XRP Price Today: Vanguard’s Game-Changing ETF Move Could Fuel $2 Defense & Liquidity Surge

XRP isn't just holding a line—it's defending a fortress. The $2 level has transformed from a price point into a psychological battleground, and the cavalry might be arriving from an unlikely source: traditional finance.

The Vanguard Variable

Forget slow-moving institutional adoption; this is a potential liquidity injection. A spot ETF listing by a giant like Vanguard doesn't just open a new door—it potentially installs a financial firehose. It signals a shift from niche crypto fund to mainstream asset, pulling capital from portfolios that once viewed digital assets as a curiosity at best.

Liquidity: The Real Trophy

Price targets make headlines, but liquidity is what builds markets. Enhanced liquidity means tighter spreads, reduced slippage, and a more resilient price floor. It's the difference between a price that's easily pushed around and one that stands firm. For XRP, defending $2 is the immediate fight, but securing deep, sustainable liquidity is the long-term war.

A Cynical Twist on Wall Street's Embrace

Let's be real—the same institutions that spent years dismissing crypto now see a regulated, fee-generating vehicle. It's less a damascene conversion and more a calculated pivot to a new revenue stream. The irony is thicker than a legacy bank's quarterly report.

The takeaway? Watch the $2 level, but watch the fund flows closer. A major ETF listing isn't a magic bullet, but it could be the catalyst that turns a defense into a lasting foundation.

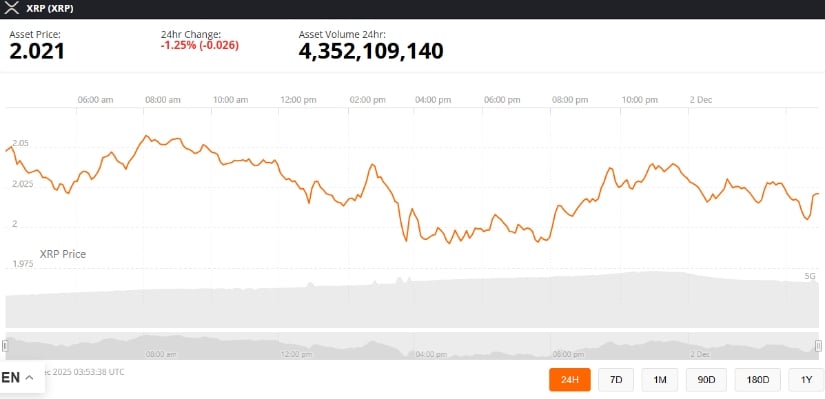

XRP is trading around $2.02, based on TradingView spot data, following a brief pullback that was later met with buying interest. Despite recent downward pressure, the asset continues to defend the psychologically important $2 support zone, which has historically acted as a major price floor across multiple market cycles.

This short-term retracement coincides with broader institutional accessibility to XRP, adding context to the current price dynamics.

Wyckoff Setup Shows Support Holding

Technical analysts tracking XRP’s broader structure have noted a Wyckoff re-accumulation pattern, which spans several months (according to technical research published on TradingView). XRP is currently positioned in Phase C, a stage where temporary dips below support—known as “springs”—can occur before recovery (Phase C often includes short-term tests of demand to confirm support).

$XRP is approaching its multi-month support within a reaccumulation pattern, with attention on potential dips into the ‘Spring’ zone. Source: ChartNerd via X

A technical analyst specializing in Wyckoff patterns explained that brief dips below support do not necessarily invalidate the broader structure but may indicate final shakeouts before renewed buying interest enters the market.

From a longer-term perspective, XRP remains above its 20-month exponential moving average (EMA) NEAR $1.94, according to TradingView data. This level has historically acted as a trend indicator. Additionally, the $2.05 zone aligns with prior all-time high wick closures from earlier cycles, adding further significance to the support range.

Longer-Term Structure Mixed but Constructive

While XRP faces resistance on shorter timeframes, the monthly chart shows a generally constructive trend. Analysts observing XRP’s chart note that it is trading below the 21 EMA on daily and weekly timeframes but remains above this EMA on the monthly chart, suggesting the broader accumulation phase may still be intact.

I’m planning short-term long positions on select altcoins, targeting a 20% gain before stepping out of the market for a month. Source: msadeghjoveini on TradingView

A long-term digital asset strategist noted that, as long as the monthly price structure maintains its formation, higher medium-term valuation targets could remain technically feasible. However, these scenarios are conditional on XRP holding its key macro support zones.

ETF Listings and Institutional Flows

The XRP market narrative is shifting as spot XRP ETFs expand institutional access. According to publicly available fund filings and market trackers, several XRP-related investment vehicles have recently seen significant net inflows.

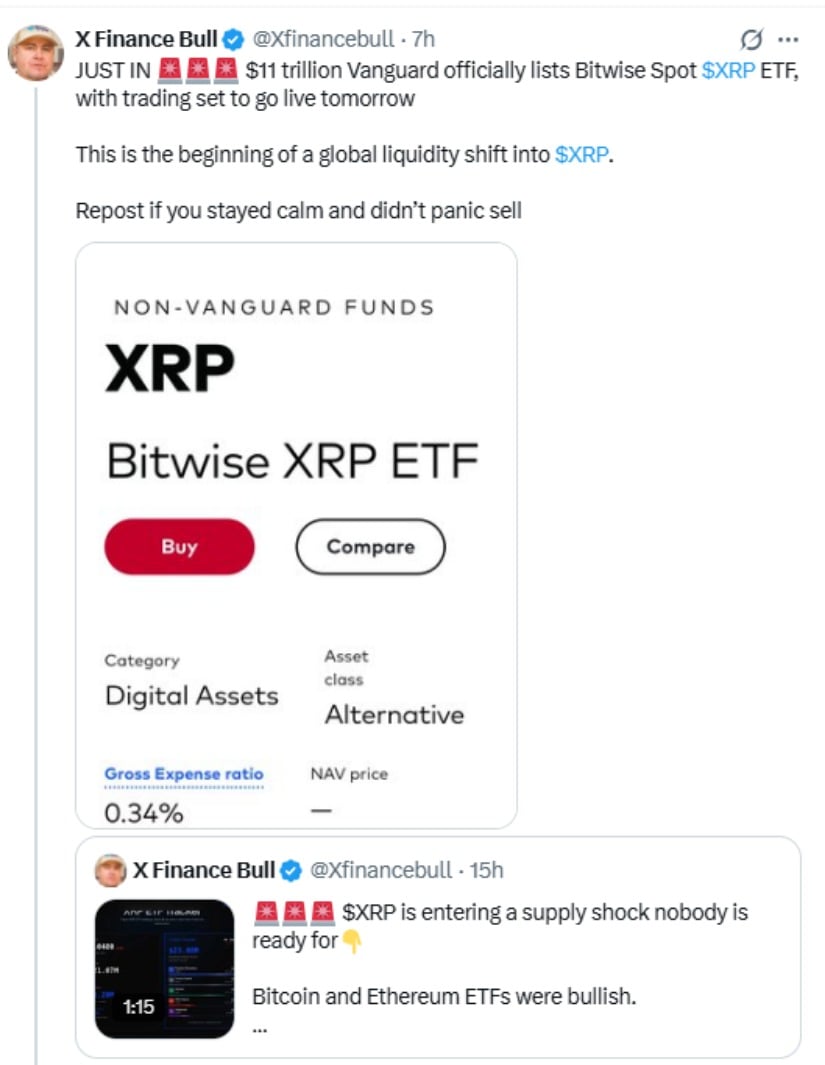

Liquidity is shifting into $XRP following Vanguard’s integration of the Bitwise ETF, strengthening institutional demand near the $2.03 level. Source: X Finance Bull via X

In a notable development, Vanguard listed the Bitwise Spot XRP ETF under its non-Vanguard fund offerings, potentially expanding access for institutions managing trillions in assets. The ETF carries a reported expense ratio of 0.34%, per fund documentation.

While some structured products appear to hold portions of the XRP supply, estimates vary, and the full impact on the liquid market supply is uncertain. Historically, inflows from Bitcoin spot ETFs have influenced supply dynamics; XRP could experience similar effects over time, although market maturity and structure differ.

Technical Levels and Key Considerations

XRP continues to respect a multi-week descending trendline, forming a series of lower highs, signaling ongoing short-term selling pressure (based on TradingView charts). Rejection recently occurred near the convergence of the trendline, the 50- and 100-period EMAs, and the 0.5–0.618 Fibonacci retracement zone.

XRP remains bearish below trend resistance, with $1.8476 as the key downside liquidity target. Source: Quant_Trading_Pro on TradingView

On the downside, the $1.8476 level is cited by technical analysts as a potential liquidity zone (according to TradingView data). A recovery scenario may require XRP to reclaim the trendline and sustain above the Fibonacci “golden pocket” (a zone often used by traders to identify key support/resistance levels).

Neutral Market Takeaway

XRP’s defense of $2 support remains a technical focal point for traders, institutions, and long-term holders. If this level holds and ETF inflows continue, liquidity conditions could gradually shift in favor of price stability.

XRP was trading at around 2.02, down 1.25% in the last 24 hours at press time. Source: xrp price via Brave New Coin

Conversely, a sustained break below the $1.85–$1.90 zone may introduce downside risk and delay recovery. XRP remains in a transitional phase where structural adoption via ETFs intersects with short-term technical weakness.