XRP Price Today: Can XRP Hold Its Rebound From $2.02 as Ripple Integrates the Token Into $12.5T Enterprise Systems?

XRP just bounced off $2.02—now the real test begins. Ripple's latest play isn't about retail hype; it's wiring the token directly into the arteries of global enterprise finance. We're talking about a $12.5 trillion market.

The Enterprise On-Ramp

Forget speculative trading. This integration is about utility on an industrial scale. Ripple is embedding XRP into payment and settlement systems used by massive institutions—the kind that move money for multinationals and banks. It’s a direct bid for legitimacy and volume that doesn't rely on crypto Twitter sentiment.

The $2.02 Litmus Test

That rebound level is now critical support. Technical traders are watching it like hawks. A hold above it suggests the market is pricing in this new enterprise utility. A break below? That could signal traders are still skeptical—viewing the news as just another corporate announcement in a sector that's seen plenty of promises. After all, in traditional finance, a 'strategic partnership' often means a press release and not much else.

Beyond the Price Chart

This move cuts out intermediaries and aims to bypass legacy settlement delays. If adoption follows the announcement, the resulting transaction flow could fundamentally alter XRP's supply dynamics and demand profile. It shifts the narrative from 'digital asset' to 'infrastructure tool.'

The gamble is clear: can real-world utility finally decouple a major crypto's price from the whims of the broader market? Or will XRP get dragged down in the next wave of fear, proving that even a $12.5 trillion opportunity can't outrun crypto's collective mood swings? The charts will tell the story—one cynical trader at a time.

The digital asset, part of Ripple’s ecosystem, is gaining attention as it becomes increasingly integrated into large-scale enterprise treasury systems.

TD Sequential Buy Signal Spurs Short-Term Rebound

Analysts tracking XRP’s price movements noted that the TD Sequential “9” buy signal on the daily chart suggests potential exhaustion in recent downtrends. This technical indicator, developed by Tom DeMark, flags moments when consecutive closes may indicate a reversal is imminent.

XRP shows a bullish reversal signal, marked as a buy by the TD Sequential indicator. Source: @ali_charts via X

Crypto analyst Ali (@ali_charts) highlighted, “$XRP is a buy according to the TD Sequential. A reversal from $2.18 could target $2.44–$2.85 by late December 2025.” On-chain metrics support this view, revealing that whale holdings have reached a seven-year high of 48 billion tokens, even as the number of large wallets has declined.

Short-term traders are watching 4-hour charts closely, expecting potential price movement within the next 20 hours. While bullish signals are clear, experts caution that volatile market conditions may affect price stability.

Ripple Integrates XRP into Enterprise Treasury Systems

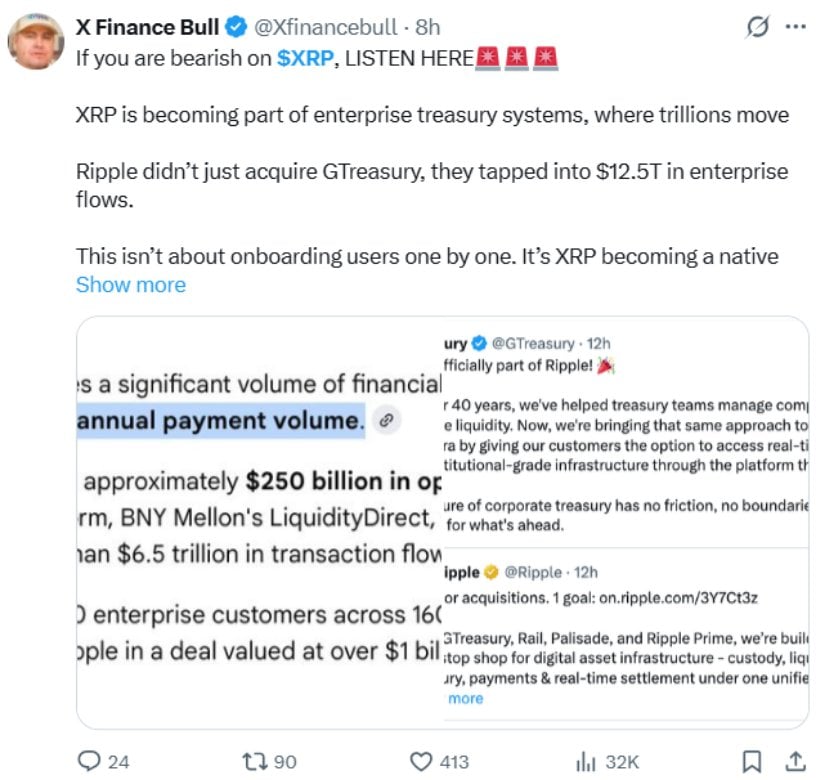

Beyond technical signals, XRP is increasingly positioned as a core infrastructure tool for high-volume financial operations. Following Ripple’s acquisition of GTreasury, the cryptocurrency is now embedded in enterprise treasury systems managing $12.5 trillion in annual flows.

XRP is evolving from a crypto asset to a core enterprise payment rail, handling $12.5T in global treasury flows. Source: @Xfinancebull via X

According to X Finance Bull (@Xfinancebull), “XRP is becoming part of enterprise treasury systems, where trillions move. This isn’t about onboarding users one by one. It’s XRP becoming a native infrastructure for high-volume, cross-border operations.”

GTreasury integrations extend to systems like BNY Mellon’s LiquidityDirect, supporting over $6.5 trillion in transaction flows annually and serving more than 1,000 multinational clients across 160 countries. This strategic MOVE positions XRP beyond retail speculation, emphasizing its utility in payroll, supply chains, liquidity management, and real-time settlement.

Price Action and Key Levels

Currently, XRP is trading around $2.06, after two unsuccessful attempts to surpass the $2.20 resistance this week. Market analysts note that a sustained bounce from the $2.02 support level could propel XRP back to $2.20, with a potential breakout to $2.26 if momentum continues.

XRP trades at $2.06, testing $2.02 support, with the potential to reach $2.20–$2.26 if bullish momentum holds. Source: BeInCrypto via X

Conversely, a failure to maintain support at $2.02 may place the $2.00 level at risk, with further declines toward $1.94 or $1.85 possible. TradingView contributor BeInCrypto emphasized the importance of monitoring these key support and resistance zones: “Price stability NEAR $2.02 is critical for XRP to maintain its bullish outlook.”

Final Thoughts

XRP’s recent rebound from $2.02, supported by the TD Sequential buy signal, highlights a potential short-term bullish trend. Ripple’s integration of XRP into large-scale enterprise treasury systems further strengthens the cryptocurrency’s role beyond retail speculation, positioning it as a key infrastructure for high-volume, cross-border financial flows.

While the crypto community remains divided, with some cautious about price stagnation below $3, Ripple’s institutional adoption and upcoming developments—such as XRP ETFs and ongoing SEC regulatory updates—could play a decisive role in shaping the asset’s future performance. Investors and traders are advised to monitor key support and resistance levels closely, as well as broader market and regulatory trends.