move, while repeated rejection or a breach of $3,020 could extend the consolidation phase. Macro factors, including Bitcoin’s movements and broader market conditions, remain crucial. As the market navigates short-term volatility, Ethereum’s performance over the coming days will likely determine whether it experiences a deeper correction or a renewed bullish surge, maintaining its position as a leading digital asset.