BNB Shatters Resistance: Analysts Predict Explosive Momentum Ahead in New Week

Binance Coin just pulled off a textbook breakout. The kind that makes chart watchers sit up straight and portfolio managers quietly recalculate their quarterly projections. Forget sideways drift—this is momentum catching fire.

The Technical Blueprint

Pattern recognition software is flashing green. BNB didn't just nudge past a key level; it cleared it with the kind of volume that suggests more than just speculative day-trading. This isn't a fluke. It's a signal that the underlying buy pressure—often a mix of ecosystem utility and, let's be honest, pure speculative fervor—has reached a tipping point. The charts are now pointing toward higher highs, assuming the broader market doesn't decide to throw one of its classic tantrums.

Eyes on the Horizon

So, what's next? Analysts are mapping trajectories toward previous resistance zones. The conversation has shifted from "if" it will test higher levels to "how fast." Each successful hold above the breakout point adds fuel, turning former ceilings into floors—a basic market mechanic that somehow still surprises traditional finance every single time. Watch for consolidation here; a healthy pause that builds energy for the next leg up.

The real driver? It's a blend. The relentless expansion of the BNB Chain ecosystem creates constant, real-world demand sinks for the token. Meanwhile, the perpetual motion machine of crypto trading does what it does best. This breakout might just be the starter's pistol for a week where BNB reminds everyone it's more than just an exchange token—it's a market force in its own right. Of course, in crypto, a 'classic breakout' can sometimes just be the prelude to a classic rug-pull, but let's stay optimistic for now.

With price reclaiming key support zones and targeting major resistance levels, the market structure is turning positive. Current consolidation suggests buyers are preparing for another push, making its upcoming moves crucial for confirming a sustained trend reversal.

Market Structure Shows Breakout Conditions

BNB is showing a classic breakout pattern after a prolonged downtrend, with price action moving above a long-standing descending trendline. This shift follows a series of lower highs that previously maintained bearish control. The new movement above the trendline suggests a change in pressure, with buyers stepping in at a previously tested demand zone. The structure has created a more favorable environment for upward continuation if the current levels hold.

The market has also formed a series of higher lows, an early indication that buyers are building strength. This development occurs as Binance holds above the mid-range level around 822, a zone that has repeatedly served as a stabilizing point during past corrections. Maintaining this area enables the chart to retain a constructive structure while reducing the risk of a return to deeper support zones.

Analysts Track Key Resistance Levels for Further Movement

Analyst commentary points to the 898 price region as an area of interest. This level has acted as a challenging barrier in previous attempts, often triggering pauses in upward continuation. A move above 898 WOULD place BNB in a favorable position to extend toward the next resistance band near the 920 level, which previously reacted to similar upward pushes.

BNBUSD Chart | Source:x

Another focus remains on the support at 822, with analysts noting that losing this level may expose the price to the broader liquidity area NEAR 800. Past chart behavior at 800 shows multiple wicks and reversals, indicating market interest at lower ranges. Analysts state that the movement between these zones may determine the next directional bias for the asset, especially as the week begins.

Short-Term Volatility Within a Narrow Range

The asset’s recent 4-hour chart shows the altcoin moving within a narrow window between 872 and 880. The price has displayed intermittent volatility, with several lower wicks forming during intraday dips. These wicks indicate buyer activity at lower points, though the overall candlestick formation suggests consolidation as the market waits for stronger direction.

BNB Chart | Source:x

Volume remains steady without major fluctuations, signaling a balanced tug-of-war between buyers and sellers. With no major volume surges, the chart maintains a neutral tone in the near term. If buyers defend the lower boundary of the range, the asset could revisit the upper segment around 878 to 880. A break below the lower end of the range may shift the focus toward deeper supports and pause upward attempts.

Market Outlook as the New Week Begins

Binance Coin begins the week in a recovery phase supported by price stability around 825 to 865, an area known for building momentum during previous upward moves. Consistent trading above these levels suggests that market participants are attempting to establish a footing before testing higher resistances.

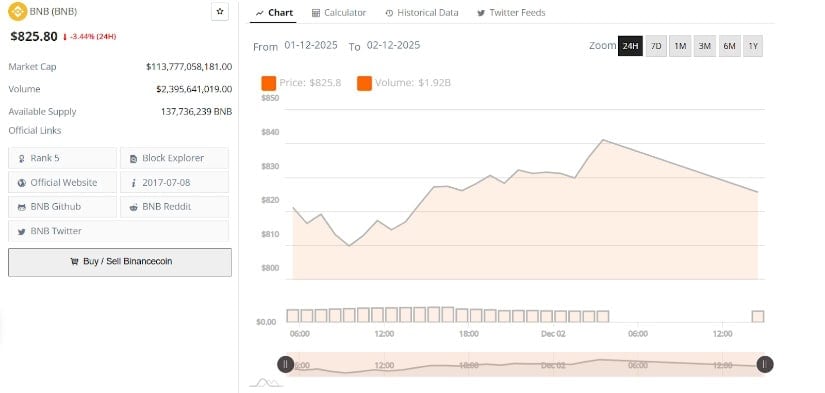

BNBUSD 24-Hr Chart | Source: BraveNewCoin

The breakout seen earlier in the chart continues to shape expectations as technical indicators align with improving structure. Analysts observe that the recent trendline break, combined with stable volume and the presence of clear target zones, creates a focused path for traders monitoring its next move. The upcoming sessions may determine whether the asset maintains the current recovery or moves back toward the lower range for another retest.