XRP Price Today: Rare TD Sequential Buy Signal Flashes as Institutions Pour $243M Into Crypto ETFs

XRP just flashed a rare technical buy signal—the kind that makes chart analysts sit up straight. The TD Sequential indicator, a tool that spots potential trend exhaustion and reversals, is painting a bullish picture for the embattled asset.

Institutional Money Talks

It's not just the charts whispering. While retail traders debate, institutions are putting real money on the line. A fresh $243 million has flooded into cryptocurrency ETFs this week, signaling a vote of confidence from the big players who typically move markets. It's a classic case of 'follow the money,' even if that money sometimes moves with the glacial speed of a traditional bank wire.

The Bigger Picture

This combination—a precise technical setup aligning with heavyweight capital inflows—creates a potent narrative. It suggests the recent consolidation might be a springboard, not a stagnation. Of course, in crypto, a 'sure thing' is about as reliable as a financial advisor's prediction—but the signals are too compelling to ignore.

Markets have a funny way of rewarding patience and punishing hype. Right now, the data is doing the talking.

Despite the decline, investor participation remains strong across XRP markets, with high trading volume and rising institutional engagement hinting that the ongoing correction may be approaching a critical inflection point.

XRP Price Slides Despite Technical Buy Signal

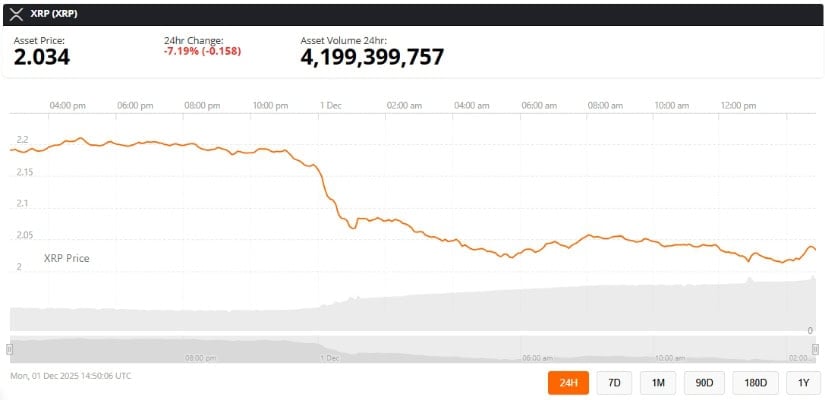

XRP price today trades at $2.03, marking a 7.19% decline over the past 24 hours, according to the latest market data. The drop extends what has been a multi-week retracement from the recent swing high near $3, signaling persistent selling pressure following broader crypto market weakness. Despite the downward move, liquidity remains strong. XRP recorded more than $4.19 billion in trading volume over the past day, reflecting sustained participation from traders and institutional desks.

Short-term altcoin positions aim for a 20% gain before exiting the market for a month. Source: msadeghjoveini on TradingView

Market observers continue to monitor XRP’s correlation with Bitcoin—currently around 0.85, according to aggregated TradingView data. This high degree of correlation means that Bitcoin’s direction may continue to dictate XRP’s short-term price behavior. Additionally, ongoing developments in the Ripple vs. SEC legal landscape remain an influential macro factor, shaping both investor confidence and institutional allocation across XRP markets.

TD Sequential Buy Signal Emerges on Weekly Chart

A significant development this week came from crypto analyst Ali (@ali_charts), who highlighted that XRP has printed a TD Sequential “9” buy signal on the weekly timeframe. The indicator, developed by Tom DeMark, is designed to identify trend exhaustion by counting a series of consecutive candle closes. Historically, XRP and other volatile cryptocurrencies have frequently shown relief bounces following such signals—though outcomes vary depending on broader market conditions.

XRP flashes a weekly TD Sequential buy signal, hinting at a potential rebound ahead. Source: @ali_charts via X

The TD Sequential tool is often cited for its 65–75% probability of indicating short-term reversals when used across high-volatility assets, based on historical pattern studies conducted by traders using platforms like TradingView. XRP’s recent decline from $3 to the $2.05 region aligns closely with previous TD setups that preceded temporary trend reversals. However, analysts caution that TD signals can lag during stronger macro downtrends, especially when Bitcoin dominance is rising or liquidity across altcoins is thinning.

Institutional Inflows Hit Record $243.95 Million

Institutional interest in XRP has intensified sharply, with data from STEPH IS CRYPTO (@Steph_iscrypto) revealing a record $243.95 million in net inflows into XRP spot ETFs for the week ending November 28, 2025. This marks the largest weekly inflow since XRP ETFs launched, signaling renewed appetite from institutional buyers despite the recent price correction. The inflow data aligns with independent figures compiled by platforms such as CoinGlass, which track weekly ETF FLOW trends across major digital assets.

XRP records its biggest week ever with $243.95M in net ETF inflows, signaling surging institutional demand. Source: @Steph_iscrypto via X

This surge comes at a time when a 2025 EY-Parthenon institutional asset allocation survey reported that nearly 60% of institutions now diversify beyond bitcoin and Ethereum—adding exposure to altcoins like XRP amid growing regulatory clarity. However, despite the strong inflows, XRP’s price remained relatively stable, partially due to its large pre-mined supply of 100 billion tokens, as noted by Investopedia. This supply structure tends to dilute the immediate price impact of new capital compared to supply-capped assets like Bitcoin.

Analysts Weigh Risks and Opportunities as Market Consolidates

Market sentiment around XRP remains divided. Optimists view the combination of the TD Sequential buy signal and record ETF inflows as potential early signs of stabilization. Some traders argue that these signals, paired with historically strong responses to institutional accumulation phases, may support a short-term relief rally if Bitcoin maintains its footing above key support levels. The next few weekly closes will likely determine whether buyers can regain momentum.

On the other hand, skeptics warn that XRP’s past TD Sequential signals have appeared during prolonged downtrends without triggering meaningful upside follow-through. With Bitcoin volatility elevated and global macro conditions influenced by shifts in interest-rate expectations and U.S. dollar strength, risk assets may remain under pressure. Analysts emphasize that any bullish XRP price prediction must remain sensitive to these broader market dynamics.

Looking Ahead: Can XRP Maintain Support and Build Momentum?

Traders are watching the $2.40 resistance zone closely, as a breakout above this level WOULD strengthen the case for a broader recovery. XRP must also remain above short-term support zones near $2.00 to keep bullish hopes alive. A strong weekly close above these thresholds may validate the TD Sequential signal and open the door for a retest of higher range levels.

XRP was trading at around 2.03, down 7.19% in the last 24 hours at press time. Source: xrp price via Brave New Coin

Institutional ETF participation continues to provide a foundation of long-term support, reinforcing liquidity depth and reducing volatility spikes. As Ripple’s global partnerships and regulatory clarity progress, long-term sentiment toward XRP and Ripple-based solutions may further strengthen. For now, XRP remains caught between short-term pressure and early signs of accumulation—making the upcoming weekly candles pivotal for direction.