XRP Price Prediction: Bullish Structure Holds Firm as ETF Assets Surge to $1.18 Billion

XRP's technical foundation refuses to buckle—even as Wall Street's latest crypto play balloons to a staggering $1.18 billion.

The Chart Doesn't Lie

Forget the noise. The price action tells a cleaner story. Key support levels have held, painting a classic bullish structure on the weekly timeframe. It's the kind of setup that makes traders lean forward in their chairs.

ETF Inflows: A $1.18 Billion Vote of Confidence

The real headline isn't on the chart—it's in the fund flows. Exchange-traded products tied to digital assets have quietly amassed a war chest. That $1.18 billion figure isn't just capital; it's institutional momentum finding a home. A cynical observer might call it the finance industry's expensive attempt to buy a seat at a table it spent years trying to flip over.

What's Next for the Digital Asset?

The convergence is clear: robust technicals meeting heavyweight financial endorsement. This isn't retail FOMO. It's a calculated accumulation phase playing out in plain sight. The path of least resistance points north—provided the broader market doesn't throw a tantrum.

Watch the key levels. Respect the structure. And maybe—just maybe—trust the tape more than the talking heads.

Market data shows XRP consolidating NEAR the $2 level after breaking out from a prolonged multi-year base. At the same time, rising assets in XRP-linked exchange-traded products and improving sentiment around Ripple’s regulatory outlook have added support to the current market structure rather than undermining it

Technical Structure Signals a Bullish Regime Shift

From a structural perspective, XRP has already completed a meaningful technical transition. On the daily chart, XRP has remained above its 21-day exponential moving average (EMA) near $1.80 for several consecutive weeks, a behavior historically associated with trend continuation during prior XRP expansion phases rather than late-stage rallies.

XRP shows a bullish 3–6 month outlook, consolidating above its 21 EMA near $1.80 after a multi-year breakout, with technical signals projecting 43–75% potential upside. Source: @egragcrypto via X

Crypto market analyst EGRAG CRYPTO, who focuses on long-term XRP market cycles, described the shift as structural rather than speculative. “Ignoring the percentages on the formation and focusing purely on market structure, the higher-probability scenario is up, not down,” EGRAG crypto wrote on X.

The breakout above a multi-year consolidation range marked XRP’s first sustained impulsive MOVE since its prior cycle peak. In technical analysis, such impulsive legs typically signal a transition from accumulation into expansion, with subsequent pullbacks often representing corrective pauses instead of trend reversals.

Time-cycle symmetry, comparing the duration and structure of previous XRP market phases, combined with Fibonacci extension modeling, suggests potential upside ranges of 43% to 75% from recent highs. However, this framework remains conditional. Sustained daily closes below $1.60 WOULD weaken the bullish structure and signal that the breakout has failed to hold.

XRP ETF Assets Rise to $1.18B, Highlighting Institutional Interest

Alongside technical developments, institutional exposure to XRP-linked products has continued to expand. Data shared by ChartNerdTA, citing ETF FLOW tracker WhaleInsider, shows that total net assets across XRP-related exchange-traded products have reached approximately $1.18 billion following recent net inflows of more than $20 million. “$XRP ETF: Total Net Assets now sits at $1.18BN,” ChartNerdTA posted.

XRP ETF inflows surged by $20.17 million, lifting total assets to $1.18 billion as steady net inflows since mid-November highlight growing institutional demand around the $2 price level. Source: @ChartNerdTA via X

The figures primarily reflect non-U.S. exchange-traded products, including regulated ETPs listed in select international jurisdictions. Visual data from SoSoValue, a platform that tracks digital asset fund flows, shows net inflows remaining positive since mid-November, with cumulative assets trending steadily higher.

While these products differ structurally from U.S. spot ETFs approved for Bitcoin and Ethereum, the growth in assets nonetheless signals rising institutional participation and demand for regulated XRP exposure amid improving regulatory clarity.

Consolidation Phase Reflects Market Balance, Not Weakness

Short-term price action continues to reflect consolidation rather than directional breakdown. According to TradingView analyst ZACKFX7, who focuses on range-based market structures, XRP is currently trading within a clearly defined zone following a rebound from established demand levels.

“XRPUSDT is currently trading inside a well-defined range after a strong move from the demand zone,” the analyst noted.

XRP consolidates within a tight range above key support, signaling building bullish pressure as traders await a confirmed breakout for the next directional move. Source: ZACKFX7 on TradingView

Within this range, price reactions have continued to FORM higher lows, indicating that buyers remain active on pullbacks. This behavior is commonly associated with accumulation phases, where the market absorbs supply before attempting continuation.

A confirmed break above the range high and buyer-controlled zones would likely open the path toward upper supply targets. Conversely, failure to maintain support could result in another controlled retest of demand without necessarily invalidating the broader structure.

Regulatory Progress Remains a Key Background Driver

Regulatory developments continue to serve as an important backdrop rather than an immediate catalyst. Ongoing progress in the Ripple vs. SEC case has gradually reduced uncertainty for institutional participants assessing XRP exposure, even though no new legal milestones were announced during the period.

While regulatory clarity has improved relative to previous years, legal outcomes remain a variable. Any adverse developments could still influence sentiment, liquidity, and product availability across regulated markets.

Final Thoughts

XRP’s current price behavior reflects consolidation within a broader bullish framework rather than signs of structural exhaustion. The combination of a confirmed long-term breakout, sustained participation in XRP-linked investment products, and steady technical support suggests the market is absorbing supply rather than distributing it.

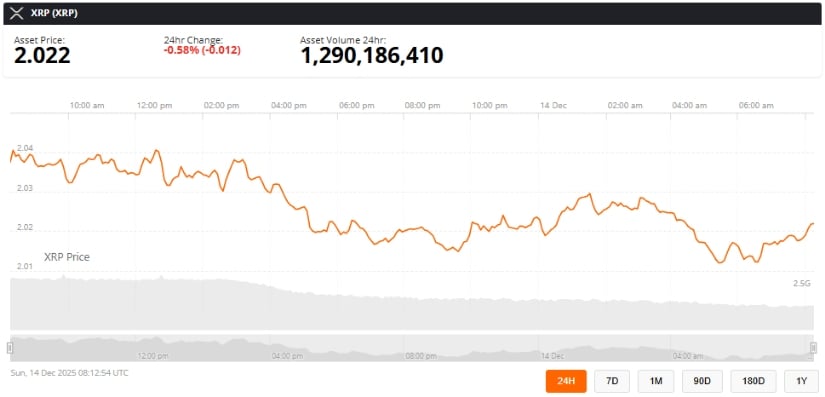

XRP was trading at around 2.02, down 0.58% in the last 24 hours at press time. Source: xrp price via Brave New Coin

That said, the outlook remains conditional. Macro volatility, regulatory uncertainty, and failures to hold key support levels would alter the trend narrative. For now, analysts broadly emphasize confirmation and structure over speculation, positioning XRP within a constructive but closely watched market regime heading into 2025.