Floki Price Outlook: Open Interest Drops, Momentum Weakens - What’s Next?

Floki's open interest just took a dive. Momentum's fading fast. The memecoin darling faces a critical test as traders pull back and the charts flash warning signs.

Open Interest Plummets: A Clear Signal

When open interest contracts, it's not just a number—it's capital fleeing the scene. It tells you the smart money is getting cautious, reducing leveraged bets as the easy gains evaporate. This isn't a minor blip; it's a fundamental shift in trader conviction.

Momentum Hits a Wall

The price action tells the same story. That explosive upward thrust? Gone. Replaced by sideways churn or gentle declines. Key support levels are now resistance, and each rally attempt gets sold into faster than a Wall Street banker sells 'long-term growth stories' to retail investors. The buying pressure simply isn't there to sustain a move.

The Path Forward for FLOKI

So where does Floki go from here? The immediate outlook hinges on whether this is a healthy consolidation or the start of a deeper correction. Without fresh capital or a major catalyst to reignite the narrative, the path of least resistance points lower. The community's resilience will be tested, and the project's fundamentals—beyond the meme—will need to shine. In crypto, momentum is everything until it isn't. For Floki, that 'isn't' moment may be now.

Market conditions now show softer demand, fading speculative positioning, and reduced momentum — all pointing toward a cautious short-term environment.

Open Interest Signals Reduced Leverage Appetite for FLOKI

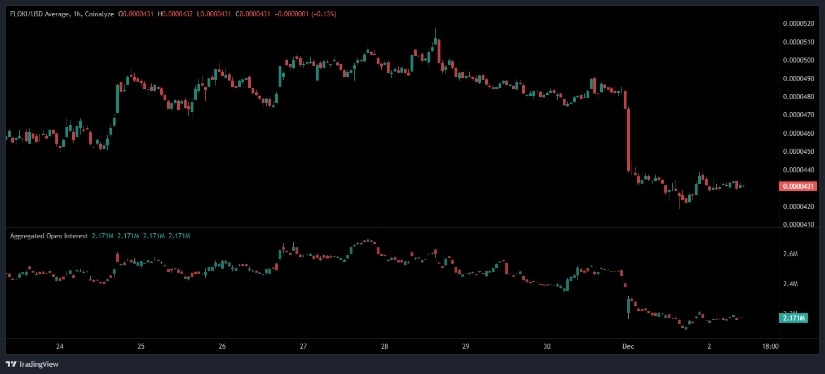

On the 1-hour chart, FLOKI continues to move sideways following the steep intraday decline that pulled price into the $0.0000420–$0.0000430 zone. The candles reflect compressed volatility, with small-bodied formations highlighting hesitation from both sides. Earlier, the aggressive sell-off candle erased multiple hours of gains, leaving a structural break that bulls have not reclaimed.

Source: Open Interest

Aggregated open interest sits near 2.17M, noticeably lower than previous peaks recorded before the sharp drop. This decline shows a clear reduction in Leveraged exposure — a typical signature of forced liquidations or heavy profit-taking rather than a steady distribution pattern. Even after stabilizing, OI has not bounced, meaning sidelined capital remains cautious and has not re-entered with conviction.

For the crypto to regain short-term strength, price must reclaim the minor breakdown zone around $0.0000445, ideally accompanied by a measurable uptick in OI. Without that rise in leveraged participation, the risk remains tilted toward further consolidation or a retest of the lower support range.

Data Highlights Pressure as FLOKI Slides 2.39% on the Day

According to BraveNewCoin market data, the token is down 2.39% in the past 24 hours, with a market cap of $414.3M and daily volume around $55.44M. The intraday structure shows a continuation of the broader downtrend that has persisted since early November, where repeated attempts to push higher have been met by consistent supply.

Market depth also reflects thinning liquidity on the bid side, another sign that buyers are waiting for lower entries rather than stepping in aggressively. As long as the coin remains below the $0.0000450 pivot, it stays within a corrective pattern that leaves bulls reacting instead of leading.

The current stabilization around $0.0000425–$0.0000430 may delay stronger moves, but without volume expansion, upside momentum remains limited.

Indicators Show Weak Momentum and Limited Buying Pressure

On the daily chart, FLOKI trades at $0.00004323, sitting NEAR recent local lows after a multi-week decline. The MACD remains negative at -0.00000467, beneath its signal line at -0.00000487, indicating bearish momentum still outweighs bullish attempts. The histogram is marginally positive, suggesting the selling pressure is softening — but not enough to indicate a reversal.

Source: TradingView

Capital flows remain notably weak. The Chaikin Money FLOW (CMF) sits around -0.19, confirming net outflows and sustained distribution. This aligns with the muted volume spikes seen across the last several sessions.

If FLOKI is to shift into a constructive trend, it must reclaim $0.000048–$0.000050, paired with a CMF MOVE back above zero and a MACD crossover toward the baseline. If these signals do not develop, the chart favors continued sideways-to-down movement, with the $0.0000400 band acting as the next important support zone.

Let me know if you want this converted into a full SEO article with title, Meta tags, H2s, and keyword density.