Texas Grid Crisis: AI Data Centers Now Outpace Bitcoin Miners in Energy Consumption

The Lone Star State's power grid is buckling under a new kind of digital gold rush.

### The New Power Guzzlers on the Block

Forget the crypto miners—the real energy vampires now are the sprawling campuses of AI data centers. These facilities, humming with thousands of high-performance GPUs training the next generation of large language models, are consuming electricity at a rate that makes even the most ambitious Bitcoin mining operation look like a modest side project. The demand is relentless, 24/7, and it's pushing Texas's famously independent grid to its operational limits.

### A Grid Built for Peaks, Not Plateaus

Texas designed its energy infrastructure to handle seasonal spikes—blazing summer air conditioning loads, primarily. It wasn't engineered for a permanent, industrial-scale baseline load that grows exponentially quarter after quarter. The AI boom isn't a peak; it's a steep, rising plateau. Grid operators are scrambling, caught between the promise of economic growth and the physical reality of transformers, transmission lines, and generation capacity.

### The Irony of 'Clean' Tech's Dirty Secret

Here's the twist: much of this compute is branded as the frontier of 'clean' innovation. Yet, its most immediate physical impact is a surge in demand for often fossil-fuel-powered electricity. It's a stark reminder that in the digital age, every algorithmic breakthrough has a very tangible, watts-per-second cost. The energy bill for artificial intelligence is coming due, and it's payable in real-time, in gigawatts.

### A Provocative Close

So, while Wall Street analysts cheer every incremental parameter count in a new AI model, the folks in Texas grid control rooms are watching a different, far more critical metric: the frequency. When that dips, the lights—and the servers—go out. It's the ultimate reality check for an industry often accused of operating in the cloud. Turns out, it's all very much grounded in the dirt, steel, and frantic energy politics of the real world. A classic case of virtual ambitions meeting a very physical grid—and the grid, for now, is losing.

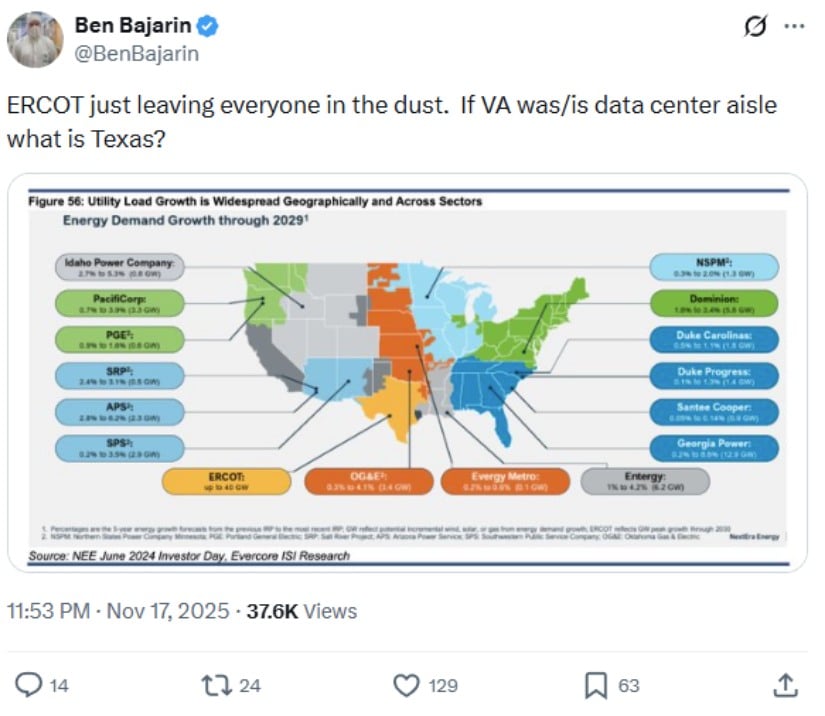

The Electric Reliability Council of Texas (ERCOT) reported that large-load power requests have jumped to 226 gigawatts in 2025 – nearly four times the 63 gigawatts recorded at the end of 2024.

This surge marks a dramatic shift in the state’s energy landscape. While Bitcoin miners once dominated large power requests in Texas, AI companies now account for roughly 73% of new applications. The change is reshaping how the state plans its power grid and forcing regulators to rethink their approach to energy distribution.

Record-Breaking Power Requests Strain Grid Planning

ERCOT received 225 large-load applications through mid-November 2025 alone. This number already exceeds the total requests submitted during the entire 2022-2024 period combined. The second quarter saw the most intense activity, with 78 requests totaling over 70,000 megawatts.

Many individual AI projects now request more than one gigawatt of power – equivalent to a large gas plant but used purely for computing. These massive facilities require constant electricity, unlike the flexible operations that bitcoin miners traditionally provided.

Source: @BenBajarin

The grid operator is reviewing 1,999 generation requests totaling 432 gigawatts on the supply side. However, 77% of these new power sources are solar and battery projects. These renewable sources cannot provide the steady, around-the-clock power that AI data centers need.

Economic Forces Drive Industry Transformation

The economics strongly favor AI over Bitcoin mining. AI data centers generate approximately $25 per kilowatt-hour compared to Bitcoin’s $1 per kilowatt-hour. This massive revenue difference is pushing utilities to prioritize AI clients over crypto miners.

Energy prices in key mining regions like Texas have risen 15-20% in 2025 as AI demand strains grid capacity. These higher costs are squeezing Bitcoin miners who already face reduced profits after the April 2024 halving event cut their block rewards in half.

Many Bitcoin mining companies are responding by converting their facilities to serve AI customers. Galaxy Digital secured $460 million to transform its former Texas mining site into an AI data center. The company signed a 15-year lease with AI cloud provider CoreWeave that could generate over $1 billion in annual revenue.

Other major miners are following similar paths. IREN landed a $9.7 billion five-year deal with Microsoft for AI infrastructure at its Texas facility. CleanSpark acquired 271 acres near Houston and secured 285 megawatts for AI data center development.

Grid Reliability Concerns Mount

The rapid expansion creates serious reliability risks for Texas residents and businesses. During extreme winter weather, the state’s available power could drop to around 69.7 gigawatts while demand reaches 85.3 gigawatts. This WOULD create a supply shortage of over 15 gigawatts.

Texas experienced devastating blackouts during the 2021 winter storm Uri when similar supply shortfalls occurred. More than 4 million people lost power and over 200 died during that crisis. State officials are working to prevent similar disasters as energy demand continues growing.

Research from Texas A&M shows that Bitcoin mining equipment is highly sensitive to voltage changes. Even brief 20-millisecond power disturbances can shut down mining operations for up to a minute. AI data centers face similar challenges but often invest in backup battery systems that miners typically cannot afford.

Regulatory Response and Policy Changes

State regulators are scrambling to manage the unprecedented demand surge. The Public Utility Commission of Texas released new draft rules requiring any customer seeking 75 megawatts or more to meet stricter coordination requirements with utilities and ERCOT.

These proposed rules aim to weed out “phantom loads” – speculative projects that request grid connections but may never actually build facilities. ERCOT has more than doubled the number of transmission projects under review compared to 2024.

Energy Secretary Chris Wright sent a letter to federal regulators in October 2025 requesting new rules to cut grid connection times from years to just 60 days for large electricity users. The proposal could help both AI companies and Bitcoin miners access power more quickly.

Bitcoin Miners Adapt or Exit

Bitcoin miners face a crucial decision point as AI dominates energy markets. JPMorgan analysts identified a nine-month window for miners to secure deals with AI companies before opportunities diminish.

Some miners are leveraging their ability to quickly adjust power consumption to help stabilize the grid. When electricity demand is low, they can absorb excess renewable energy. When demand spikes, they can shut down instantly. This flexibility makes them valuable partners for grid operators managing variable renewable power sources.

However, many smaller mining operations cannot compete with the capital requirements for AI infrastructure conversion. Converting a 100-megawatt site to serve AI customers requires an estimated $3 billion investment in advanced graphics processing units and cooling systems.

The Power Struggle Continues

The energy competition between AI data centers and Bitcoin miners represents a fundamental shift in how Texas manages its power grid. ERCOT projects data center demand alone could reach 78 gigawatts by 2030 – more than double current forecasts.

Major projects like OpenAI and Oracle’s $500 billion Stargate complex in Abilene will require 1.2 gigawatts when completed in 2026. This single facility could consume enough electricity to power over one million Texas homes.

The state’s grid must adapt quickly to handle this transformation while maintaining reliability for residential and business customers. Success will require careful coordination between regulators, utilities, and the technology companies driving this unprecedented demand surge.