SEI Price Alert: Wedge Formation Signals Imminent Breakout—Are Bulls Ready to Charge?

SEI's price action tightens into a textbook wedge—traders are circling like sharks scenting blood in the water.

The setup: Every consolidation breeds volatility. This symmetrical squeeze mirrors pre-pump patterns seen in Solana and Avalanche during their 2023 rallies.

Market psychology: Retail FOMO meets institutional accumulation. Whispers of a Binance listing (again) fuel speculation—because nothing pumps a coin like exchange-driven artificial scarcity.

Technical trigger: A decisive close above $0.75 on the 4H chart could ignite algorithmic buying. Watch for derivative liquidations to amplify the move.

Remember: 'Breakout' is Wall Street code for 'please hold our bags.' But in crypto's casino economy, someone's always willing to roll the dice.

Market participants are watching closely as the asset moves toward a pivotal compression point in November 2025.

Breakout Level After Completing Falling Wedge Pattern

In a recent X post published on November 14, 2025, analyst ZAYK Charts highlighted that the SEI/USDT 2-day chart has completed yet another falling wedge formation, a structure associated with trend exhaustion and early bullish reversal setups. The analyst notes that the coin has produced multiple falling wedges since early 2024, each followed by a breakout and measurable upside expansion.

Source: X

Current price action is compressing tightly NEAR the wedge’s upper boundary, historically the zone where downward momentum weakens. According to the analyst’s model, a confirmed breakout could open the path toward the 100–150% upside targets displayed in the projected green zone. The pattern remains technically valid, but the breakout requires confirmation via price strength and expanding volume.

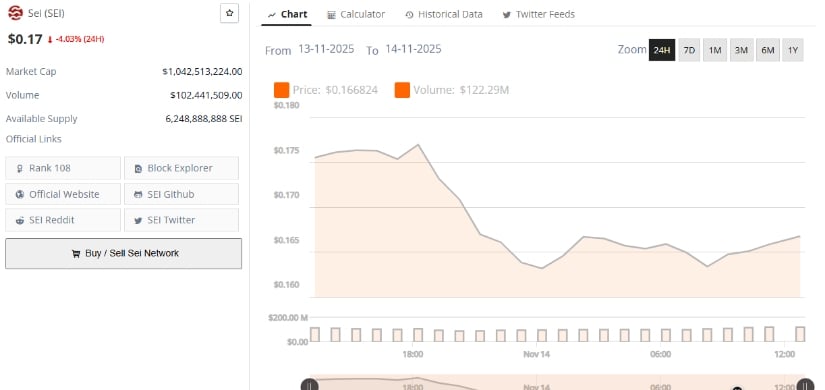

Market Metrics Reflect Neutral Demand as SEI Trades at $0.17

According to BraveNewCoin market data recorded on November 14, 2025, the token trades at $0.17, posting a 4.03% decline over the past 24 hours. The asset maintains a market capitalization of $1,042,513,224, supported by a daily trading volume of $102,441,509, with an available supply of 6,248,888,888 tokens.

Source: BraveNewCoin

Despite the short-term pullback, the coin remains ranked #108 globally, sustaining liquidity within its recent trading corridor. Price movement continues to fluctuate between $0.16 and $0.18, reinforcing the broader picture of tightened volatility.

Analysts note that the $0.152–$0.210 level represents a pivotal consolidation range; re-entry into the upper half of this band could strengthen the bullish continuation case.

Limited Momentum as SEI Holds Near Lower Band

On the other hand, data recorded on November 14, 2025, shows the crypto trading around $0.1630, positioned below the basis Bollinger Band at $0.1813. The Bollinger Bands remain tightly contracted, reflecting reduced volatility and signaling a lack of immediate directional strength. Price action remains closer to the lower band at $0.1524, consistent with ongoing bearish pressure.

Source: TradingView

Momentum readings reflect similar caution. The Relative Strength Index (RSI) stands at 36.91, while its moving average sits slightly higher at 38.39, indicating that the asset is nearing—but has not yet entered—oversold territory. Historically, similar readings have preceded short-term rebounds; however, the absence of expanding buying volume suggests that confirmation remains necessary before anticipating a reversal.