Bitcoin’s Next Move: Can $90K Be Reclaimed After an $88K Bounce and $86M Whale Sell-Off?

Bitcoin just staged a dramatic recovery, bouncing off a key level and surging toward $88,000. The move injected fresh optimism into the market, but a shadow looms: major holders, the so-called 'whales,' cashed out a staggering $86 million in profits on the upswing.

The Whale Exodus: A Bullish Signal or a Warning?

That massive profit-taking event is the story within the story. On one hand, it's classic market behavior—locking in gains after a strong run. On the other, it raises the million-dollar question: are the smartest hands in the room signaling a local top, or simply rebalancing their portfolios for the next leg up? It's the kind of move that makes retail traders nervously check their screens while Wall Street analysts nod sagely—a tale as old as trading itself.

The $90,000 Threshold: A Psychological Battleground

All eyes are now fixed on the $90,000 resistance level. Reclaiming it isn't just about a price point; it's about momentum and market psychology. A clean break could trigger a wave of FOMO buying, pushing BTC into uncharted territory. Failure here, however, might see the asset consolidate or even retrace, testing the resolve of recent buyers. The market's next narrative hinges on this clash.

Looking Ahead: Volatility is the Only Guarantee

Forget crystal balls. The immediate future promises heightened volatility as the market digests the whale activity and tests key levels. Traders are buckling up, knowing that in crypto, the only sure bet is a wild ride. One cynical finance jab? It's just another day where the 'long-term vision' of hodlers meets the 'short-term reality' of traders looking to pay for their next yacht. The dance continues.

Both technical and on-chain data highlight a mixed outlook—whale profit-taking, liquidity clusters around $90K, and cooling momentum indicators now define Bitcoin’s current setup. This combination creates a highly reactive environment where both bullish continuation and another pullback remain equally plausible in the days ahead.

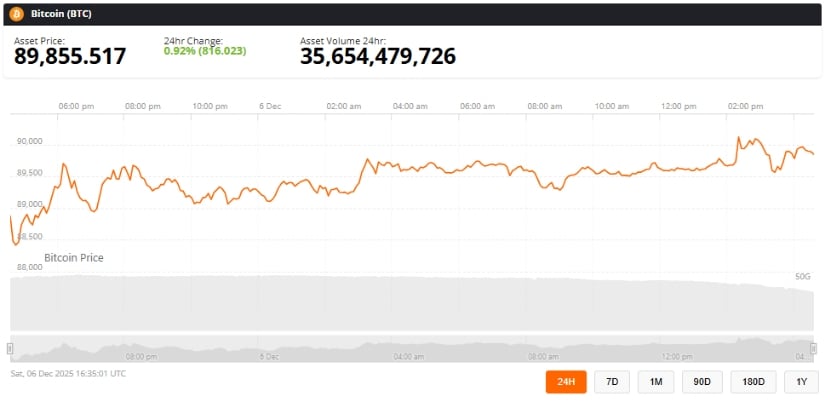

Bitcoin Price Today

Bitcoin (BTC) is trading at $89,855, up 0.92% over the last 24 hours, with $35.65 billion in trading volume. This modest recovery follows a clean retest of the $88,000 support zone—an area that has consistently acted as a liquidity base since early Q2.

Bitcoin (BTC) bounced off $88,000 but must reclaim $90,000 to sustain upside, or it could drop back toward $87,000–$88,000. Source: @TedPillows via X

After reviewing short-term order FLOW and the 1-hour structure, BTC shows repeated absorption of sell pressure around 88,200, suggesting sellers are losing momentum at this level. However, the $90,000 region continues to reject multiple intraday attempts, signaling strong resting sell orders and a lack of aggressive buyer follow-through.

Crypto trader Ted (@TedPillows) remarked that BTC “retested the $88,000 level and then had a bounce-back,” noting that reclaiming $90K is critical for any sustained upside. A failure to clear this zone commonly sends the price back toward $87,000–$88,000, which aligns with the highest-density liquidity cluster on the current liquidation heatmap.

On the daily chart, Binance price action confirms a clear supply wall NEAR $90K. A decisive breakout could unlock short-term upside toward $95,000, but without increasing spot demand or ETF inflows, consolidation remains the more probable short-term scenario.

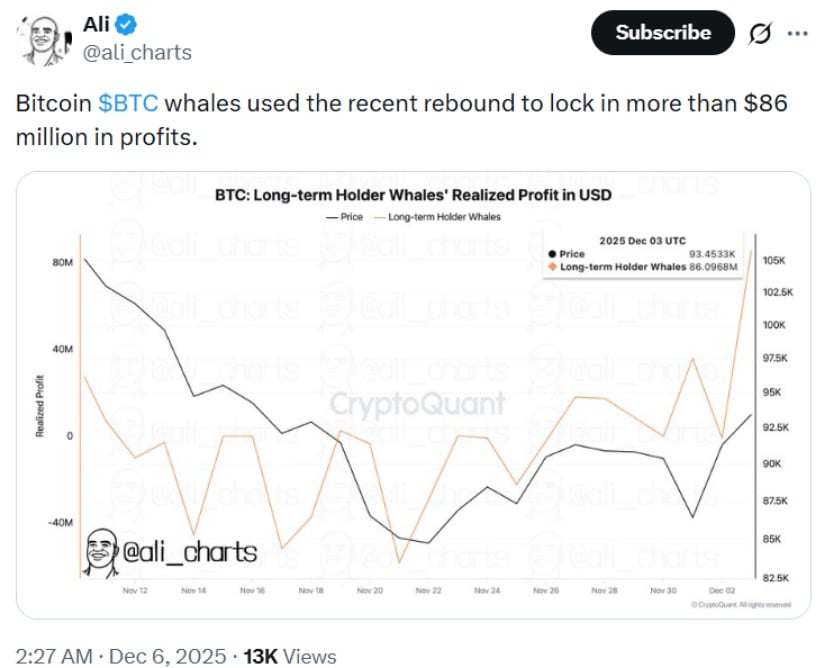

Whales Realize $86M in Profits

On-chain data from CryptoQuant shows a sharp spike in realized profits on December 3, indicating that whales took advantage of BTC’s bounce to secure more than $86 million in gains. This behavior mirrors a well-documented pattern in Bitcoin cycles where long-term holders sell into strength during high-volatility phases.

Bitcoin whales cashed out over $86 million during the recent rebound, highlighting major profit-taking at current price levels. Source: @ali_charts via X

While this activity can briefly suppress bullish momentum, it does not necessarily signal a trend reversal. Instead, these realized profit spikes often mark liquidity resets, where the market digests large moves before establishing a new direction.

Historically, whale profit-taking—especially near local highs—has preceded short-term corrections but rarely disrupts higher-timeframe structure unless accompanied by declining ETF inflows or weakening spot demand. Analysts also note that the recent spike occurred as BTC tapped the $93,500 region, consistent with profit zones observed earlier in Q3.

Technical Indicators Suggest a Possible Bounce

From a technical standpoint, intraday charts show a mixed, but slightly optimistic, structure. TradingView analyst CryptoAnalystSignal describes the current setup as a descending channel on the 1-hour timeframe, with price touching the lower boundary and preparing for a potential breakout.

Bitcoin is bouncing off $88,200 within a 1-hour descending channel, signaling a potential upward MOVE toward the upper boundary. Source: CryptoAnalystSignal on TradingView

Key insights from chart analysis:

-

RSI is hovering at lower levels, reflecting seller fatigue and improving bounce potential.

-

The 88,200 support zone continues to generate consistent reactions—an early sign that buyers are defending this level with moderate aggression.

-

BTC is approaching the 100-period moving average, a line that has frequently served as a magnet during short-term stabilization phases.

How Bitcoin Could React Next

Bitcoin’s next move depends heavily on its ability to reclaim the $90,000 resistance. A confirmed breakout would indicate renewed buyer aggression and could attract momentum traders watching BTC today, bitcoin technical analysis, and short-term forecast models.

However, failure to break through could send BTC back toward the $87,000–$88,000 area, where liquidity remains dense. These zones historically offer both rebound opportunities and breakdown risk depending on ETF flows, broader risk sentiment, and how much spot demand enters the market.

For now, Bitcoin remains in a neutral-but-fragile structure—supported by strong demand at $88K but restricted by equally strong supply near $90K.

Final Thoughts

Bitcoin’s rebound from the $88,000 support zone highlights active buyer interest, but whale profit-taking and persistent resistance at $90K continue to limit upside momentum. Until BTC can reclaim this level with conviction, the market remains locked in a tight mid-range structure.

Bitcoin was trading at around 89,855, up 0.92% in the last 24 hours at press time. Source: Bitcoin price via Brave New Coin

With traders watching ETF flows, liquidity maps, and broader Bitcoin price prediction trends, a decisive break above $90K could reset bullish momentum. Conversely, continued rejection may trigger another revisit to the lower support band, shaping Bitcoin’s short-term trajectory in the days ahead.