Bitcoin (BTC) Price Prediction: Short-Term Pressure Builds, But the Long-Term Path Still Points to $125K

Bitcoin's next move is a tale of two timeframes. The immediate outlook is getting squeezed, but the macro trajectory remains locked on a staggering target.

The Short-Term Squeeze

Forget smooth sailing. The charts are flashing warning signs as selling pressure mounts, testing key support levels that traders are watching like hawks. Every dip is a battle—a tug-of-war between panic and conviction that's chopping up the price action.

The $125K Horizon

Zoom out, and the noise fades. The long-term thesis hasn't budged. Analysts tracking institutional flows, adoption curves, and sheer network momentum still see a path to that elusive $125,000 price tag. It's a marathon, not a sprint—and the finish line is a number that would make a traditional portfolio manager's spreadsheet crash.

So, buckle up for volatility. The road to a six-figure Bitcoin is paved with corrections, each one a gift for those who see the bigger picture—and a nightmare for anyone trying to time the market like it's just another over-leveraged stock. Sometimes, the best financial innovation is simply holding on.

The digital asset recently declined approximately 6% to $90,400, following an $18,000 drop in November, based on TradingView and Yahoo Finance data. Analysts note that while medium-term momentum may lean bearish, key support zones and institutional interest could help stabilize the market.

Bitcoin Faces Short-Term Pressure

Bitcoin (BTC) has experienced heightened volatility in the late 2025 trading environment, influenced by both technical corrections and broader market sentiment. On December 1, 2025, BTC fell to roughly $90,400 after the November decline, according to Yahoo Finance. Analysts interpret this as a period of consolidation, where traders are reassessing positions following prior gains.

A BTC trader’s chart signals possible short-term downside amid a recent 6% drop, while long-term forecasts remain bullish. Source: Killa via x

Quantitative trader @KillaXBT, a market analyst who publishes BTC models and comparative charts, highlighted a potential medium-term correction. His chart overlays Bitcoin’s 2021 parabolic rise to $69,000 and subsequent 75% crash with the 2024 climb to $73,000, indicating possible reversal points. As he cautioned, “Don’t shoot the messenger,” reflecting the uncertainty inherent in cryptocurrency markets.

Technical Indicators Signal Weakness

Several technical measures now suggest short-term pressure on Bitcoin. Monthly charts, according to TradingView data, show signs of declining momentum and potential trend reversals. Analysts explain that such signals may indicate buyers are temporarily losing strength, though the long-term fundamentals—such as growing institutional adoption and ETF activity—remain supportive.

The BTC market also appears overbought after rapid price appreciation. In technical analysis, an oversaturated market refers to conditions in which prices have risen too quickly, increasing the likelihood of a corrective phase in the NEAR term.

Potential Medium-Term Drop Toward $55K

Some market observers suggest that BTC could test lower levels in the coming weeks. Based on the chart analysis shared by @KillaXBT, a quantitative trader focusing on derivatives and crypto modeling, a medium-term scenario could see Bitcoin reaching around $55,000 if bearish momentum continues.

BTC shows medium-term downside pressure with overbought conditions, indicating a potential test of $55K, while some traders monitor the $85K–$95K range for possible sell opportunities. Source: peterbokma on TradingView

The analyst described a potential approach for traders as a strategy for monitoring the market: selling between $85,000 and $95,000 and considering re-entry near $60,000. Analysts emphasize that these figures represent illustrative scenarios rather than direct trading instructions.

Long-Term Bullish Outlook Remains

Despite short-term pressures, Bitcoin’s long-term outlook continues to attract interest. Weekly charts, based on TradingView and CoinDCX data, show that the current correction is occurring within a broader bullish structure. Key support zones between $80,000 and $82,000, with deeper support at $76,000, may help stabilize BTC and provide a foundation for upward momentum.

The weekly BTC chart remains bullish despite a corrective pullback to key support between $76K and $82K, with the potential to retest $123K–$125K if support holds. Source: CryptoSanders9563 on TradingView

Some analysts suggest that a weekly close below $76,000 could signal increased risk toward mid-$60,000 levels, whereas maintaining support could allow BTC to retest the previous distribution band around $123,000–$125,000. Here, a distribution band refers to a price range where BTC has previously consolidated before continuing a trend.

Key Levels to Watch

BTC has been consolidating in the $85,000–$87,000 range, holding an important demand zone. Technical indicators, including RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence), show oversold conditions, while a weakening bearish divergence suggests that the short-term downtrend may be losing strength.

BTC consolidates around $86K after a 5% pullback, holding key support at $85K–$87K, with technical indicators showing oversold conditions and signs of a potential reversal. Source: MyTradingJourna on TradingView

-

Support Levels: $85,000 (swing low), $83,000 (next demand)

-

Resistance Levels: $86,500 (breakout test), $89,500–$93,500 (supply)

These ranges may help traders assess potential continuation patterns, though analysts caution that the BTC price remains sensitive to market and macroeconomic factors.

Bitcoin Price Forecast: Navigating Volatility

While short-term caution persists, the broader bitcoin community remains attentive to long-term prospects. Analysts highlight that careful observation of technical patterns, demand and supply zones, and institutional activity can help identify scenarios rather than guarantees.

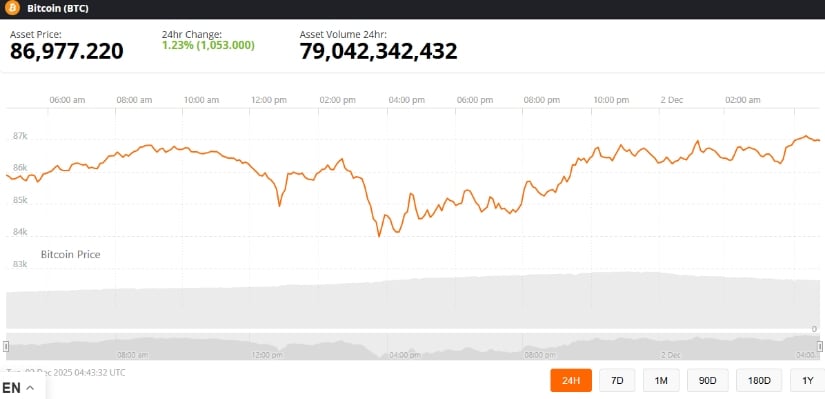

Bitcoin was trading at around 86,977.22, up 1.23% in the last 24 hours at press time. Source: Bitcoin price via Brave New Coin

Macro factors—including ETF inflows, interest rate movements, and broader crypto market sentiment—may influence BTC price direction in the coming months.

In summary, Bitcoin (BTC) faces medium-term volatility with potential downside near $55,000. However, strong technical support and long-term fundamentals could support a scenario toward $125,000 if favorable conditions persist.