Solana Price Prediction: SOL Nears Critical Trendline Support - Bulls Target $165 Rebound in 2025

Solana's price action hits a decisive inflection point—technical patterns suggest a make-or-break moment for the fifth-largest cryptocurrency.

Key Support Holds the Line

SOL currently tests a major ascending trendline that's defined its recovery since early 2025. This isn't just another dip—it's the level where institutional algos and retail traders both place their bets. Break below, and the narrative shifts from accumulation to distribution.

The $165 Target: More Than Just a Number

That rebound target represents more than a 25% climb from current levels. It's the gateway to retesting yearly highs and potentially challenging its all-time peak. The path there requires SOL to first reclaim its 50-day moving average—a feat that would trigger a cascade of automated buying across derivatives platforms.

Market Mechanics at Play

Options flow shows smart money accumulating December calls at the $160-165 strike range. Meanwhile, perpetual funding rates remain neutral—suggesting this isn't a leverage-fueled pump but genuine accumulation. The blockchain's metrics tell the same story: daily active addresses hover near yearly highs, and DeFi TVL continues its steady climb despite price volatility.

The Institutional Angle

Traditional finance finally gets it—or at least pretends to. Another round of ETF filings hit regulatory desks last month, with asset managers suddenly discovering Solana's "institutional-grade architecture" after ignoring it for years. Nothing like potential fees to spark financial innovation.

What Comes Next

Watch the volume profile. A bounce on declining volume spells trouble—just another dead cat bounce in crypto's endless cycle of hope and despair. But conviction buying here? That signals the market's ready to price in next year's upgrade cycle and the inevitable flood of "Solana killer" projects that somehow always end up boosting SOL's dominance.

Remember: In crypto, the most crowded trade often works until it doesn't—and right now, everyone's watching that same trendline.

Solana price is once again approaching a critical point in its market structure, with price action retesting a long-standing trendline that has repeatedly triggered strong rebounds since early 2023. As SOL trades NEAR $133, participants are closely watching whether this historical support can hold and whether bullish catalysts, including a fresh TD Sequential buy signal and rising liquidity pockets, can fuel a recovery towards $150 to $165.

The broader market is showing mixed sentiment, but Solana’s internal technicals remain active. Weekly structure, momentum indicators, and heatmap positioning all suggest a decisive MOVE is not far away. Analysts believe that reclaiming mid-range levels could reset bullish momentum, while failure to hold support risks a deeper slide.

Long-Term Trendline Support Remains Key

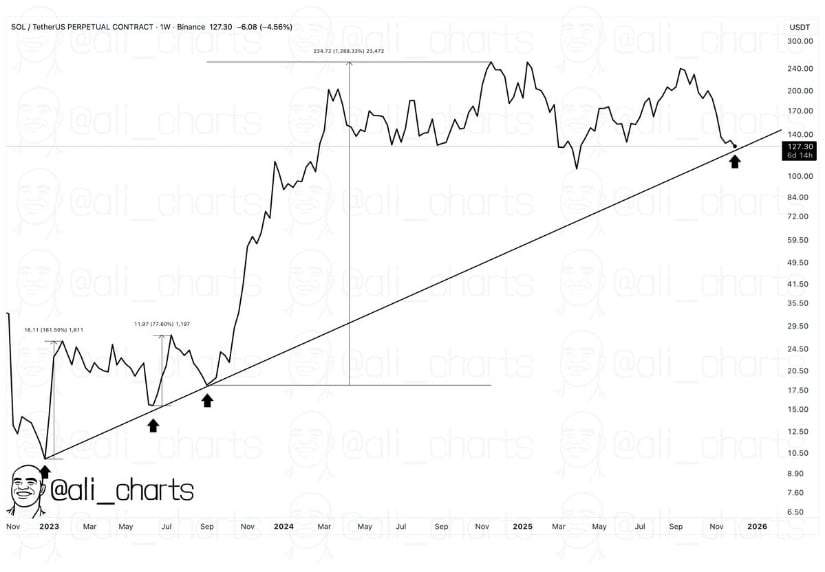

A major point of focus is the multi-year trendline that has acted as a springboard for every major rally since 2023. As highlighted in Ali Martinez’s chart, SOL has repeatedly tapped this ascending support during capitulation phases before reversing strongly. Price is testing this level again, and historically, this zone has triggered multi-week expansions.

Solana retests a multi-year trendline that has sparked major rebounds since 2023. Source: Ali Martinez via X

A clean hold above this ascending structure keeps the bullish macro bias intact. Losing it, however, exposes SOL to the next major volume pocket closer to $100, a level mentioned across several technical outlooks.

TD Sequential Flashes a Fresh Buy Signal on the Weekly Chart

Another bullish element comes from the TD Sequential indicator, which has been highly accurate in capturing trend reversals for solana since 2023. According to Ali’s analysis, previous “1” and “9” signals on the weekly have aligned perfectly with local bottoms.

TD Sequential prints a fresh weekly buy signal for SOL, historically marking reversal zones. Source: Ali Martinez via X

The indicator is flashing a new buy signal, suggesting accumulation may be underway beneath the surface even as price consolidates near support. If this signal holds, reclaiming the $145 to $150 region becomes the first bullish trigger.

OBV Compression Signals a Potential Double Bottom Setup

Volume structure is becoming an important factor. IncomeSharks noted that the On-Balance Volume (OBV) is trying to stabilize near a major support shelf, while price itself hovers above a crucial demand block.

OBV and price structure attempt to stabilize, increasing chances of a double-bottom formation. Source: IncomeSharks via X

This combination often precedes double-bottom formations, especially when both price and OBV begin flattening simultaneously. The bullish case relies on a successful defense of $133, which WOULD open the door for a retest of $150 and potentially $165.

Liquidity Heatmaps Suggest a Pullback Before Expansion

Heatmap data from 5.0Trading shows a dense band of liquidation clusters stacked above current price levels, particularly towards the $150–$165 region. Markets typically gravitate toward these pockets, especially after prolonged downtrends. This clustering reinforces the idea that once SOL reclaims momentum, upside targets remain magnetized.

Large liquidity clusters near $150–$165 signal where price may gravitate next. Source: 5_0Trading via X

Macro Channel Points Much Higher Targets

Despite all the short-term noise, the long-term structure for Solana price is still extremely bullish. Trader Tardigrade highlighted a broader ascending mid-term channel that has guided SOL for over 1,200 days. SOL Solana price is currently in the lowest sub-channel zone, an area where previous rallies have originated. According to the analysis, any momentum-driven breakout could carry Solana price towards the mid-range zone first, with higher targets extended towards $1,500 in the far macro structure.

Solana trades inside the bottom sub-channel of a multi-year ascending structure. Source: TATrader_Alan via X

Final Thoughts

Solana’s recent correction brings it back to one of its most critical technical zones, a trendline that has historically launched major rallies. With price hovering around $133, a key support level, traders are watching for either a double-bottom confirmation or a breakdown towards $100.

Bullish catalysts include the weekly TD Sequential buy signal, improving OBV behavior, and strong liquidity pockets above current price. Combined, these raise the probability of a rebound towards $150 to $165 in the near term.

Solana price prediction models for 2025 remain cautiously optimistic as long as the macro trendline holds. While the risk of deeper downside persists, SOL’s multi-year structure still favors recovery attempts when major supports are defended.