Australia’s Regulator Grants Major Relief to Digital Asset Companies: A Watershed Moment for Crypto Down Under

Australia's financial watchdog just threw digital asset firms a lifeline—and the industry is breathing a collective sigh of relief. The move signals a dramatic shift from regulatory skepticism to pragmatic engagement, potentially unlocking billions in stifled capital.

Cutting Through the Red Tape

The relief package isn't just a minor adjustment; it's a strategic bypass of legacy compliance hurdles that have choked innovation for years. By streamlining licensing and operational requirements, the regulator effectively acknowledges that the old rulebook doesn't fit new technology. It's a rare case of bureaucracy moving faster than the market it oversees.

What This Means for the Market

Expect a surge in institutional activity. Local exchanges and custody providers can now operate with clearer guidelines, reducing the legal gray area that has kept traditional finance on the sidelines. This isn't just about survival for crypto firms—it's about legitimizing an entire asset class in one of the world's most developed economies. The timing is impeccable, coinciding with a global scramble for clear digital asset frameworks.

The Global Domino Effect

Australia's decision doesn't exist in a vacuum. It pressures neighboring financial hubs in Asia to accelerate their own regulatory clarity or risk losing capital and talent. Watch for similar announcements from Singapore, Hong Kong, and Japan in the coming months as the regulatory race heats up. It's a classic case of competitive liberalization—where the fear of being left behind is a stronger motivator than the desire to lead.

The Fine Print and the Future

Of course, the relief comes with strings attached. Enhanced reporting, stricter consumer protection measures, and mandatory audits are likely part of the bargain—the regulator's version of "trust, but verify." For an industry accustomed to moving fast and breaking things, this structured oversight might feel restrictive, but it's the price of admission to the mainstream financial system. And let's be honest—after watching traditional finance's recent escapades, a little extra scrutiny hardly seems unreasonable.

The bottom line? Australia just made it significantly cheaper and easier to build a compliant crypto business. For an industry perpetually battling regulatory headwinds, that's not just relief—it's rocket fuel. Now we wait to see if the market's response justifies the regulator's gamble, or if it becomes another case of building a beautiful highway for ghost cars. After all, in finance, the most expensive infrastructure often gets built just before the traffic disappears.

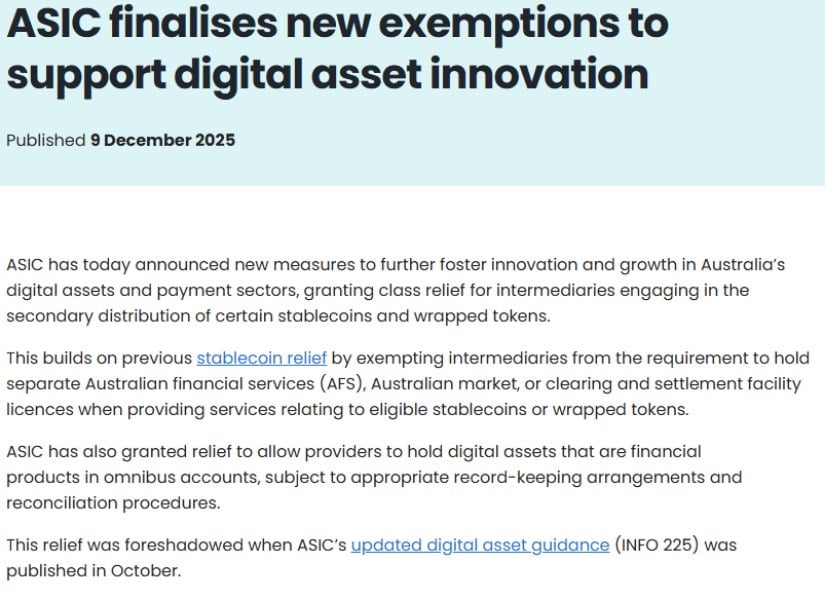

The Australian Securities and Investments Commission (ASIC) announced new measures on December 9, 2025, that will ease regulatory burdens while companies transition to comprehensive licensing requirements.

The exemptions cover stablecoin distributors, wrapped token intermediaries, and digital asset custodians. This regulatory relief comes with a clear deadline – companies have until June 30, 2026, to secure proper licenses before the temporary measures expire.

New Exemptions Target Key Digital Asset Services

ASIC’s latest relief package focuses on removing licensing barriers for specific crypto activities. Companies that distribute certain stablecoins and wrapped tokens no longer need separate Australian Financial Services licenses, market licenses, or clearing and settlement facility licenses during the transition period.

The regulator also approved omnibus account structures for digital asset custody. This change allows providers to hold multiple clients’ digital assets in pooled accounts, similar to traditional finance practices. Companies must maintain detailed records and reconciliation procedures to qualify for this relief.

Source: @asic.gov.au

According to ASIC’s announcement, these measures build on previous stablecoin relief by expanding eligibility criteria. The regulator responded to industry feedback by including stablecoins and wrapped tokens whose issuers have applied for licensing, not just those already fully licensed.

Industry Consultation Shapes Final Rules

ASIC’s approach reflects extensive industry engagement. The regulator received five submissions during its consultation period, with companies largely supporting the proposed relief measures. Industry participants requested clearer definitions and broader eligibility criteria aligned with global regulatory approaches.

The final rules address these concerns by expanding eligible products and providing additional guidance. ASIC also chose to keep record-keeping requirements principles-based rather than prescriptive, giving companies flexibility in implementation.

Commissioner Alan Kirkland emphasized the balance between innovation and protection: “Distributed ledger technology and tokenisation are reshaping global finance. ASIC’s guidance provides the regulatory clarity that firms have been calling for to innovate confidently in Australia.”

Broader Digital Asset Framework Taking Shape

These exemptions operate within Australia’s larger digital asset regulatory transformation. The government introduced the Corporations Amendment Bill on November 26, 2025, creating comprehensive rules for digital asset platforms and custody services.

The new legislation defines digital asset platforms and tokenized custody platforms as financial products. Operators must obtain Australian Financial Services licenses and comply with efficiency, honesty, and fairness standards. The framework includes exemptions for small-scale platforms processing under $5,000 per customer or $10 million in total volume annually.

ASIC clarified that stablecoins, wrapped tokens, tokenized securities, and digital asset wallets are financial products under current law. This classification means providers need proper licensing to operate legally in Australia.

No-Action Period Provides Transition Time

The regulator granted a sector-wide no-action position through June 30, 2026. During this period, ASIC will not take enforcement action against unlicensed providers making genuine efforts to comply with new requirements.

Companies must meet specific conditions to benefit from this relief. They need Australian Financial Complaints Authority membership and must register as foreign companies if not based in Australia. The no-action position excludes crypto lending products and derivatives other than wrapped tokens.

ASIC stated it will consider this transition period when reviewing past conduct but will continue acting against serious misconduct causing significant consumer harm. This approach balances regulatory flexibility with consumer protection priorities.

Industry experts note the importance of this transition period. Regulatory developments across multiple jurisdictions show governments working to create comprehensive digital asset frameworks while supporting innovation.

Global Competition Drives Regulatory Clarity

Australia’s moves come as international competition for crypto business intensifies. Other countries are developing their own digital asset frameworks, creating pressure for clear and competitive regulations.

The stablecoin market has become crucial infrastructure for digital finance, enabling cross-border payments and trading. Australia’s framework aims to capture this growing market while maintaining strong consumer protections.

Singapore, the European Union, and other jurisdictions have implemented comprehensive crypto regulations. Australia’s temporary relief measures help local companies compete while lawmakers finalize permanent rules.

The regulator emphasized that licensing ensures consumers receive full legal protections while enabling enforcement against harmful practices. This approach reflects global trends toward bringing digital assets under traditional financial services oversight.

The Road Forward

Australia’s digital asset exemptions represent a carefully calibrated approach to crypto regulation. The measures provide immediate relief while establishing clear expectations for permanent compliance.

The success of this framework will depend on industry uptake and effective implementation. Companies have until June 30, 2026, to secure proper licensing, providing adequate time for compliance without stifling innovation.

ASIC indicated the framework could expand as more stablecoin and wrapped token issuers obtain licenses. This suggests potential for significant growth in Australia’s regulated digital asset sector as the framework matures.

Bottom Line: Temporary Bridge to Permanent Framework

Australia’s regulatory exemptions offer digital asset companies breathing room while comprehensive rules take effect. The time-limited relief demonstrates how regulators can support innovation without compromising consumer protection – a model other countries may follow as crypto regulation evolves globally.