Bitcoin Price Prediction: BTC Stalls Near $93K—Will FOMC Fuel Breakout or Trigger Pullback?

Bitcoin's surge hits a wall at $93,000—all eyes turn to the Fed.

FOMC Decision Looms

The Federal Reserve's upcoming policy announcement holds the key. Traders aren't just watching for rate changes; they're parsing every word for hints about liquidity and economic outlook. A hawkish tilt could spook the market, while dovish signals might be the rocket fuel Bitcoin needs to smash through resistance.

Market Mechanics at Play

Technical charts show consolidation after a fierce rally. The $93,000 level has emerged as a major battleground between bulls and bears. On-chain data reveals large holders are accumulating, but leveraged positions are stretched thin—setting the stage for volatility.

The Macro Crossroads

Cryptocurrency no longer trades in a vacuum. It's now a high-beta play on global liquidity. The Fed's decision doesn't just affect Treasury yields; it dictates risk appetite across every speculative asset class. Sometimes, the most important chart to watch isn't a candlestick pattern—it's a central banker's speech.

Breakout or Bust?

Prepare for fireworks. Either the $93,000 resistance crumbles, propelling BTC toward six figures, or profit-taking sweeps through the market. The only guarantee? Someone will write a detailed post-mortem explaining exactly why the obvious outcome was inevitable—after it happens.

Market participants are closely watching the Federal Reserve’s upcoming rate decision, which is expected to influence liquidity and risk appetite. Historical data show that Bitcoin often reacts sharply to Fed policy changes, with past cycles triggering corrections of up to 15% following unexpected moves.

Current Price Action: Consolidation Near Resistance

Following an early-December dip to roughly $84,000, bitcoin has rebounded to just under $93,000. According to Matrixport analysts, BTC appears likely to remain range-bound until clarity emerges from the Fed. Technical charts indicate that the $93,000–$94,000 level has acted as strong resistance multiple times since April, with volume declining near this zone. Analysts at FastBull note that this consolidation reflects uncertainty among traders, who are balancing dip-buying strategies against potential macro risks.

BTC hovers NEAR $93K resistance, eyeing a potential rally to $100K or a pullback to $90K. Source: @TedPillows via X

From a technical perspective, the resistance zone aligns with prior multi-month highs. Using volume profile and moving averages, traders often observe reduced liquidity at these levels, making breakouts more challenging without a strong catalyst. BTC’s recovery to around $92,949 in the past 24 hours illustrates the tug-of-war between buyers and sellers.

Fed Policy in the Spotlight: Potential Catalyst or Risk

Market expectations currently price in a 25-basis-point rate cut, according to futures data aggregated by AInvest. Historically, Bitcoin responds positively when real yields fall and liquidity conditions improve, so a dovish signal from Fed Chair Jerome Powell could reinforce this pattern. However, economists at Standard Chartered warn that emphasizing 2026 inflation risks or a cautious macro outlook could pressure Bitcoin in the short term, potentially driving it below $90,000.

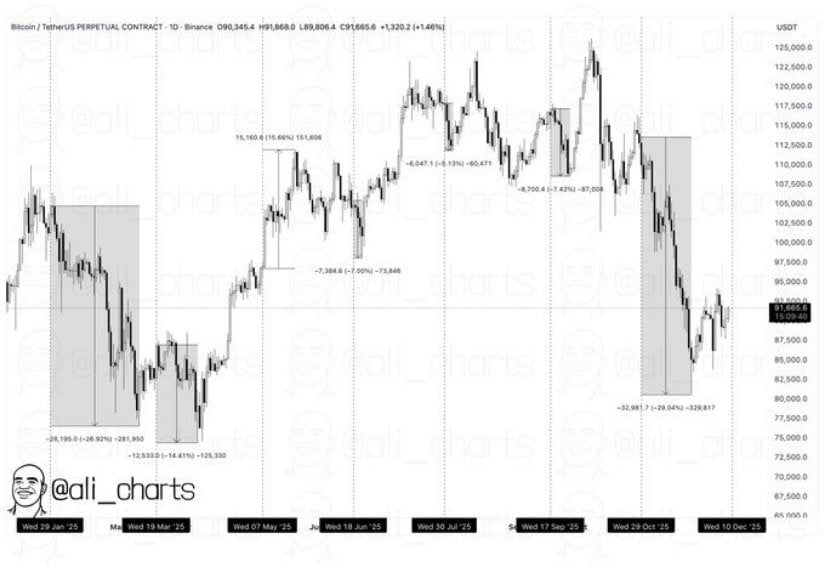

Six of seven FOMC meetings this year triggered $BTC corrections, with only one sparking a short-term rally. Source: @ali_charts via X

A trading note from DailyForex suggests that a daily close above $93,000 could pave the way to $105,000, while a drop toward $85,000 may act as a critical stop-loss level for risk-conscious traders. The divergence in forecasts reflects different assumptions: some models rely on technical momentum and past FOMC reactions, while others factor in institutional flows, ETF inflows, and macro liquidity trends.

Mixed Views: ETF Inflows and Institutional Demand

Institutional sentiment is currently mixed. Standard Chartered recently cut its year-end 2025 Bitcoin target by half, citing weak institutional demand and declining corporate treasury interest. Conversely, analysts at JPMorgan project BTC could reach $170,000 over the next 6–12 months, based on a volatility-adjusted valuation model that treats Bitcoin as a digital alternative to gold.

Bitcoin is in a range season; it warns $101K could be a FOMO trap but leaves room for a potential Christmas rally. Source: Merlia_key on TradingView

This disparity underscores the importance of monitoring ETF inflows, corporate holdings, and liquidity conditions. Sustained buying from institutional investors or strong demand for Bitcoin ETFs could provide the momentum needed to break above the current range. Conversely, muted flows or macro uncertainty could limit upside potential.

What to Watch: Key Price Levels and Market Signals

-

Resistance Zone: $93,000–$94,000. A clean breakout may signal a rally toward $100,000 or higher.

-

Support Levels: $90,000 is the first key support; $85,000 provides a deeper safety net.

-

Macro Catalyst: Upcoming Fed rate decision and commentary on 2026 monetary policy, including potential balance sheet expansion or easing signals.

-

Institutional Flows: Renewed ETF inflows or corporate Bitcoin accumulation could reinforce upward momentum.

-

Volatility Outlook: Implied volatility remains moderate, suggesting potential for consolidation. Sudden macro or on-chain triggers could increase price swings.

Traders should watch these levels closely, as short-term movements may offer insights into broader market direction.

Final Thoughts

Bitcoin remains in a delicate balance around $92,000–$93,000. The next few days are critical: a dovish Fed outcome could lift BTC toward $100,000, while hawkish signals or weak institutional participation may push it back toward $90,000.

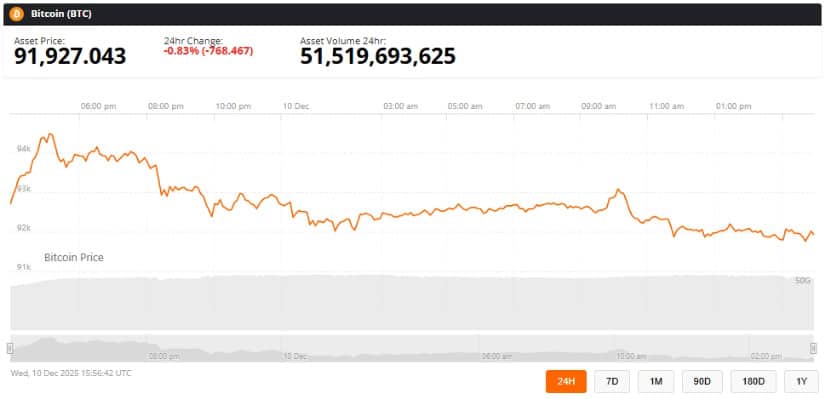

Bitcoin was trading at around 91,927, down 0.83% in the last 24 hours at press time. Source: Bitcoin price via Brave New Coin

Historically, Bitcoin has struggled to sustain breakouts during periods of elevated yields and low liquidity. Today, traders and investors must monitor resistance and support zones, Fed communications, and institutional flows to interpret potential market moves.