Ethereum Defies Gravity: ETH Holds Critical Support, Eyes $4,300 Surge in 2025

Ethereum bulls dig in as ETH price action defends make-or-break support levels. The stage is set for a potential 30% rally—if Wall Street's algo-traders don't front-run the move first.

Key levels to watch

The $3,800 zone has become Ethereum's battleground, with whales accumulating at every dip. A clean hold here could trigger a liquidity grab toward $4,300—last week's futures open interest suggests traders are positioning for exactly that.

Market psychology at play

Retail FOMO meets institutional hedging as ETH's network upgrades finally start translating to price action. Just don't mention the gas fees—this isn't 2021's meme-fueled mania (or is it?).

The cynical take

Another 'decisive breakout' narrative emerges right as CME Group launches micro ETH futures. Coincidence? The market's memory lasts exactly as long as a Twitter hype cycle.

Following a period of consolidation near $3,500, ethereum is drawing attention from both retail and institutional buyers. Analysts suggest that holding the $3,000 support level is critical for sustaining bullish momentum and potentially pushing ETH toward $4,300 in the coming weeks. Market activity indicates cautious optimism, with whale accumulation and ETF inflows reinforcing confidence amid short-term volatility.

Ethereum Price Consolidation Around $3,500

After a mid-November dip to around $3,400, Ethereum has been consolidating near the $3,500 level. According to crypto analyst Crypto Caesar, “Momentum has cooled off, but bulls are still defending that range hard.” The current ethereum price today sits at approximately $3,564, reflecting minor daily losses amid a surge in trading volume below $3,590.

Ethereum (ETH) is consolidating around $3,500, showing a healthy pullback, with bulls defending $3,000 and a potential rebound toward $4,300 if support holds. Source: crypto Caesar via X

Technical charts indicate a range-bound pattern that many analysts interpret as a healthy pullback. If support at $3,000 holds, Ethereum could resume its bullish trend and target a rebound toward $4,300, building on the broader 2025 uptrend that began from $2,800 lows.

Whale Activity Signals Institutional Interest

Recent on-chain data highlights renewed institutional accumulation of Ethereum. Notably, a verified whale purchased 75,418 ETH worth $269 million over 12 hours via Binance, boosting total holdings to 266,901 ETH, valued at $949 million. Ted Pillows, a market analyst, noted, “Whales are becoming interested in Ethereum again,” suggesting that large-scale buyers may be positioning for future gains.

A whale has purchased $269.46 million in Ethereum (ETH) today, signaling renewed institutional interest in the cryptocurrency. Source: Ted via X

Despite ongoing volatility, these purchases coincide with broader whale activity, which includes over $1.37 billion in ETH buys amid a 12% November price drop. Analysts point out that such accumulation may act as a potential bottom signal, though immediate price surges are not guaranteed.

Resistance Challenges Near $3,700

While support levels remain strong, Ethereum faces resistance NEAR $3,700. Market commentator Sjuul from AltCryptoGems observed, “This $3.7K level has been support for quite a long time and now is threatening to become resistance.” Indeed, the Bitfinex ETH/USDT chart shows at least three prior bounces from this horizontal band since late October, which implies that failure to breach the same is critical for the continuation of the uptick.

Ethereum (ETH) is approaching a critical level at $3,700, which has long acted as support but now risks turning into resistance following a recent weekend bounce. Source: Sjuul | AltCryptoGems via X

While it currently trades below this threshold at around $3,565, the short-term outlook for Ethereum’s price remains prudent, with traders advised to keep a close eye on resistance before committing to long positions.

Short-Term Technical Analysis

Intraday analysis shows Ethereum hovering near a support zone of $3,520–$3,348, with cumulative long liquidation leverage between $3,507 and $3,460. Elliott Wave Projections: Ethereum is completing a corrective wave, according to Elliott Wave projections, which may set it up for renewed bullish momentum.

Ethereum (ETH) is holding support around $3,520–$3,348, with the potential to resume its bullish trend toward resistance at $3,649–$3,726, especially if Bitcoin rises. Source: pejman zwin on TradingView

Analysts underline immediate resistance targets of $3,631, $3,665, and $3,707. In addition, Ethereum could obtain more upward momentum if BTC goes up. That WOULD further reinforce a positive outlook for Ethereum’s short-term price prediction.

Ethereum Outlook and Forecast

In general, Ethereum remains the epicenter for investors looking to catch the 2025 bullish cycle. Solid support at $3,000, with the addition of whale accumulation and ETF inflows, underpins a potential rebound toward $4,300. On-chain metrics, such as 32% of the Ethereum supply staked and $15B+ in ETF inflows since 2024 approvals, suggest resilience amid short-term fluctuations.

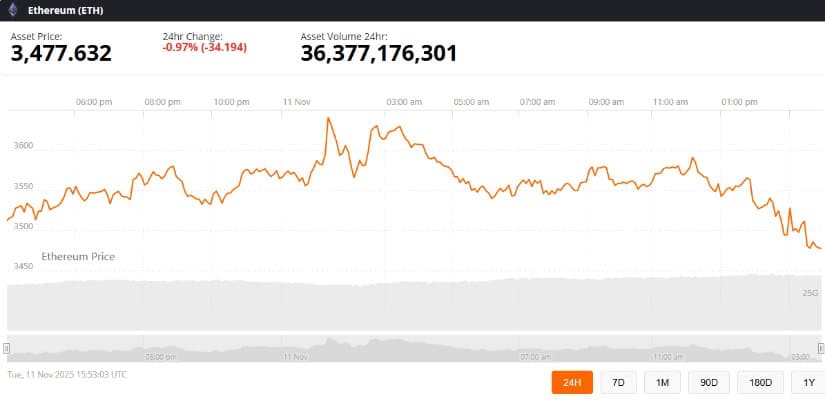

Ethereum was trading at around 3,477.63, down 0.97% in the last 24 hours at press time. Source: Brave New Coin

Based on the current ETH price trends, market participants are advised to keep an eye on the levels of support and resistance, whales, and performance of Bitcoin, since these factors will greatly influence Ethereum’s next moves. Analysts remain cautiously optimistic about the near-term outlook of Ethereum and its potential to reach new all-time high price levels.