Bitcoin’s Make-or-Break Moment: Why BTC Must Surge Past $105K to Keep the Bull Run Alive

Bitcoin's bull run hangs in the balance—again.

The king of crypto needs to smash through $105K to prove this isn't just another dead-cat bounce. Traders are watching the charts like hawks, waiting to see if this is the real deal or just another fakeout that leaves bagholders weeping.

Meanwhile, Wall Street 'experts' who called Bitcoin a scam at $1K are suddenly technical analysis gurus. Funny how that works.

After slipping briefly to around $102,750 on November 12, 2025, Bitcoin managed to hold its ground, reinforcing a pattern of stability seen during past cycle lows. Analysts and traders alike are now monitoring whether BTC can leverage this support to trigger a short-term rally toward $105K.

Bitcoin Holds Key $102K Support

Bitcoin (BTC) recently found strong support near the $102,000 level, a critical point that has historically signaled resilience during multi-month cycle lows. On November 11, 2025, bitcoin dipped roughly 3% to $102,750 after opening around $106,000, but the support held firm, reflecting what analysts call a “quick deviation then nuke” retest.

SuperBitcoinBro highlights Bitcoin’s resilience above $102K support, noting a brief dip to $102,750 on November 11, 2025, and signals a bullish outlook based on historical multi-month rebound patterns. Source: Super฿ro via X

Crypto trader SuperBitcoinBro noted, “I’m a buyer here,” highlighting the significance of higher-timeframe closes over intraday fluctuations. He emphasized that Bitcoin’s history shows repeated rebounds from similar support levels, offering a bullish outlook for traders watching this zone closely.

Short-Term Volatility and Resistance Levels

Despite holding support, Bitcoin has faced repeated rejections at $107,500, forming a descending channel on shorter timeframes. Analyst ArdiNSC reported that Bitcoin’s repeated flushes to around $102K correspond with the 61.8% Fibonacci retracement, a key technical indicator.

Bitcoin is consolidating within a bearish channel, testing support at $102.5, with resistance at $104.5 and $107.5 critical for a potential bullish breakout. Source: Ardi via X

ArdiNSC explained, “The current price around $103K confirms that bulls are defending $102.5K higher lows, but resistance at $104.5 must be overcome to avoid retesting $100K.” Short-term signals such as bearish MACD crosses and head-and-shoulders formations suggest caution for traders expecting a sustained rally.

Signs of a Potential $105K Rebound

Technical setups indicate a possible short-term bullish reversal. BTCUSDT.P recently broke above a minor descending trendline after rebounding from $102,400, hinting that buying momentum may be increasing. Price targets for the next phase could reach $105,464 for partial profits and extend toward $106,844 if the recovery strengthens.

BTCUSDT.P shows signs of a short-term bullish rebound from $102,400, targeting $105,464–$106,844, though risks remain if price falls below $103,000. Source: miljedtothemoon on TradingView

Risk management remains crucial. Analysts warn that a drop below $103,000 could weaken the bullish outlook, possibly retesting $102,400 or lower, while a stop-loss range around $101,376–$101,200 marks the threshold for invalidating the current bullish setup.

Historical Patterns and Cycle Insights

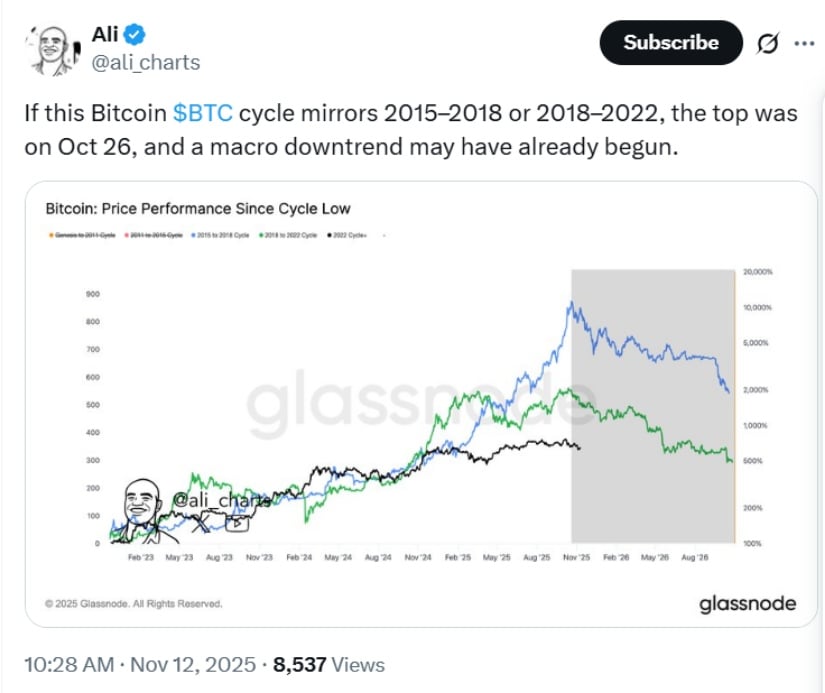

Long-term observers are drawing parallels between the current cycle and previous Bitcoin cycles, such as 2015–2018 and 2018–2022. Analyst Ali shared a Glassnode chart suggesting that October 26, 2025, marked the bull market peak, with a macro downtrend potentially underway. Bitcoin’s price fell approximately 12% from a high NEAR $114,500 to $101,000 by November 12, echoing historical patterns where post-peak corrections of 70–85% were observed in prior cycles.

If the current Bitcoin (BTC) cycle follows past trends from 2015–2018 or 2018–2022, the market likely peaked on October 26, signaling the potential start of a macro downtrend. Source: Ali Martinez via X

A Reddit-based analysis also reinforces this outlook. A user had predicted the local peak on October 6, 2025, aligning with actual market movements around $103,000. The same user forecasts a potential 2026 mania phase with BTC hitting $1 million, supported by macro tailwinds such as the Federal Reserve’s October 2025 rate cut to 3.75–4.00% and near-3% inflation, signaling possible liquidity surges similar to the 2017 and 2021 bull runs.

Bitcoin Price Outlook

With support holding at $102K and early signals of buying momentum, Bitcoin’s short-term forecast points to a potential rebound toward $105K. However, caution remains key, as resistance levels and historical cycle trends could influence volatility in the coming weeks.

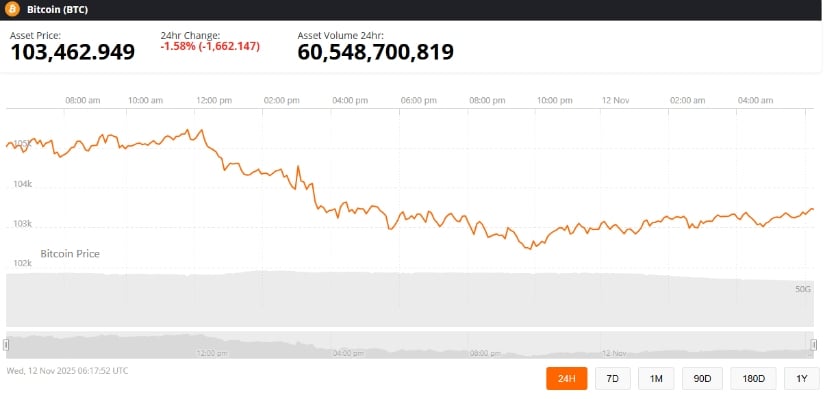

Bitcoin was trading at around 103,462.94, down 1.58% in the last 24 hours at press time. Source: Bitcoin price via Brave New Coin

For traders and investors, monitoring both technical levels and macroeconomic indicators remains essential. As the cryptocurrency continues navigating this critical juncture, the Bitcoin price today reflects a blend of resilience, caution, and potential upside opportunities.