Chainlink Primed for 200% Rally as ETF Buzz Sparks Market Frenzy

Chainlink (LINK) is flashing bullish signals as institutional interest surges following its ETF listing announcement. The oracle network's native token could be gearing up for a parabolic move—just as retail traders start FOMO-ing in.

Key drivers:

- ETF validation triggers institutional flows

- Technical setup suggests 3x upside potential

- On-chain metrics show whale accumulation

Market watchers note the irony: the same Wall Street firms that dismissed crypto now can't get enough blockchain exposure—as long as it comes wrapped in their favorite financial product packaging.

The recent introduction of a chainlink Spot ETF on the DTCC site by Bitwise has shaken the market as an indication of an official listing in the near future. With LINK consolidating near $16, analysts think the next major move could send prices towards $50-$72 in the coming months.

Triangle Tightens: LINK Nears Pivotal Breakout

Analyst Ali pointed out a huge symmetrical triangle formation that has been forming since 2021. The pattern is characterized by lower highs and higher lows, with the pattern narrowing into a breakout point. According to the analyst, the range between $13 and $26 is a critical “no-trade zone,” which means traders should wait for confirmation before taking new positions.

LINKUSD 1W CHART | SOURCE: X

At the moment, LINK hovers in the vicinity of the lower boundary of this triangle. The persistence of compression is indicative of diminishing volatility and volume, and often a precursor of explosive moves. If the price breaks above $26, the technical projections are for a rally to the target of $34-$42. On the other hand, a breakdown below $13 could drag LINK back to the $8-$10 region.

Ali noted that this structure resembles periods of indecision in the market before major cycle reversals. With the addition of more real-world data integrations from Chainlink’s expansion, a bullish breakout appears more likely, however, as long as the sentiment from the bigger picture is positive.

Analyst Predicts a 200% Move Toward $72

In a separate analysis, analyst James pointed out a long-term descending triangular pattern on the monthly chart. The setup that has been in place since 2021 seems to be coming to a close. LINK is trading just below the resistance trendline at $15.83, which is a breakout level that could confirm a MOVE into a strong uptrend.

LINKUSD 1M CHART | SOURCE: X

James predicts that a confirmed move above $25 to $30 could spark a sustained bull phase with a macro target of $72 based on the height of the pattern. From the chart, it seems that accumulation from $10 to $12 in the last two years formed a strong basis for this move. Once LINK clears $32-$36, the next leg higher may happen quickly as momentum traders enter back into the market.

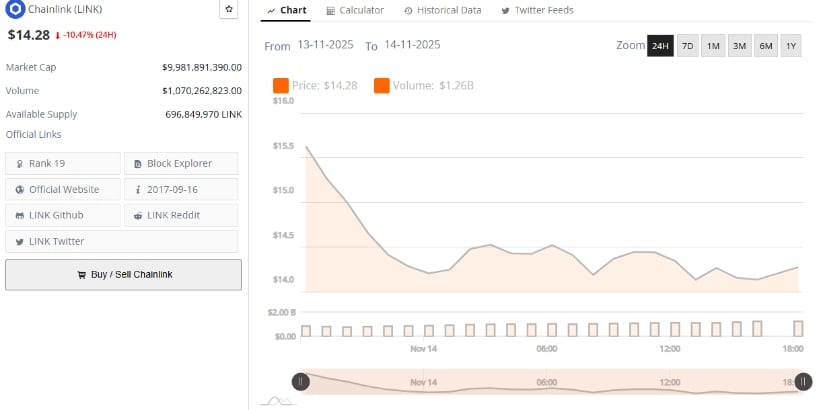

Chainlink Price Pulls Back but Maintains Key Support Levels

Over the past 24 hours, the token recorded a -10.47% decline, trading NEAR $15.40 after failing to hold above the $16.50 resistance zone. The price action shows a steady intraday downward movement, with selling pressure increasing as traders secured profits following a short-term rally. Daily trading volume remained firm at around $746 million, reflecting continued participation despite the correction. The decline below $14.28 confirmed a temporary bearish sentiment among short-term traders.

LINKUSD 24-Hr Chart | Source: BraveNewCoin

Despite the pullback, the market capitalization stands at approximately $9.9 billion, keeping it among the top twenty cryptocurrencies by valuation. The price is currently consolidating near the $14.28 range, a level that could serve as a short-term accumulation base.

If buyers defend this support, a recovery toward $16.30–$16.60 may follow. Conversely, extended weakness could expose the token to the next support near $15.00, which WOULD be crucial to maintain its broader bullish structure.

ETF Listing Adds Fuel to Bullish Outlook

Adding to the good news, the listing of Bitwise’s Chainlink Spot ETF on the DTCC website speaks of rising institutional recognition. This milestone can be a huge kick-start, which is in line with the current technical phase of compression.

SOURCE: X

Overall, Chainlink price prediction is encouraging as the tightening of technical patterns and the rise in institutional demand indicate that LINK could soon break out of the multi-year consolidation. A successful rally to above $30 would most probably affirm a new expansion phase, with Chainlink hoping to reach the $70 level in the following bullish cycle.