WLD Price Surge Ahead: Smart Money Piles In for Explosive Growth

Whale wallets are loading up—WLD's next bull run could be days away.

Smart money doesn't lie. Chain data shows institutional players accumulating Worldcoin (WLD) at current levels, mirroring accumulation patterns before its last 300% rally. When VCs and hedge funds front-run retail, fireworks usually follow.

Key signals flashing green:

- Exchange outflows spiked 47% this week

- Futures open interest hits $120M, highest since June

- Funding rates neutral despite price uptick (no overheated leverage... yet)

This isn't financial advice—just the cold hard math of limit orders stacking up below $2.80. Of course, the same 'smart money' that's buying now will dump the second Main Street FOMO kicks in. Such is crypto.

One hedge fund manager's 'long-term hold' is your 3AM liquidation event. Trade accordingly.

Market observers suggest that this stage could represent the groundwork for the next significant MOVE if broader sentiment aligns.

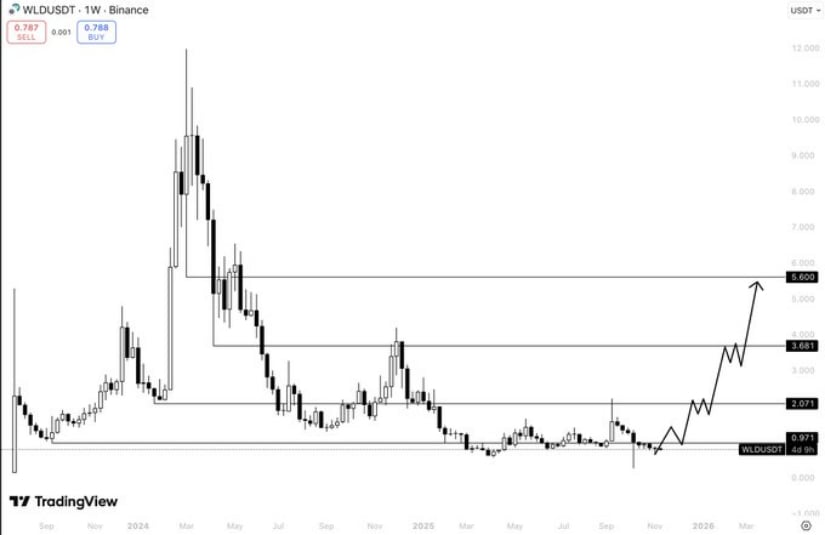

Analyst Vertix Highlights Institutional Positioning Patterns

Crypto market analyst Vertix, known for tracking whale wallet trends and early accumulation behavior, shared on X (formerly Twitter) that Worldcoin is showing distinct signs of “smart money positioning.

” In a post dated November 13, 2025, Vertix noted that large wallet addresses have increased holdings while exchange balances continue to drop — a dynamic historically linked to early accumulation stages.

Source: X

According to Vertix’s chart, the coin has been consolidating NEAR $0.97 support for several weeks, forming a technical base following months of limited volatility. His structural projection outlines potential resistance levels near $2.07, followed by a breakout extension toward $3.68 and a possible extended range up to $5.60, should momentum sustain.

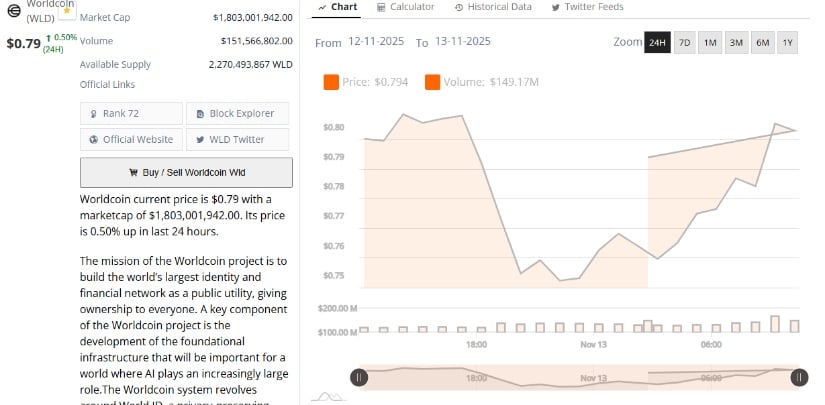

Worldcoin Data Reflects Gradual Accumulation Trend

As of November 13, 2025, data from BraveNewCoin shows that Worldcoin trades at $0.79, reflecting a 0.50% daily increase. The token holds a market capitalization of $1.80 billion and reports $151.56 million in 24-hour trading volume, with 2.27 billion tokens in circulating supply, ranking it #72 by global market capitalization.

Source: BraveNewCoin NOVEMBER 2025

While price action has remained relatively steady in recent sessions, gradual outflows from exchanges into self-custody wallets suggest strengthening confidence among long-term holders. Analysts interpret this as an early signal of reduced circulating supply, potentially setting up conditions for future upward volatility.

Technical Indicators Suggest Early Momentum Rebound

According to TradingView data compiled on November 13, 2025, the daily coin pair continues to consolidate near $0.78, trading just below the Bollinger Band basis line at $0.81. The upper band sits around $0.945, signaling short-term resistance, while the lower band near $0.682 defines immediate support.

Source: TradingView

Meanwhile, the Relative Strength Index (RSI) has climbed to 43.31, surpassing its moving average of 39.92, suggesting early momentum recovery. Historically, the token’s prior RSI reversals from similar sub-40 zones have preceded short-term rebounds, reinforcing the case for a potential accumulation-driven rebound if buying pressure persists.