BNB Price Alert: Binance Coin Defends Crucial $950 Level Amid Market Turmoil

Binance Coin (BNB) is putting up a fight at the $950 support level—a make-or-break zone for bulls. Here's why this price floor matters.

The $950 Battlefield

BNB's 2025 price action hinges on this psychological and technical support. A breakdown could trigger cascading liquidations, while a bounce might reignite the rally toward its ATH.

Exchange Token Paradox

Centralized exchange tokens like BNB thrive on volume but suffer when traders flee to self-custody—ironic for an asset tied to a platform that once promised 'decentralization.'

What's Next?

Watch for whale accumulation below $950 or panic selling if it cracks. Either way, grab popcorn—this is crypto's version of a debt ceiling standoff, just with more leverage and less Congress.

Analysts see a strong bullish construction that is still resilient even when the momentum is weakening after several months of excellent upward performance.

Analyst Notes BNB Outperforming Major Assets

Analyst DefiZeus wrote on X that BNB has been one of the most performing large-cap cryptocurrencies since February, pointing out that it has been performing better than others.

The chart demonstrates that the coin is trading in the vicinity of $954.92, after it is corrected against its parabolic climb of $1,400-$1,500, which was a perfect blow-off top.

Source: X / @DefiZeus

The long-term structure shows that the uptrend is strong since the middle of 2024, and the price continues to show a well-developed trend of increased highs and increased lows.

Bullish seasonal mission notwithstanding the retrace, the coin continues to trade above major support levels at $850-$900. In case buyers protect this area, the price can stick and then have another rising leg.

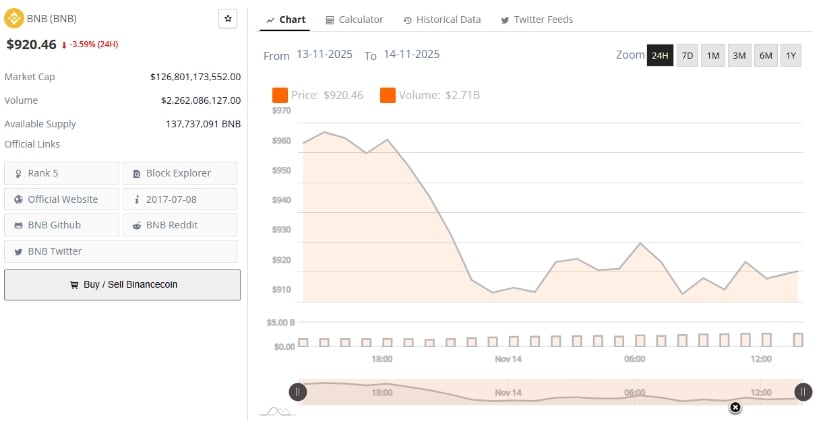

Intraday Data Shows Gradual Recovery and Stable Volume

According to BraveNewCoin data captured on November 14, 2025, BNB/USD rebounded from an early-session dip NEAR $920 to trade within the $960–$970 band later in the day. The 24-hour pattern indicates rising demand from lower levels, forming a stable intraday structure supported by balanced order flow.

(Source: BraveNewCoin, November 2025)

Trading volume has remained consistent during the recovery phase, suggesting measured participation rather than abrupt speculative swings. Analysts note that the $955–$960 range now serves as interim support, marking a key level to monitor in the short term. A firm hold above this region could open a path toward the resistance cluster around $990–$1,030, aligning with renewed bullish interest across the broader market.

Stable Open Interest Reflects Market Neutrality

On open interest, another chart that is the BNB/USD pair on the 1-hour timeframe, and that has the aggregate open interest data overlaid.

Price has been varying between $940 and $100,0, indicating that it has consolidated following a retreat of $1020. There have been comparatively no major inflows of new Leveraged or liquidations of interest as the open interest has remained between 835M and 840M.

Source: Open Interest Data

This consistent open interest goes in line with the sideways price structure, which displays equilibrium between sellers and buyers.

There was, however, a slight increase in open interest near the end of the chart, which could be a positive indication of a resurgence in open interest, and it may mean future volatility.

Technical Setup Signals Consolidation Before Next Move

BNB/USDT is trading at around $964.82 at the time of writing, with an increase of +1.26 per day. As shown in the chart, the coin has been in a narrow band of consolidation between $950 and $1,050 after cooling down after October, when it reached close to $1,350.

The bigger picture remains in favor of the bulls with price remaining above the key support of $900-$920.

Source: TradingView

The volume of trading has been made easier, which is indicative of lower volatility and possible accumulation behavior.

A decisive move out of about $1,050 WOULD open the door to the possibility of heading towards $1,200, whereas an inability to maintain the support at about $900 would pave the way to a more severe fall to about $800.