Ethereum’s Fusaka Upgrade Ignites Rally: Can ETH Price Smash Through $4,800?

Market confidence surges as Ethereum's latest upgrade goes live, pushing the digital asset to new yearly highs. The question on every trader's screen isn't 'if' but 'when' for the next major price barrier.

The Technical Catalyst

Fusaka isn't just another network tweak—it's a foundational shift. The upgrade directly tackles long-standing bottlenecks, slashing transaction finality times and cutting costs for developers building the next wave of decentralized apps. This isn't about promises; it's about measurable on-chain improvement that institutional money can't ignore.

Breaking the Psychological Ceiling

All eyes are locked on the $4,800 resistance level. A clean break above it wouldn't just be another milestone—it would fling open the doors to a price discovery phase not seen since the last bull run. The charts show consolidation at elevated levels, a classic sign of strength gathering before a potential breakout. Forget the hype; the liquidity and volume patterns are telling the real story.

The Road Ahead

While the upgrade provides rocket fuel, macro winds still matter. The path to $4,800 and beyond will hinge on sustained developer activity post-Fusaka and whether traditional finance finally stops treating crypto like a speculative side-bet and starts seeing it as the infrastructure play it truly is. One cynical note for the finance veterans: the same institutions that once called it a 'fraud' are now quietly building their biggest positions—some principles are always for sale at the right price.

Ethereum's ecosystem isn't just waiting for a price target. It's building the value to justify it.

The major altcoin recently bounced NEAR $3,100 following the upgrade, which aims to improve scalability, reduce Layer-2 fees, and enhance network efficiency. Analysts suggest these technical improvements could set the stage for renewed momentum in both retail and institutional markets.

Current State: ETH Holds Near $3,100 as Upgrade Boosts Confidence

After a period of consolidation, ethereum (ETH) recently bounced near the $3,100 mark, following the activation of a major network upgrade. The so-called Fusaka Upgrade—Ethereum’s second significant hard fork of 2025—went live on December 3. Among its key changes is a new data‑availability system called PeerDAS, which reduces the burden on validators by letting them process smaller data samples rather than full data blobs.

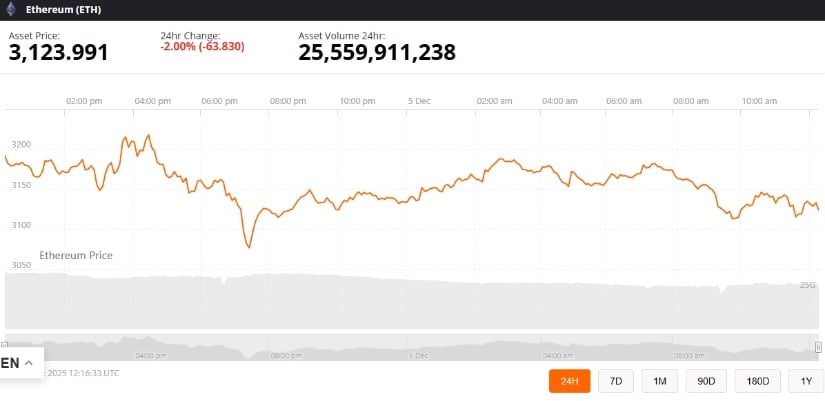

Ethereum was trading at around 3,123.99, down 2.00% in the last 24 hours at press time. Source: ethereum price via Brave New Coin

The ETH price climbed about 4.3% on the day of the upgrade, briefly trading around $3,200. This uptick reflects renewed optimism among some holders and traders that the network’s improved scalability and lower Layer‑2 fees could support stronger demand.

What Fusaka Means for Ethereum’s Long-Term Outlook

The Fusaka upgrade addresses one of Ethereum’s long-standing bottlenecks: scalability. By enabling rollups and Layer‑2 networks to handle data more efficiently, lower fees and smoother transaction flows become more feasible. That, in turn, could increase on‑chain activity and attract new users and developers.

Ethereum (ETH) has rebounded to around $3.2K following the Fusaka upgrade, forming a long-term ascending triangle and double bottom that signal a potentially meaningful bullish reversal. Source: TheCryptoFire on TradingView

Analysts writing in the wake of Fusaka suggest that if Layer‑2 adoption accelerates and ecosystem activity picks up, ETH could see substantial upside. Some projections point to a range of $7,000–$12,000+ by end‑2026, as improved fee economics and broader network utility begin to materialize.

The Ambitious Long-Term Forecast: $62,000 ETH?

Despite recent strength, ETH remains far below its more aggressive long-term targets. One of the most talked‑about predictions comes from Tom Lee, who has argued that under ideal conditions, ETH could one day reach $62,000 per token.

Ali notes that Ethereum, currently around $3,114, must first clear $4,800, $6,800, and $8,800 before potentially reaching Tom Lee’s $62,000 target. Source: Ali Martinez via X

Lee’s case hinges on two main pillars: a long consolidation base built over several years (since around 2018) and a potential reversion of the ETH/BTC ratio to historical highs—possibly implying a structural shift in how capital flows between major crypto assets.

But even Lee acknowledges that reaching such lofty levels WOULD likely take many years. The $62,000 target is more of a long-term “bull case” than a short-term projection, assuming widespread adoption, macro tailwinds, and continued growth of Ethereum’s ecosystem.

Final Thoughts

Ethereum’s recent Fusaka upgrade marks a significant technical milestone, improving scalability and lowering Layer‑2 costs—changes that could underpin a stronger network and renewed interest. Short-term momentum suggests a modest rebound, but for ETH to push toward $4,800—and beyond toward dream scenarios like $62,000—a combination of structural growth, ecosystem adoption, macro tailwinds, and investor confidence will be essential.

While long‑term bull cases remain alluring, the path forward is anything but guaranteed. For now, ETH trades in a phase of consolidation and cautious optimism.